Posts by Matt Hargreaves

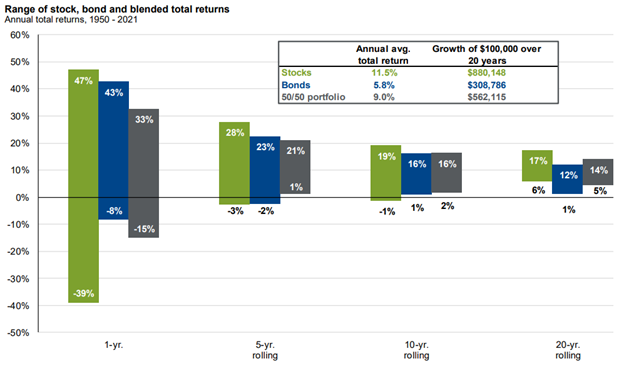

The Huge Cost of Doing Nothing

One of the biggest decisions when transitioning into adult life is when to start saving. Putting off savings till later comes with a cost of waiting. Cost of waiting describes the opportunity cost when an individual decides to wait before beginning to save money. This cost can result in a smaller portfolio at retirement, larger…

Read MoreWhat Should you do when there’s Market Volatility?

During this time of market volatility, we want to share the things we are doing and some things that you can do to help ease your worries. Rebalancing your portfolio. Volatile times can lead to rebalancing opportunities. Market changes can skew your allocation from its original target. We may rebalance your portfolio by selling positions…

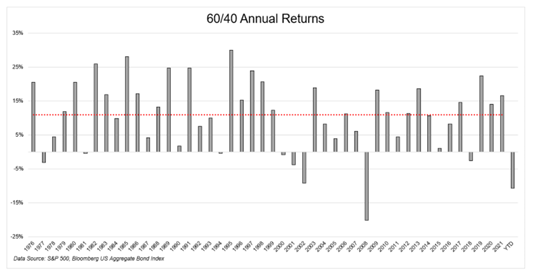

Read More2022 2nd Quarter Investment Commentary

• Stocks and bonds had a difficult start to 2022, falling together through the first half of the year. Rising interest rates amid an inflation spike was the main catalyst. • The economic backdrop remained uncertain with the U.S. economy contracting in the 1st quarter. Data was mixed but recessions risks increased. • Better…

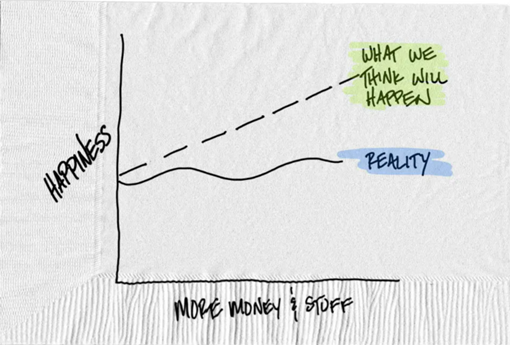

Read MoreDoes Having More Money Equate to More Happiness?

The relationship between happiness and money is complicated. Just consider this sampling of the myriad studies that explore the link between the dollars we earn and the happiness we feel. A study from the 1970s by Philip Brickman, Dan Coates and Ronnie Janoff-Bulman for the Journal of Personality and Social Psychology even found that lottery…

Read MoreMarket Update: May 2022

As we move into spring and leave behind the last signs of a long winter, many worries from a chilly start to the year for markets, unfortunately, are still with us. The S&P 500 Index had its worst April in more than 40 years, and the decline has continued in May leaving the index down…

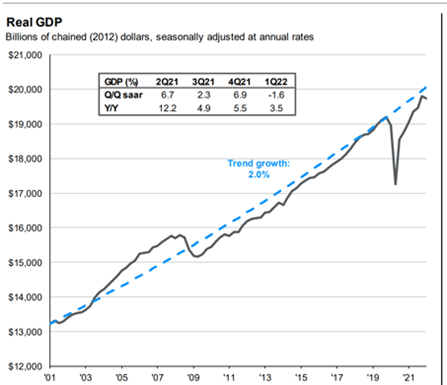

Read More2022 1st Quarter Investment Commentary

• The war in Ukraine, high inflation, and rising interest rates increased volatility. Both stock and bonds fell during the quarter. • Corporate balance sheets and earnings were on track to hit record highs in 2022. • The risks to an economic slowdown increased but the U.S. economy still appeared on track to grow through…

Read MoreWhat Can Investors do to Hedge Inflation?

If you missed part 1 on the current inflation environment, here is a quick summary: Inflation is at 40-year highs in the United States. However, sustained periods of elevated inflation in the U.S. are rare. Over the past 100 years, U.S. inflation has stayed below 5% the vast majority of the time. In the aftermath…

Read MoreMarket Update: February 25, 2022

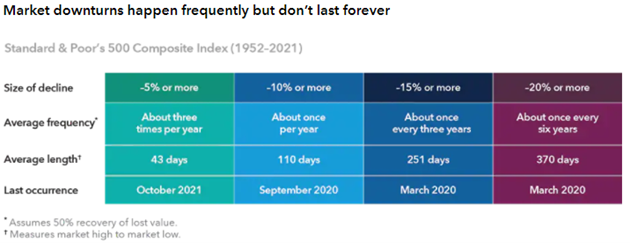

It has been a rough start to the year for risk assets with the S&P 500 off 11%+ and U.S. growth stocks down even more. Both the Fed’s hawkish pivot and the Russia/Ukraine conflict have weighed on risk assets. We haven’t seen a 10% correction in the S&P 500 since March 2020, and we only…

Read MoreMarket Update: February 15th, 2022

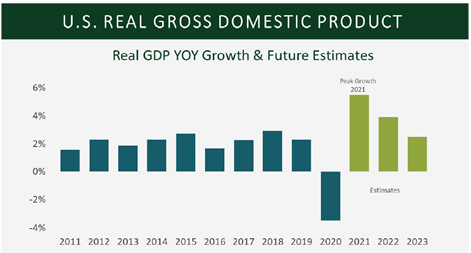

Market Update The U.S. economy continued to grow at a fast pace. 4th quarter 2021 data showed that the U.S. economy grew 5.7% for all 2021, the most significant increase since 1984 (1). 2021′s strong growth created a lot of good outcomes, including a record 6.4 million jobs and higher wages to workers. But it…

Read More2021 4th Quarter Investment Commentary

• The S&P 500 Index gained 11% on the quarter and over 28% on the year, buoyed by strong corporate earnings growth. • The U.S. economic recovery remained on firmed footing despite inflation, COVID-19 and supply chain disruptions. Going forward, extreme fiscal and monetary support will likely be withdrawn in favor of the private…

Read More