Jul 15, 2022 2022 2nd Quarter Investment Commentary

• Stocks and bonds had a difficult start to 2022, falling together through the first half of the year. Rising interest rates amid an inflation spike was the main catalyst.

• The economic backdrop remained uncertain with the U.S. economy contracting in the 1st quarter. Data was mixed but recessions risks increased.

• Better yields across fixed-income and lower-valuation multiples within equities made markets more attractive.

• We remained 2% overweight equities but added to more defensive sectors of the market.

Market Summary

Against an unusually difficult macroeconomic backdrop, the S&P 500 had its worst start to the year since 1970, losing over 16% during the quarter and over 20% year-to-date. The poor equity performance was even starker for growth areas of the market, raising the question of whether the long era of tech and growth equity leadership has ended. All US sectors posted losses during the quarter. Factors including value, low volatility and non-US outperformed the S&P 500.

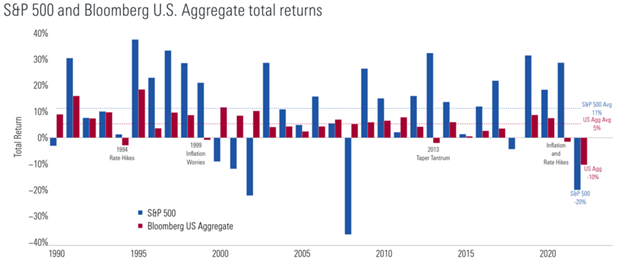

Bonds, as measured by the Bloomberg U.S. Aggregate Bond Index, were off to their worst start to the year since the 1976 inception of the Index. They were down over 4% on the quarter and over 10% year-to-date. Some bond styles, like short-term high-quality bonds, lost less, but every bond category ended the quarter in the red. Both stocks and bonds were down in back-to-back quarters for only the third time in the past 45 years. The 6-month returns for a 60% S&P 500/40% 5-year Treasury portfolio were in the bottom 2% of rolling returns going back to 1926 (1). This means 98% of the time, returns have been better than what we just lived through. For the second quarter in a row, commodities were the only major asset class to post a positive return.

The main reason for the risk-off behavior was inflation, which was at its highest level in 40 years. Inflation’s persistence forced an abrupt shift from the Federal Reserve. The Fed moved from 0% rates at the beginning of the year to 1.5% by the end of the quarter. Rates were projected to hit 3.25% by the end of 2022. Investors had to repeatedly reset expectations for how fast and high the Fed would raise rates. This new reality created a lot of uncertainty around inflation, interest rates, economic growth, and corporate earnings. The big question in the year’s second half is whether the Federal Reserve can slow inflation without stifling economic growth more than necessary.

Below is a summary of the major benchmark returns (2).

Economic Analysis

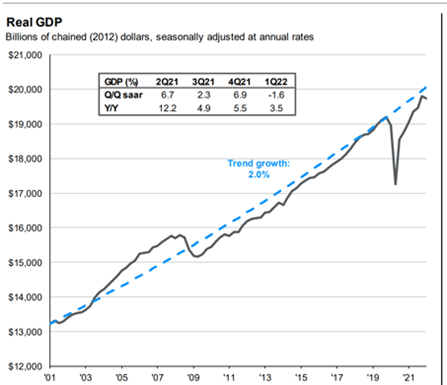

While some portions of the US economy remained relatively strong, the economy showed signs of slowing, and there was a growing probability that the US economy could slip into a recession. The US economy contracted 1.6% in the first quarter, as measured by Real Gross Domestic Product, and the Federal Reserve Bank of Atlanta’s “nowcast” of economic growth pointed toward a -1% contraction for the second quarter (3).

There were a few reasons for the slowdown. First, after two years of record government spending, the economy was no longer being helped by stimulus. The decline in spending reflected an end to stimulus checks, enhanced unemployment benefits, enhanced child tax credits, and a host of other programs supporting many households during the pandemic.

Secondly, the Federal Reserve expressed willingness to risk a recession to bring inflation down. In recent economic cycles, inflation wasn’t a problem. When faced with slowing economic growth, the Fed paused rate hikes or even cut interest rates. However, today the Fed doesn’t have that luxury because if they were to pause interest rate hikes, they would risk higher inflation. They see inflation as a more significant risk than recession and continue to raise interest rates quickly. Higher interest could be felt across the economy but are more critical for cyclical areas of the economy, like home sales, vehicle sales, and durable goods orders.

Since last November, the aggressive Fed actions significantly tightened financial conditions: bonds yields, mortgage rates, and corporate spreads doubled in 6 months, equity markets were down 20 to 30%, and the US dollar was the strongest since 2002. These were significant moves that helped reduce the rate of inflation but also signaled a recessionary environment. As a result, the narrative may change from a market worrying about runaway inflation to a market concerned about slowing economic growth or a recession. Ideally, the Fed could bring down inflation without generating a recession, but it may not be possible to do both. Should a recession occur, solid private sector balances and an absence of financial imbalances may lessen the severity and duration of any economic contraction.

That said, other data show the economy was surprisingly resilient. The ISM Purchasing Managers Index hasn’t yet declined below 50, the Conference Board Leading Economic Index was near its high reached earlier this year, and jobs growth continued to be positive. It’s difficult to have a recession with such a strong labor market. The unemployment rate was near 50-year lows, people quitting their jobs were near all-time highs, and layoffs were near their all-time lows. Also, there were nearly two job openings for every unemployed person, near record highs reached just a few months ago.

Furthermore, many of the pain points in the economy began to correct themselves – commodity prices came down significantly in the back half of the quarter, global supply chain pressures showed signs of easing, and market expectations for inflation decreased.

Market Analysis

Heading into midyear, stocks, as measured by the S&P 500, were down 20% and bonds, as measured by the Bloomberg U.S. Aggregate Index, were down 10% (see chart below (4)). It was the first time in thirty plus years that US stocks and bonds fell together for two quarters in a row. Generally, bonds do well when stocks decline but both stocks and bonds were hurt by surging inflation and the interest-rate hikes aimed at curbing inflation.

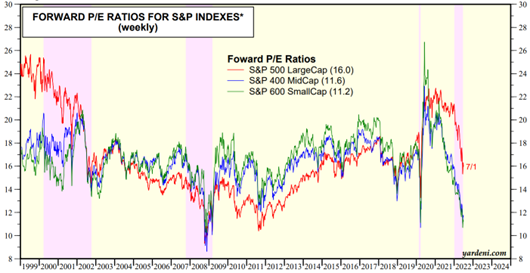

With the unusual losses in both markets, just about the only safe harbors from the storm were cash, commodities-focused strategies, and, to a lesser extent, high-dividend stocks. Growth companies that did well in the “work from home” environment had significant losses. Despite the poor quarter, the S&P 500 was still up 10.6% per year over the last three years. Notably, the decline in stocks was mainly valuation-driven rather than earnings driven. Year-to-date through Q2 of 2022, the S&500 price-to-earnings (P/E) multiple dropped by 27%, while earnings grew 6.7% (5). While the outperformance of value moved the relative valuations between growth and value to more historic norms, we continued to see the potential for value to outperform. Below shows US returns by style box (6).

Toward the end of the quarter, worries shifted from inflation to recession. We saw a shift in leadership from more inflation-sensitive assets to assets that typically do better in a downturn. The risk of a next leg down, should it occur, may be driven primarily by lower-than-expected corporate earnings. So far, earnings have been strong, and analyst estimates were for continued growth into 2023. However, a lot depends on the economic environment. The average decline during non-recessionary bear markets was 25.9% vs 39.4% during recessionary bear markets. Also, earnings have historically declined an average of 13% during recessions (7).

There were some positive signs when it came to the longer-term outlook. Following this market selloff, better yields across fixed-income and lower-valuation multiples within equities made markets more attractive than they have been in some time. For example, the forward P/E multiples of small-cap and mid-cap stocks were at levels not seen since the Great Financial Crisis of 2008 (see chart (8)). In addition, bond yields were well above their averages of the last ten years across all fixed income sectors. Our future return expectations for stocks and bonds increased because of the valuation reset.

History suggests that unless the economy is in a deep recession, the stock market may rebound in the second half. This is the ninth time since WWII that the S&P 500 fell 15% or more in a quarter. One quarter later, the S&P was up 87% of the time with median gain of 6.3%. Two quarters later, the S&P 500 was up 100% of the time with median gain of 13.0%. One year later, the S&P 500 was up 100% of the time with a 25.1% median gain (9). Of course, past performance doesn’t predict future returns.

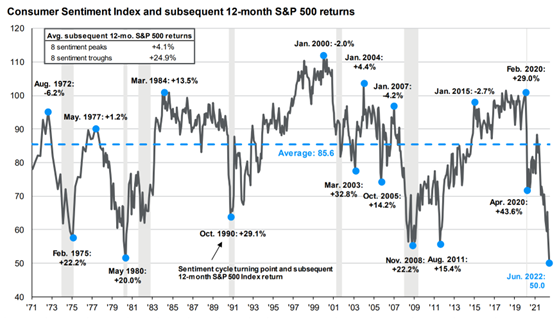

Also, various measures of investor sentiment reflected extreme levels of pessimism, indicating that investors were pricing in a worst-case scenario for the market. Consumer sentiment was at its lowest level in over 50 years (10). History suggests that investing during periods of extreme lows in pessimism has been rewarding.

Portfolio Positioning

The economy and markets were in an odd position where if the Fed tightens too much, the result could be a recession and if it tightens too little, inflation is the more significant threat. We are not concentrating portfolios on any particular outcome. The optimal portfolio to combat inflation differs from the optimal portfolio for a recession. When uncertainty is so high, portfolio diversification matters more than usual.

During the quarter, we increased our position in an inflation-sensitive fund and weighting toward value and defensive stocks. Models remained 2% overweight equities compared to their benchmarks. Moving to cash is far from the ideal solution because of inflation. Instead, we prefer incorporating defensive stocks, high-dividend stocks, high-quality bonds, and inflation-sensitive assets like commodities and Treasury Inflation Protected Securities (TIPS).

Please reach out to your advisor if you have any questions or concerns.

- A wealth of common sense, “The Worst 6 Months Ever for Financial Markets”

- Morningstar Direct, as of 6/30/2022

- As of 6/30/2022

- Moringstar, as of 6/30/2022

- Accuvest Global Advisors

- Morningstar Direct, as of 6/30/2022

- Blackrock. Data from 1957-2020. Earnings decline calculated for the S&P 500 Index starting from the earnings peak prior to the recession and ending with the recession period earnings trough.

- Yardeni Research

- Ned Davis Research

- JPMorgan, University of Michigan consumer survey

Company News

Market Commentary

Retirement Planning

Tax Planning

Cyber Security

Important Disclosures

Leonard Rickey Investment Advisors, PLLC (“LRIA”), is an SEC registered investment adviser located in the State of Washington. Registration does not imply a certain level of skill or training. For information pertaining to the registration status of LRIA, please contact LRIA or refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov).

This is provided for general information only and contains information that is not suitable for everyone. As such, nothing herein should be construed as the provision of specific investment advice or recommendations for any individual. To determine which investments may be appropriate for you, consult your financial advisor prior to investing. There is no guarantee that the views and opinions expressed herein will come to pass. This newsletter contains information derived from third party sources. Although we believe these third-party sources to be reliable, we make no representations as to the accuracy or completeness of any information prepared by any unaffiliated third party incorporated herein and take no responsibility therefore.

Any projections, forecasts and estimates, including without limitation any statement using “expect” or “believe” or any variation of either term or a similar term, contained here are forward-looking statements and are based upon certain current assumptions, beliefs and expectations that LRIA considers reasonable or that the applicable third parties have identified as such. Forward-looking statements are necessarily speculative in nature, and it can be expected that some or all of the assumptions or beliefs underlying the forward-looking statements will not materialize or will vary significantly from actual results or outcomes. Some important factors that could cause actual results or outcomes to differ materially from those in any forward-looking statements include, among others, changes in interest rates and general economic conditions in the U.S. and globally, changes in the liquidity available in the market, change and volatility in the value of the U.S. dollar, market volatility and distressed credit markets, and other market, financial or legal uncertainties. Consequently, the inclusion of forward-looking statements herein should not be regarded as a representation by LRIA or any other person or entity of the outcomes or results that will be achieved by following any recommendations contained herein. While the forward-looking statements here reflect estimates, expectations and beliefs, they are not guarantees of future performance or outcomes. LRIA has no obligation to update or otherwise revise any forward-looking statements, including any revisions to reflect changes in economic conditions or other circumstances arising after the date hereof or to reflect the occurrence of events (whether anticipated or unanticipated), even if the underlying assumptions do not come to fruition. Opinions expressed herein are subject to change without notice and do not necessarily take into account the particular investment objectives, financial situations, or particular needs of all investors.

For additional information about LRIA, including fees and services, please contact us for our Form ADV disclosure brochure using our contact information herein. Please read the disclosure brochure carefully before you invest or send money.

Celebrating Independence—Both National and Financial