Feb 25, 2022 Market Update: February 25, 2022

It has been a rough start to the year for risk assets with the S&P 500 off 11%+ and U.S. growth stocks down even more. Both the Fed’s hawkish pivot and the Russia/Ukraine conflict have weighed on risk assets.

We haven’t seen a 10% correction in the S&P 500 since March 2020, and we only had a single 5% pullback last year. The average year sees nearly three separate 5% corrections, putting in perspective just how rare last year was with only one and why greater volatility this year would be quite normal. The S&P 500 has had about one 10% correction per year (see our recent blog here for more detailed analysis).

This type of market volatility can make investors worry and be a catalyst for ill-timed trading decisions. Investors have also had to navigate extreme style rotation. Many growth stocks that benefited from COVID have seen greater than 50% corrections in the last three months while value-oriented stocks have held up relatively well so far. We were trimming our growth holdings last year and adding to value and lower volatility equities.

While a 11%+ pullback in equity prices is never enjoyable, we don’t believe recent market weakness is indicative of a certain recession. The COVID-19 case count has dropped dramatically, corporate revenues and earnings both continue to grow meaningfully, and the U.S. consumer is benefitting from rising wages, ample savings, and home price appreciation. Of course, there are always risks including continued contraction in valuations, tighter financial conditions and inflation pressures to name a few.

The economic backdrop is important because the average market drawdown was shorter in duration and less severe when there wasn’t a recession versus when there was one (see graph below) (1). On balance, we think the rewards outweigh the risks for equities and we are looking to take advantage of the volatility and add to stock positions.

Time in the market matters, not timing the market

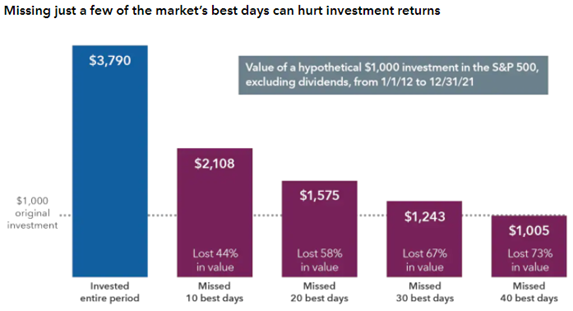

No one can accurately predict short-term market moves, and investors who sit on the sidelines risk losing out on periods of meaningful price appreciation that follow downturns.

Even missing out on just a few trading days can take a toll. For example, a hypothetical investment of $1,000 in the S&P 500 made in 2012 would have grown to more than $3,790 by the end of 2021. But if an investor missed just the 10 best trading days during that period, he or she would have ended up with 44% less (2).

Diversification matters

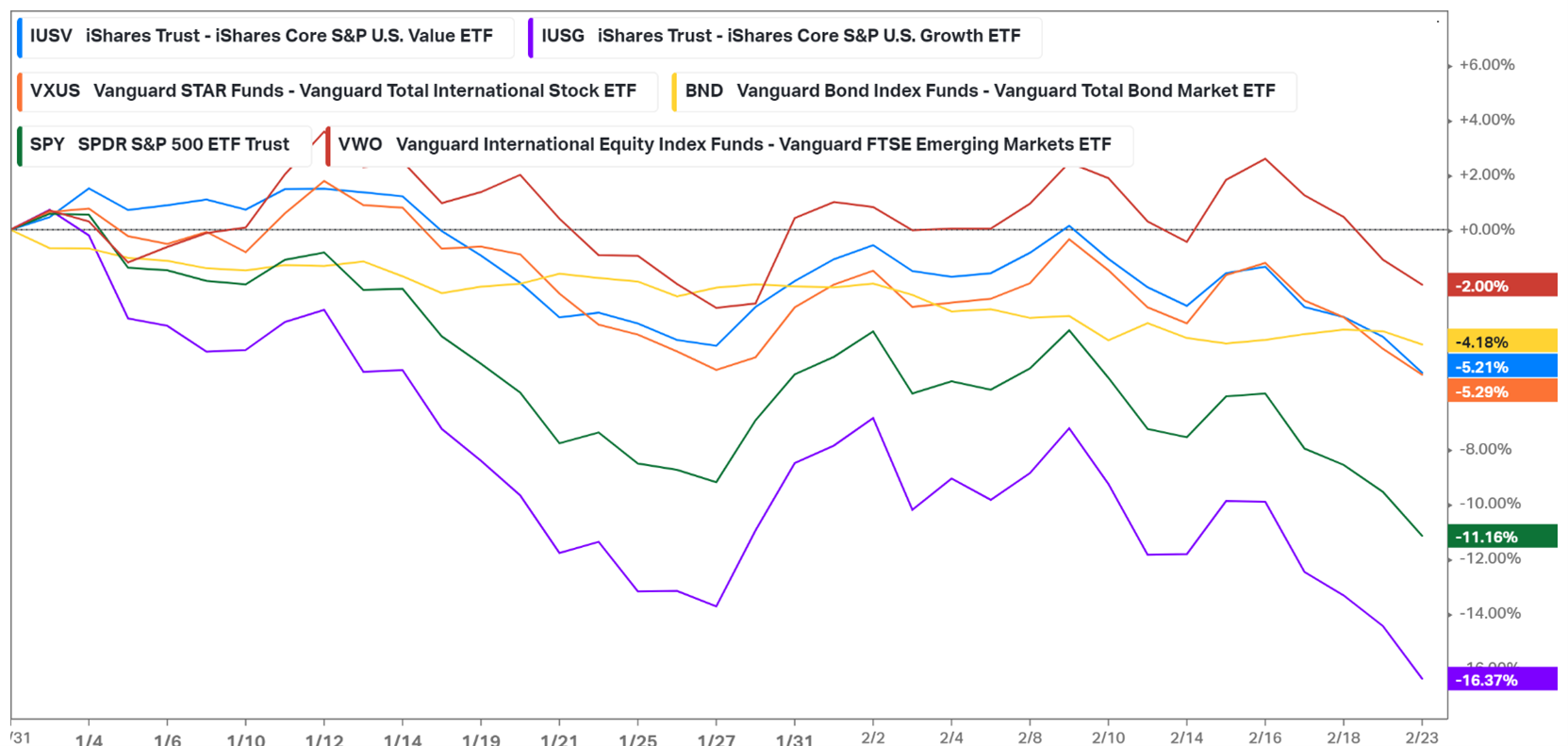

A diversified portfolio doesn’t guarantee profits or assure that investments won’t decrease in value, but it does help lower risk. By spreading investments across various asset classes, investors can buffer the effects of volatility on their portfolios. As a result, overall returns won’t reach the highest highs of any single investment — but they won’t hit the lowest lows either.

This correction is hitting expensively valued growth stocks particularly hard (see purple line below). Value-oriented U.S. stocks (blue line) have fared much better than growth areas of the market and non-U.S. stocks (orange and red lines) have performed better than the S&P 500 Index (green line). While bonds (yellow line) haven’t had positive returns in this drawdown like they have in many past drawdowns, they have had better relative returns than the S&P 500 Index (3).

Zooming Out

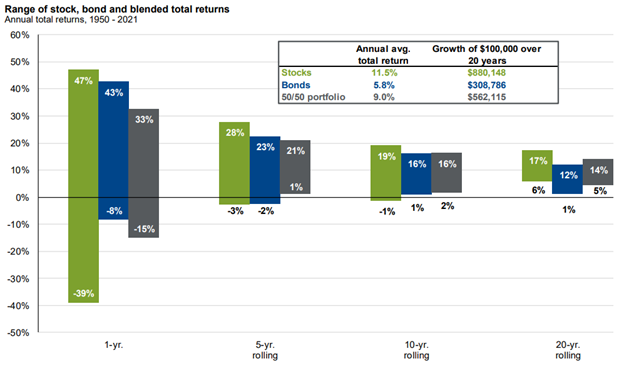

History has shown the longer the period, the greater the chances of a positive outcome. For example, over the past 71 years, 99% of 10-year periods have had positive returns for stock investors (Green bar below) (4).

We can also look at recent history to provide additional context. For example, the CRSP U.S. Total Market Index returned 16.3% per year over the last 10 years, a period in which there were 14 drawdowns of at least 5% (four of those were drawdowns greater than 10%) (5).

The bottom line?

Downturns and volatility are part of investing. As investors, we can’t control markets, but we can control our risk levels and how we react.

We realize it’s easy to say volatility and market dips work themselves out over time, but we know it’s much harder to live through. It can be challenging to watch your portfolio decrease, no matter how much of a buying opportunity it may present.

Please reach out to your advisor if you would like to review your accounts.

(1) Table from Ben Carlson

(2) Capital Group

(3) Koyfin

(4) JPMorgan Guide to the Markets. Based on calendar year returns. Stocks represented by the S&P 500.

(5) Avantis Investors, Monthly Field Guide, January 2022

Company News

Market Commentary

Retirement Planning

Tax Planning

Cyber Security

Important Disclosures

Leonard Rickey Investment Advisors, PLLC (“LRIA”), is an SEC registered investment adviser located in the State of Washington. Registration does not imply a certain level of skill or training. For information pertaining to the registration status of LRIA, please contact LRIA or refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov).

This is provided for general information only and contains information that is not suitable for everyone. As such, nothing herein should be construed as the provision of specific investment advice or recommendations for any individual. To determine which investments may be appropriate for you, consult your financial advisor prior to investing. There is no guarantee that the views and opinions expressed herein will come to pass. This newsletter contains information derived from third party sources. Although we believe these third-party sources to be reliable, we make no representations as to the accuracy or completeness of any information prepared by any unaffiliated third party incorporated herein and take no responsibility therefore.

Any projections, forecasts and estimates, including without limitation any statement using “expect” or “believe” or any variation of either term or a similar term, contained here are forward-looking statements and are based upon certain current assumptions, beliefs and expectations that LRIA considers reasonable or that the applicable third parties have identified as such. Forward-looking statements are necessarily speculative in nature, and it can be expected that some or all of the assumptions or beliefs underlying the forward-looking statements will not materialize or will vary significantly from actual results or outcomes. Some important factors that could cause actual results or outcomes to differ materially from those in any forward-looking statements include, among others, changes in interest rates and general economic conditions in the U.S. and globally, changes in the liquidity available in the market, change and volatility in the value of the U.S. dollar, market volatility and distressed credit markets, and other market, financial or legal uncertainties. Consequently, the inclusion of forward-looking statements herein should not be regarded as a representation by LRIA or any other person or entity of the outcomes or results that will be achieved by following any recommendations contained herein. While the forward-looking statements here reflect estimates, expectations and beliefs, they are not guarantees of future performance or outcomes. LRIA has no obligation to update or otherwise revise any forward-looking statements, including any revisions to reflect changes in economic conditions or other circumstances arising after the date hereof or to reflect the occurrence of events (whether anticipated or unanticipated), even if the underlying assumptions do not come to fruition. Opinions expressed herein are subject to change without notice and do not necessarily take into account the particular investment objectives, financial situations, or particular needs of all investors.

For additional information about LRIA, including fees and services, please contact us for our Form ADV disclosure brochure using our contact information herein. Please read the disclosure brochure carefully before you invest or send money.

2025 1st Quarter Investment Commentary