May 13, 2022 Market Update: May 2022

As we move into spring and leave behind the last signs of a long winter, many worries from a chilly start to the year for markets, unfortunately, are still with us. The S&P 500 Index had its worst April in more than 40 years, and the decline has continued in May leaving the index down over 17% for the year. Previously high-flying stocks have come back to earth, many of them cut in half or more. And bonds, which have historically provided support during stock market volatility, have done little to protect portfolios.

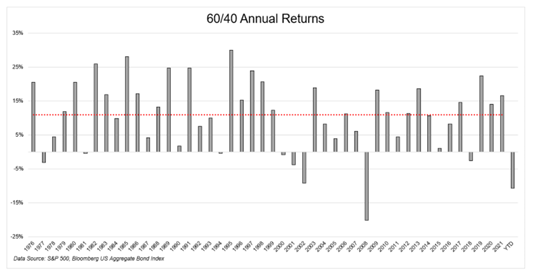

The concerns of rising interest rates and inflation contribute to a retreat in bonds. At the same time, rising interest rates and slowing growth are weighing on equity markets. As a result, a 60/40 portfolio of stocks and bonds is down the most since 2008.

The concerns that have contributed to the poor start are well-known. Historically high inflation, supply chain disruptions, China in another lockdown, geopolitical concerns, an aggressive Federal Reserve Bank (Fed) rate hiking campaign, and soaring yields have all contributed to the worries. Not to mention economic growth worries are spreading after the 1.4% decline in the gross domestic product (GDP) during the first quarter.

Just as April’s dark storm clouds are often chased away by a brighter May, we remain optimistic that more sunshine could be coming. Yes, the GDP report showed an economy that contracted in the first quarter, but that was mainly due to drags on inventory and trade, while more important parts of the economy like consumer spending, housing, and private sector investment all accelerated compared to the fourth quarter. Additionally, 2011 and 2014 both saw negative first-quarter GDP prints, followed by big rebounds in the second quarter to avoid recessions.

Inflation could be nearing a peak, offering a potential driver for improved confidence in the second half of this year. Used car and truck prices have significantly decreased over the past two months, while shipping costs have also dropped nicely. These two data bits suggest inflation may be past its peak, even if it may take a while to get back to normal. Add in supply chain normalization and the potential for a ceasefire in Ukraine to remove some upward pressure on commodities. The Fed may not hike rates nine times as the bond market is currently pricing in. If the Fed overshoots its mark in managing inflation resulting in economic contraction and increased unemployment, we think the resulting recession would do a lot to tame inflation. For many retirees, the risk of hyper-inflation is more acute than the risk of a recession.

From its early January peak, the S&P 500 has corrected 17.9% (as of May 11), slightly above the average yearly correction since 1980 of 14.0%. Midterm years tend to be even more volatile, correcting more than 17% on average, but the index rebounded 32% on average in the 12 months following those midterm year lows. Lastly, the last 21 times the S&P 500 has been down double-digits since 1980, the index rallied back to end the year positive 12 times.

The US economy still carries decent momentum, and a deep recession in 2022 seems unlikely. Factors we consider include:

U.S. unemployment is low, companies are still hiring, and wage growth is solid.

- While Q1 U.S. real GDP growth was disappointing (-1.4 pct), the Atlanta Fed GDPNow model is looking for +1.8 pct growth in Q2 based on the latest readings for the U.S. economy.

- The current unemployment rate is 3.6 percent, very close to the pre-pandemic lows of 3.5 percent and lower than any point in the economic cycles of the 1980s (5.0 pct low), 1990s (3.8 pct low), or 2000s (4.4 pct).

- Job openings hit a new record last month, signaling that companies weren’t worried about the economy or their future earnings.

Corporate bonds are not signaling recession risk. Corporate bond spreads are wider than last year but not near levels consistent with prior recessions.

- Investment-grade corporate bond spreads are 1.45 percentage points over Treasuries, a level that has not been consistent with near or actual recessions(1) .

- High yield corporate bond spreads are 4.55 percentage points over Treasuries. Levels above 6.00 points signal recession or near-recession(2) .

Inflation may be peaking. While the Russia-Ukraine war continues to be a risk for higher inflation, commodity prices have stabilized.

- The highs for WTI crude ($124/barrel on March 8th) are now two months old.

- The most recent CPI report showed lower inflation (8.3%) than the previous month (8.5%).

- The market’s expectation for inflation, measured by the 5-year breakeven inflation rate, peaked in March and has come back down to 2.92%(3).

Household and corporate fundamentals look good.

- First quarter corporate earnings continued to grow and reached record levels.

- Consumer balance sheets are strong, and debt as a percentage of income is near record lows. “Good debt” as a percentage of income is extremely low.

A lot of the damage may already be done.

- Investor sentiment is near record lows, as measured by the University of Michigan consumer sentiment survey and the AII Investor sentiment survey. Stocks usually begin moving up when things seem most dour, and the news is gloom and doom.

- Both stock and bond expected returns have improved. The S&P 500 went from a forward price-to-earnings ratio of 21.7 at the end of April to 16.6 as of May 11(4). The yield-to-worst for the Barclays Aggregate Bond Index as of the end of April 2021 was 1.51%. As of May 11th, it reached 3.47%(5).

The investing climate is quite challenging, but based on historical trends, we believe patience may be rewarded. Even if there may be some downside in the short term, consumer and business fundamentals remain supportive. Strong profits and lower stock prices mean more attractive valuations, and current levels may end up being an attractive entry point for suitable investors.

Please contact your advisor if you have any questions or would like to review your risk tolerance.

(1) Federal Reserve Economic Data, as of 5/11/22. https://fred.stlouisfed.org/series/BAMLC0A0CM

(2) Federal Reserve Economic Data, as of 5/11/22. https://fred.stlouisfed.org/series/BAMLH0A0HYM2

(3) Federal Reserve Economic Data, as of 5/11/22. https://fred.stlouisfed.org/series/T5YIE

(4) Factset

(5) LPL Research

Company News

Market Commentary

Retirement Planning

Tax Planning

Cyber Security

Important Disclosures

Leonard Rickey Investment Advisors, PLLC (“LRIA”), is an SEC registered investment adviser located in the State of Washington. Registration does not imply a certain level of skill or training. For information pertaining to the registration status of LRIA, please contact LRIA or refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov).

This is provided for general information only and contains information that is not suitable for everyone. As such, nothing herein should be construed as the provision of specific investment advice or recommendations for any individual. To determine which investments may be appropriate for you, consult your financial advisor prior to investing. There is no guarantee that the views and opinions expressed herein will come to pass. This newsletter contains information derived from third party sources. Although we believe these third-party sources to be reliable, we make no representations as to the accuracy or completeness of any information prepared by any unaffiliated third party incorporated herein and take no responsibility therefore.

Any projections, forecasts and estimates, including without limitation any statement using “expect” or “believe” or any variation of either term or a similar term, contained here are forward-looking statements and are based upon certain current assumptions, beliefs and expectations that LRIA considers reasonable or that the applicable third parties have identified as such. Forward-looking statements are necessarily speculative in nature, and it can be expected that some or all of the assumptions or beliefs underlying the forward-looking statements will not materialize or will vary significantly from actual results or outcomes. Some important factors that could cause actual results or outcomes to differ materially from those in any forward-looking statements include, among others, changes in interest rates and general economic conditions in the U.S. and globally, changes in the liquidity available in the market, change and volatility in the value of the U.S. dollar, market volatility and distressed credit markets, and other market, financial or legal uncertainties. Consequently, the inclusion of forward-looking statements herein should not be regarded as a representation by LRIA or any other person or entity of the outcomes or results that will be achieved by following any recommendations contained herein. While the forward-looking statements here reflect estimates, expectations and beliefs, they are not guarantees of future performance or outcomes. LRIA has no obligation to update or otherwise revise any forward-looking statements, including any revisions to reflect changes in economic conditions or other circumstances arising after the date hereof or to reflect the occurrence of events (whether anticipated or unanticipated), even if the underlying assumptions do not come to fruition. Opinions expressed herein are subject to change without notice and do not necessarily take into account the particular investment objectives, financial situations, or particular needs of all investors.

For additional information about LRIA, including fees and services, please contact us for our Form ADV disclosure brochure using our contact information herein. Please read the disclosure brochure carefully before you invest or send money.

Celebrating Independence—Both National and Financial