Acting in Your Best Interest Investment Management

A Variety of Investment Solutions

As a fiduciary, we always act in the best interest of our clients. We only make recommendations that are in your best interests.

Wealth Management

Our wealth management portfolios are built to reflect your personal goals, risk tolerance and time horizon. Portfolios are designed to be diversified, low cost and tax efficient and are invested across a spectrum of risk objectives including conservative, moderate and aggressive.

Portfolios feature long-term strategic allocations complemented by active shifts, based on our view of current market opportunities. This dynamic approach enables us to remain flexible and to take advantage of market conditions both now and in the long term while staying aligned to your goals.

Environmental, Social, and Governance (ESG)

Our ESG Portfolios may be right for investors who want to better align their values and preferences with their portfolio. If you want to help raise the bar on sustainable corporate practices these portfolios might be for you. Portfolios are based on sound investment principles and are built using a diversified set of asset classes.

We emphasize broad diversification across countries, industries and companies, low costs and tax efficiency.

We place equal importance on sustainability scores and performance.

The funds we select employ a range of ESG investment methods.

Integrated ESG Strategy

Integrates all three factors into one broadly diversified portfolio.

Tailored ESG Strategy

Focuses specifically on what factor is most important to you – Either Environmental issues or Governance issues.

Individual Equities

Portfolio of individual stocks uniquely tailored to your preferences. Your decisions negatively screen out companies and sectors that don’t align with your values.

Institutional clients including 401(k) plans for employers, non-profits and endowments

To help meet your fiduciary responsibility, we provide:

Customized investment policy statements

Investment management including selecting investments, monitoring and trading

Cash flow management

Reporting on performance

Education

Coordinate and lead investment committee meetings

Tech/client portal

For more details on how we design portfolios please visit the links below:

Plan. Save. Invest. Enjoy. Investment Philosophy

Our investment philosophy is guided by a set of core principles. We believe that these principles will improve your odds of success.

Markets are Rewarding

The financial markets have rewarded long-term investors that have stayed invested. Historically, both the equity and bond markets have provided growth of wealth that has more than offset inflation.

Risk and Return Are Related

We believe there is a strong relationship between risk and return. In general, higher risk (i.e. volatility of return) is associated with a higher return. We help balance your goals with 1) your tolerance for risk and 2) your capacity for risk. Risk tolerance refers to your willingness (or psychological makeup) to accept volatility. Risk capacity refers to the amount of risk you "need" to take given your current financial situation to reach your financial goals. Take our risk assessment quiz here.

Smart Diversification

Holding securities across multiple asset classes, investment styles, market capitalizations, sectors, and regions can help manage overall risk. You never know which market segments will outperform from year to year. By holding a globally diversified portfolio, you are well-positioned to seek returns wherever they occur.

Asset Allocation is More Important than Security Selection

The allocation among asset classes (i.e. stocks, bonds, cash, etc) influences long-term portfolio results more than the selection of individual securities. Using the broad principles of diversification, we optimize the return of your portfolio with your goals and your risk tolerance. Learn more about our allocation framework.

We Utilize Both Strategic and Tactical Asset Allocation

Markets generally "work" over the long term and our strategic allocation is designed to capture the long-term returns markets provide. A smaller portion of the portfolio is tactically managed to take advantage of short-, mid-, and long-term opportunities the markets present or to manage risk in the portfolio. Learn more about our tactical asset allocation.

Rebalancing Matters

We review your portfolio for rebalancing opportunities on at least a quarterly basis. We consider the costs of transacting and the tax consequences when rebalancing your portfolio.

Taxes Matter

It is not what you make but what you keep that is important. We look at taxes as a year-round strategy. We use tax-efficient strategies to keep taxes low and continually review your portfolios for tax-loss harvesting opportunities.

Costs Matter

Every dollar paid in fees and expenses is a dollar less in return earned. We use low-cost investments, which allow you to keep more your returns. Learn more about our manager selection process.

Staying Disciplined

Markets are unpredictable and your behavior has a significant impact on your long-term returns. Daily market news and commentary can challenge your investment discipline. Some messages stir anxiety about the future, while others tempt you to chase the latest investment fad. Reacting to news headlines may lead to making poor investment decisions. It's crucial to maintain a long-term perspective.

Investment Process Allocation Framework

Step 1

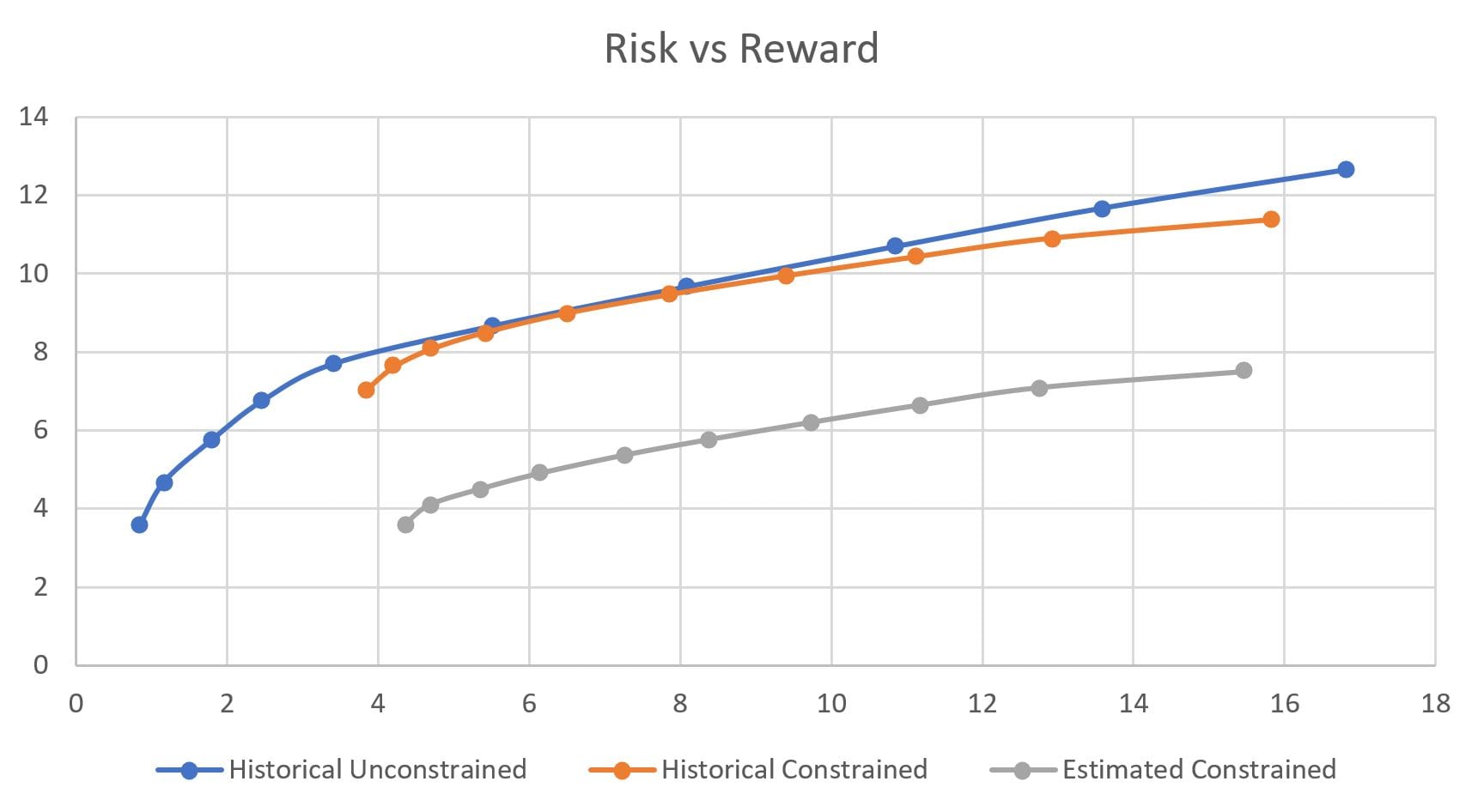

The first step in the asset allocation process is to review historical asset class returns and use mean-variance optimization to create an efficient portfolio. This first step is done with no constraints on the weight of the different asset classes. While technically efficient, this process often leads to an unbalanced and undiversified portfolio due to the limited constraints.

Step 2

The second step is again done using historical returns, but the asset classes are constrained, so the portfolio is more balanced. Maximum and minimum allocations for each asset class are set so that the portfolio remains more diversified.

Step 3

The model is extremely sensitive to the estimated return assumption therefore, the third and final step is to estimate future returns instead of use historical returns. While historical returns are a reasonable proxy for how the asset class may behave in the future, they are not exact and can often be wildly misleading. Overall, this process weighs the return, risk and correlation characteristics of the available asset classes and creates an optimal blend.

Investment Process Strategical & Tactical Allocation

LRIA's primary methods of analysis are fundamental, technical and cyclical analysis.

Fundamental analysis involves the fundamental financial condition and competitive position of a company. LRIA will analyze the financial condition, capabilities of management, earnings, new products and services, and the company's markets and position amongst its competitors to determine the recommendations. The primary risk in using fundamental analysis is that while a company's overall health and position may be good, market conditions may negatively impact the security.

Technical analysis involves analyzing past market data rather than specific company data in determining the recommendations made to clients. Technical analysis may involve the use of charts to identify market patterns and trends which may be based on investor sentiment rather than the fundamentals of the company. The primary risk in using technical analysis is that spotting historical trends may not help to predict such trends in the future.

Cyclical analysis is similar to technical analysis. It involves analyzing market conditions at a macro (entire market/economy) or micro (company specific) level, rather than the overall fundamental analysis of the health of the particular investment LRIA is recommending. The risks with cyclical analysis are similar to those of technical analysis.

Investment Process Manager Selection

Our manager selection process is objective and utterly independent of outside influences. We use a comprehensive approach that examines both quantitative and qualitative criteria. We use both actively managed mutual funds and ETF's. The evaluation criteria can be broken out into four general areas:

Price

A large body of research indicates funds that charge below-average fees tend to generate above-average returns.

Process

Investment managers should have a clearly articulated investment philosophy that communicates investment objectives, approaches, and strategies employed.

People

Managers with high ethical standards, long tenure, incentives that are aligned with investors and a strong track record are preferred.

Performance

Past performance is seldom the most useful metric for forecasting a fund's future returns. Most funds in the top quartile of previous five-year returns did not maintain a top-quartile ranking in the following five years. (insert graph). No single performance statistic contains sufficient information to make rational judgments but reviewing risk-adjust performance, performance consistency and rolling period returns versus peer groups can provide important information in picking investments.

Disclosures

Nothing herein should be construed as the provision of specific investment advice or recommendations for any individual. To determine which investments may be appropriate for you, consult your financial advisor prior to investing. All performance referenced herein is historical in nature and is not an indication of or a guarantee of future results. All indices are unmanaged and cannot be invested into directly.

Any projections, forecasts and estimates, including without limitation any statement using “expect” or “believe” or any variation of either term or a similar term, contained here are forward-looking statements and are based upon certain current assumptions, beliefs and expectations that LRIA considers reasonable or that the applicable third parties have identified as such. Forward-looking statements are necessarily speculative in nature, and it can be expected that some or all the assumptions or beliefs underlying the forward-looking statements will not materialize or will vary significantly from actual results or outcomes.

Opinions expressed herein are subject to change without notice and do not necessarily consider the particular investment objectives, financial situations, or particular needs of all investors. This site contains information derived from third party sources. Although we believe these third-party sources to be reliable, we make no representations as to the accuracy or completeness of any information prepared by any unaffiliated third party incorporated herein, and take no responsibility, therefore.

Your experience may vary according to your individual circumstances and there can be no assurance that LRIA will be able to achieve similar results for all clients in comparable situations or that any strategy or investment will prove profitable. As investment returns, inflation, taxes and other economic conditions vary, your actual results may vary significantly.

Stock investing includes numerous specific risks including the fluctuations of dividend, loss of principal, and potential illiquidity of the investment in a falling market. International and emerging markets investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. Small cap stocks may be subject to a higher degree of risk than more established companies’ securities. The illiquidity of the small cap market may adversely affect the value of these investments. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values and yields will decline as interest rates rise and bonds are subject to availability and change in price. The risks associated with investment-grade corporate bonds are considered significantly higher than those associated with first-class government bonds. The fast price swings in commodities and currencies can result in significant volatility in an investor’s holdings.

Growth of a Dollar, 1926-2019: In USD. US Small Cap is the CRSP 6–10 Index. US Large Cap is the S&P 500 Index. US Long-Term Government Bonds is the IA SBBI US LT Govt TR USD. US Treasury Bills is the IA SBBI US 30 Day TBill TR USD. US Inflation is measured as changes in the US Consumer Price Index. CRSP data is provided by the Center for Research in Security Prices, University of Chicago. S&P data © 2020 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. US long-term government bonds and Treasury bills data provided by Ibbotson Associates via Morningstar Direct. US Consumer Price Index data is provided by the US Department of Labor Bureau of Labor Statistics.

Annual Returns by Market Index: In USD. US Large Cap is the S&P 500 Index. US Large Cap Value is the Russell 1000 Value Index. US Small Cap is the Russell 2000 Index. US Small Cap Value is the Russell 2000 Value Index. US Real Estate is the Dow Jones US Select REIT Index. International Large Cap Value is the MSCI World ex USA Value Index (gross dividends). International Small Cap Value is the MSCI World ex USA Small Cap Value Index (gross dividends). Emerging Markets is the MSCI Emerging Markets Index (gross dividends). Five-Year US Government Fixed is the Bloomberg Barclays US TIPS Index 1–5 Years. S&P and Dow Jones data © 2020 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. Frank Russell Company is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes. MSCI data © MSCI 2020, all rights reserved. Bloomberg Barclays data provided by Bloomberg. Chart is for illustrative purposes only.

Risk vs Reward:

Disclosures to come