Jun 8, 2022 Does Having More Money Equate to More Happiness?

The relationship between happiness and money is complicated. Just consider this sampling of the myriad studies that explore the link between the dollars we earn and the happiness we feel.

A study from the 1970s by Philip Brickman, Dan Coates and Ronnie Janoff-Bulman for the Journal of Personality and Social Psychology even found that lottery winners took less satisfaction than nonlottery winners in everyday events, and in general, they were not any happier than those who didn’t win the lottery.

Another study from the 1970s, conducted by economist Richard Easterlin, found that rich countries were no happier than less well-off nations. But within countries, he concluded there was a relationship between individuals’ incomes and happiness—relative wealth was crucial to well-being(1).

Almost 30 years later, economists Betsey Stevenson and Justin Wolfers reexamined Easterlin’s findings by analyzing a dataset with far more countries and people. They concluded there was a relationship between people’s incomes and happiness not just within countries but among countries as well. At least according to this paper, more money equals more happiness(2).

How did these researchers make these determinations? Using surveys, they measured respondents’ well-being by presenting a picture of a ladder with this guidance: “Please imagine a ladder with steps numbered from zero at the bottom to 10 at the top.

Suppose we say that the top of the ladder represents the best possible life for you, and the bottom of the ladder represents the worst possible life for you. On which step of the ladder would you say you personally feel you stand at this time?”

Is this truly happiness, though? This ladder scale represents one way to measure what researchers call “life satisfaction.” It taps into something more abstract than how happy you feel in each moment. Happiness, by contrast, is the amount of positive emotion you experience day to day.

More Money May Fuel Happiness, but Returns Ebb After a Certain Threshold

In 2010, Nobel Prize-winning economists Daniel Kahneman and Angus Deaton decided to investigate the link between happiness (positive emotions) and wealth. They collaborated with survey firms to ask hundreds of thousands of people how happy they were the day prior and correlated the responses with income(3).

Their finding? Happiness and income tracked each other closely up until about $75,000, but the relationship fizzled after that. So, more money helped fuel happiness only to a certain point.

What you might not know is that research earlier this year challenged this classic $75,000 finding by showing that happiness did rise with income(4). But happiness tracked income only when income was transformed into logarithmic terms.

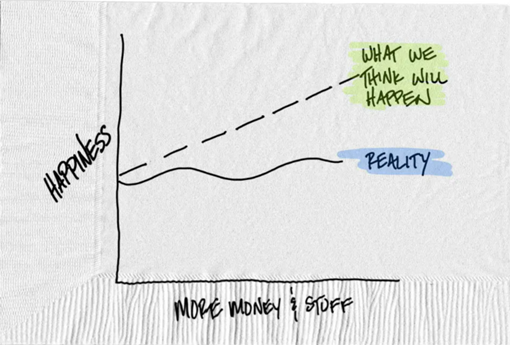

Without going too far down a stats rabbit hole, the point is that more money leads to more happiness, but the returns diminish once you surpass a certain threshold. Put differently, each dollar you earn doesn’t lead to an equal increase in the amount of happiness you experience. The following drawing from Carl Richards illustrates the point well:

So, How Should You Spend Your Money?

After surveying the literature on the relationship between money and happiness, psychologists Liz Dunn, Dan Gilbert and Timothy Wilson observed that if more money isn’t making you happy, perhaps you’re not spending it right(5).

If that’s the case, how should you be spending your money to positively impact your happiness? Dunn and Mike Norton lay out a compelling framework for smart spending in their entertaining book, Happy Money: The Science of Happier Spending(6). A few of their main principles:

Buy Experiences (and Turn Things into Experiences, Too)

It seems like a generational rallying cry for millennials: Buy experiences, not things! And to some extent, scientific research backs this assertion—studies have shown that experiences often lead to greater happiness than material purchases. The research indicates experiences surpass material things for three reasons:

- Experiences are harder to compare than things.

- Experiences are anticipated, felt and remembered.

- Experiences are often inherently social (think about the last concert or sporting event you attended).

But are experiences harder to compare than things? With the prevalence of social media, experiences may have become the thing (so to speak) to compare.

Nonetheless, experiences are still social with elements of what economists deem anticipatory, experienced and retrospective utility. So, you could expand the popular sentiment of “Buy experiences, not things!” by advocating “Turn things into experiences!” as well.

After all, if experiences trump material goods because of their ability to be social, anticipated, felt and remembered, then why not also apply these same principles to the material goods you inevitably buy? A new TV for your living room, for example, could be just another “thing.” Or you could do your best to anticipate its purchase, savor the time you spend watching your favorite programming and to the extent possible, enjoy watching TV in the company of others.

Spend Now, Consume Later

With the rise of credit cards in the 1980s and more recent addition of digital purchasing platforms, such as Apple Pay and Venmo, it’s easier than ever to succumb to instant gratification.

The problem with being able to buy whatever you want whenever you want it is that consumption happens immediately, but payment happens at some later date.

When you consume in this way, you may rob yourself of the positive feelings that go along with anticipating a purchase and often buy more than you can afford. What if, as Dunn and Norton asked, you flipped things around and tried your best to pay now and consume later?

Doing so would automatically allow you to add some anticipation back into the purchase process. With the benefit of planning and decisions made in a “colder” state, paying now and consuming later would also allow you to think more deeply about what you actually want and need.

For example, when you pay in advance for a flight, hotel stay or rental car, you’re paying now and consuming later. Of course, not all purchasing contexts allow for this sort of behavior. You can, however, game the system: Saving in advance of the big purchase may reap the same psychological benefits as paying now and consuming later.

Buy Time

If a genie gave you the choice between having more money or more time, which would you choose? Researchers asked this to thousands of Americans(7).

After considering basic demographic factors and income, a clear pattern emerged: People who valued time over money were happier. And, perhaps there’s a reason: More time, if spent in ways that are deemed productive or social, may be beneficial to our happiness.

Where does money come into the picture? As researcher Ashley Whillans and her colleagues have found, spending money to buy time can also boost happiness(8).

This isn’t just a correlation. Their work showed that people who were prompted to spend money on time-saving services subsequently experienced greater happiness versus having spent their money on things. This relationship between time-saving expenditures and improved well-being applies across the income spectrum.

Fixing the Relationship Between Happiness and Money

Putting these various pieces together suggests income and happiness don’t have to be such distant partners. Their coupling can be much closer—more income can be tied to more happiness if you spend money more intentionally to increase your happiness.

Disclosures

This was written by Hal Hershfield, Ph.D, a Professor of Marketing and Behavioral Decision Making in the Anderson School of Management at the University of California, Los Angeles and a consultant to Avantis Investors. It was edited by Leonard Rickey Investment Advisors.

(1) Richard A. Easterlin, “Does Economic Growth Improve the Human Lot? Some Empirical Evidence,” in Nations and Households in Economic Growth: Essays in Honor of Moses Abramovitz, eds. Paul A. David and Melvin W. Reder (New York: Academic Press, 1974), 89-125.

(2) Betsey Stevenson and Justin Wolfers, “Economic Growth and Subjective Well-Being: Reassessing the Easterlin Paradox,” NBER Working Paper 14282, (August 2008).

(3) Daniel Kahneman and Angus Deaton, “High income improves evaluation of life but not emotional well-being,” Proceedings of the National Academy of Sciences 107, no. 38 (September 2010): 16489-16493.

(4) Matthew A. Killingsworth, “Experienced well-being rises with income, even above $75,000 per year,” Proceedings of the National Academy of Sciences 118, no. 4 (January 2021): e2016976118.

(5) Elizabeth W. Dunn, Daniel T. Gilbert, Timothy D. Wilson, “If money doesn’t make you happy, then you probably aren’t spending it right,” Journal of Consumer Psychology 21, no. 2 (April 2011): 115-125.

(6) Elizabeth Dunn and Michael Norton, Happy Money: The Science of Happier Spending, (New York, Simon & Schuster, 2014).

(7) Hal E. Hershfield, Cassie Mogilner, Uri Bamea, “People Who Choose Time Over Money Are Happier,” Social Psychological and Personality Science 7, no. 7 (September 2016): 697-706.

(8) Ashley V. Whillans, Elizabeth W. Dunn, Paul Smeets, et al., “Buying time promotes happiness,” Proceedings of the National Academy of Sciences 114, no. 32 (August 2017): 8523-8527.

Company News

Market Commentary

Retirement Planning

Tax Planning

Cyber Security

Important Disclosures

Leonard Rickey Investment Advisors, PLLC (“LRIA”), is an SEC registered investment adviser located in the State of Washington. Registration does not imply a certain level of skill or training. For information pertaining to the registration status of LRIA, please contact LRIA or refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov).

This is provided for general information only and contains information that is not suitable for everyone. As such, nothing herein should be construed as the provision of specific investment advice or recommendations for any individual. To determine which investments may be appropriate for you, consult your financial advisor prior to investing. There is no guarantee that the views and opinions expressed herein will come to pass. This newsletter contains information derived from third party sources. Although we believe these third-party sources to be reliable, we make no representations as to the accuracy or completeness of any information prepared by any unaffiliated third party incorporated herein and take no responsibility therefore.

Any projections, forecasts and estimates, including without limitation any statement using “expect” or “believe” or any variation of either term or a similar term, contained here are forward-looking statements and are based upon certain current assumptions, beliefs and expectations that LRIA considers reasonable or that the applicable third parties have identified as such. Forward-looking statements are necessarily speculative in nature, and it can be expected that some or all of the assumptions or beliefs underlying the forward-looking statements will not materialize or will vary significantly from actual results or outcomes. Some important factors that could cause actual results or outcomes to differ materially from those in any forward-looking statements include, among others, changes in interest rates and general economic conditions in the U.S. and globally, changes in the liquidity available in the market, change and volatility in the value of the U.S. dollar, market volatility and distressed credit markets, and other market, financial or legal uncertainties. Consequently, the inclusion of forward-looking statements herein should not be regarded as a representation by LRIA or any other person or entity of the outcomes or results that will be achieved by following any recommendations contained herein. While the forward-looking statements here reflect estimates, expectations and beliefs, they are not guarantees of future performance or outcomes. LRIA has no obligation to update or otherwise revise any forward-looking statements, including any revisions to reflect changes in economic conditions or other circumstances arising after the date hereof or to reflect the occurrence of events (whether anticipated or unanticipated), even if the underlying assumptions do not come to fruition. Opinions expressed herein are subject to change without notice and do not necessarily take into account the particular investment objectives, financial situations, or particular needs of all investors.

For additional information about LRIA, including fees and services, please contact us for our Form ADV disclosure brochure using our contact information herein. Please read the disclosure brochure carefully before you invest or send money.

Celebrating Independence—Both National and Financial