Mar 17, 2022 What Can Investors do to Hedge Inflation?

If you missed part 1 on the current inflation environment, here is a quick summary:

Inflation is at 40-year highs in the United States. However, sustained periods of elevated inflation in the U.S. are rare. Over the past 100 years, U.S. inflation has stayed below 5% the vast majority of the time. In the aftermath of the 2007–2009 financial crisis, inflation has struggled to reach the Fed’s 2% goal despite unprecedented stimulus measures and historically low interest rates.

There are many factors to today’s inflation but some of the main sources are:

- Large consumer demand for goods (versus services) due in large part to social distancing during COVID lockdowns.

- The supply chain, already hampered by COVID, can’t keep up with the increased demand for these goods.

- More recently, rents and wages have increased. The rate of increase isn’t extreme yet, but rents and wages tend to be persistent and may lead to inflation sticking around longer. Read the whole blog here.

What can investors do to hedge inflation?

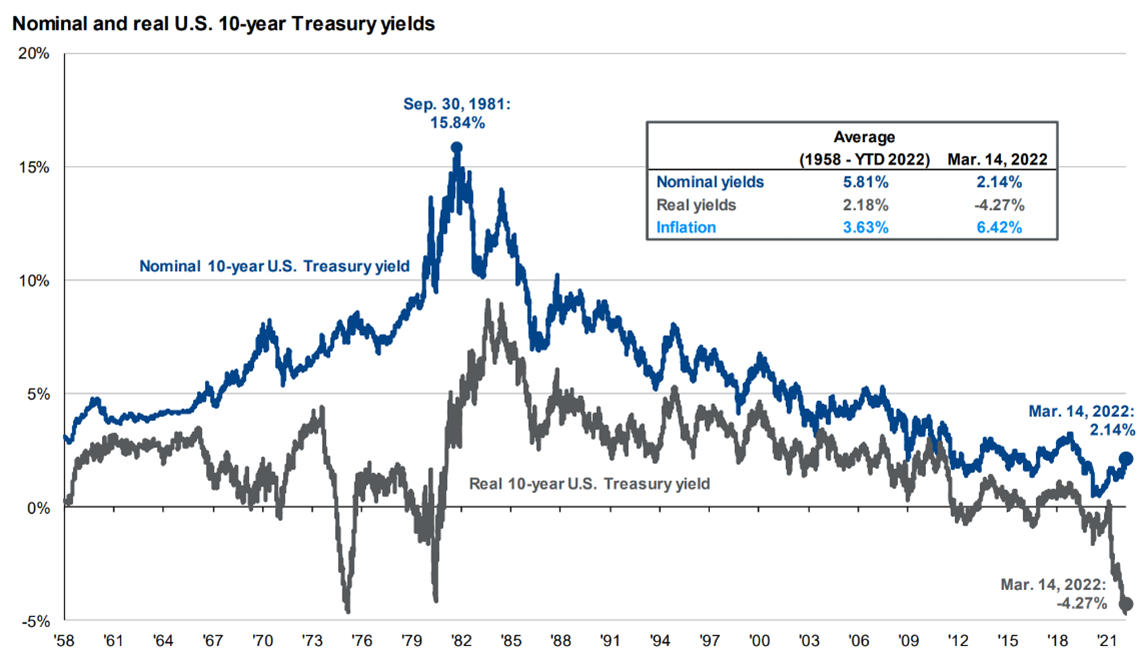

It’s a confusing situation for investors. Inflation is surging, yet the 10-year Treasury yield is only 2.14%, well below current inflation. As a result, Treasury yields after inflation are negative and at their lowest levels in decades (see gray line below) (1).

Inflation hedges aim to track the short-term fluctuations in inflation very precisely. Historically, Treasury bonds haven’t done a great job of protecting investors during above-average periods of inflation. This is because bonds pay their investors a fixed payment over time. If inflation increases, these fixed payments lose their purchasing power, which causes the bonds to decline in value as well. Bonds with longer maturities are more sensitive to inflation than those with shorter maturities.

The clearest inflation hedge is Treasury Inflation-Protected Securities (TIPS). Like Treasury bonds, these bonds are issued by the U.S. government, but unlike Treasury bonds, they are directly indexed to the Consumer Price Index (CPI). If inflation spikes up more than expected, owners of TIPS are compensated through an adjustment for the increase in CPI. It’s important to note that TIPS are still bonds and therefore have interest rate risk.

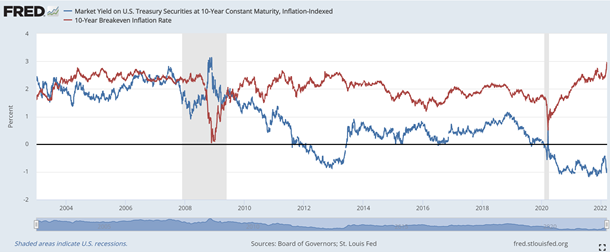

The after inflation yield TIPS offer is currently around negative 1% (blue line below) (2). Currently the market is suggesting inflation of around 2.9% annually over the next decade (red line below). While this is the highest rate in over a decade, it is a far cry from the current inflation rate of 7.9%.

This 2.9% inflation expectation is being priced into TIPS prices. If inflation over the next 10 years is higher than 2.9%, TIPS can outperform Treasury bonds with a similar duration (price sensitivity to changes in interest rates). If inflation over the next 10 years is lower than 2.9%, TIPS may underperform Treasury bonds with similar duration. This makes sense because the point of TIPS is to hedge against inflation risk. TIPS prices reflect a 2.9% annualized inflation over the next 10 years.

Do stocks keep up with inflation?

While not a direct hedge against inflation, stocks have a long history of preserving purchasing power over the long run. Stocks don’t make great inflation hedges in the short term, but they tend to retain their value during inflationary periods because they can raise prices for their customers. In addition, stocks are in businesses that charge prices and pay wages, so their cash flows should keep up with inflation over long periods.

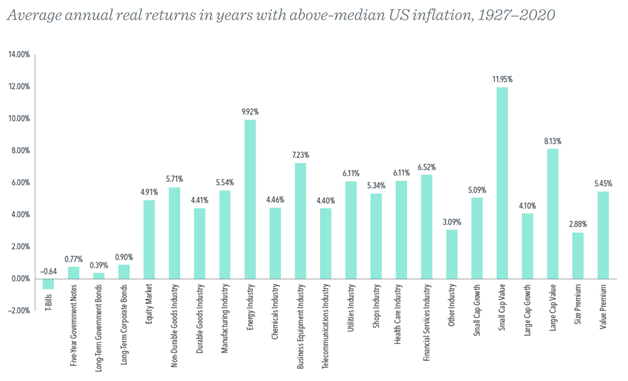

Indeed, history shows us that stocks have outperformed inflation over time. Over the past three decades through June 2021, the S&P 500 had an annualized return of 8.5% after adjusting for inflation (3). The below graph shows the real returns (after inflation is factored in) in years with above average inflation (defined as above 5.5%) of asset classes ranging from various bonds, stocks, and sectors (4). Each of these assets outpaced inflation except for T-Bills. (T-Bills are short-term debt issued and backed by U.S. government). Value equities and commodity-linked companies have performed the best during times of above average inflation.

Do other asset classes keep up with inflation?

For the same reason stocks tend to maintain purchasing power, real estate can be a good store of value. It is a real asset that can derive income from monetary payments (rents, leases). Therefore, if payments increase due to inflation, the value of the land/property should go up with them. This is what we see in the historical data.

Commodities can also do well as a store of value. Many commodities are input into production and a source of rising prices. So, having some commodity exposures in a portfolio may help hedge against rising prices. However, commodities are a diverse set of assets and the inflation hedging properties depend on the individual commodity. They are also very volatile so it may be best to keep any investment relatively small.

Gold is often seen as a safe-haven asset during inflationary periods; however, its historical track record is mixed. Gold is influenced by a variety of factors that don’t always correlate directly to actual inflation. For instance, if the end of the 1970s and the early 1980s is taken out of the sample, the inflation hedging properties look much weaker.

Some proclaim bitcoin is the digital version of gold and can be an inflation hedge due to the ‘limited’ supply. While this may be true for individual cryptocurrencies, it isn’t true in aggregate – by last count there are over 10,000 different cryptocurrencies, up from just 66 in 2013 (5). In addition, bitcoin is untested with only nine years of data – none of which include an inflation regime. Furthermore, Bitcoin is more than five times more volatile than the S&P 500 or gold, which could lead to it being an unreliable hedge.

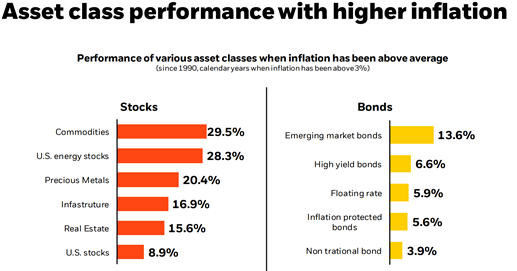

The below graph gives a good summary of how various asset classes have performed when inflation has been above 3% (6). All these assets, except TIPS, are not directly linked to CPI. Consequently, they can only do an imperfect job of hedging broad-based purchasing power erosion. For example, if you pick the wrong stocks and inflation affects those companies’ labor costs more than is compensated for by their rising prices, those shares could decline. If you pick the wrong commodities, they could see less value appreciation than others driving the broader trend.

Inflation is a large risk that we haven’t seen for many years. Unfortunately, we don’t know if recent inflation signals a coming wave of broad and persistent inflation or just a temporary snapback following the unusually sharp economic downturn in 2020. The future is always uncertain. The possibility of unwelcome or unexpected events is something we address in your portfolio’s initial design and review consistently. The breakout of war in Eastern Europe has added fuel to the inflation environment and made inflation a larger risk. As a result, we have adjusted portfolios to better account for this risk.

Company News

Market Commentary

Retirement Planning

Tax Planning

Cyber Security

Important Disclosures

Leonard Rickey Investment Advisors, PLLC (“LRIA”), is an SEC registered investment adviser located in the State of Washington. Registration does not imply a certain level of skill or training. For information pertaining to the registration status of LRIA, please contact LRIA or refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov).

This is provided for general information only and contains information that is not suitable for everyone. As such, nothing herein should be construed as the provision of specific investment advice or recommendations for any individual. To determine which investments may be appropriate for you, consult your financial advisor prior to investing. There is no guarantee that the views and opinions expressed herein will come to pass. This newsletter contains information derived from third party sources. Although we believe these third-party sources to be reliable, we make no representations as to the accuracy or completeness of any information prepared by any unaffiliated third party incorporated herein and take no responsibility therefore.

Any projections, forecasts and estimates, including without limitation any statement using “expect” or “believe” or any variation of either term or a similar term, contained here are forward-looking statements and are based upon certain current assumptions, beliefs and expectations that LRIA considers reasonable or that the applicable third parties have identified as such. Forward-looking statements are necessarily speculative in nature, and it can be expected that some or all of the assumptions or beliefs underlying the forward-looking statements will not materialize or will vary significantly from actual results or outcomes. Some important factors that could cause actual results or outcomes to differ materially from those in any forward-looking statements include, among others, changes in interest rates and general economic conditions in the U.S. and globally, changes in the liquidity available in the market, change and volatility in the value of the U.S. dollar, market volatility and distressed credit markets, and other market, financial or legal uncertainties. Consequently, the inclusion of forward-looking statements herein should not be regarded as a representation by LRIA or any other person or entity of the outcomes or results that will be achieved by following any recommendations contained herein. While the forward-looking statements here reflect estimates, expectations and beliefs, they are not guarantees of future performance or outcomes. LRIA has no obligation to update or otherwise revise any forward-looking statements, including any revisions to reflect changes in economic conditions or other circumstances arising after the date hereof or to reflect the occurrence of events (whether anticipated or unanticipated), even if the underlying assumptions do not come to fruition. Opinions expressed herein are subject to change without notice and do not necessarily take into account the particular investment objectives, financial situations, or particular needs of all investors.

For additional information about LRIA, including fees and services, please contact us for our Form ADV disclosure brochure using our contact information herein. Please read the disclosure brochure carefully before you invest or send money.

2025 1st Quarter Investment Commentary