Feb 15, 2022 Market Update: February 15th, 2022

Market Update

The U.S. economy continued to grow at a fast pace. 4th quarter 2021 data showed that the U.S. economy grew 5.7% for all 2021, the most significant increase since 1984 (1). 2021′s strong growth created a lot of good outcomes, including a record 6.4 million jobs and higher wages to workers. But it also brought the highest inflation in 40 years. To slow down inflation, the Federal Reserve was preparing for interest rate hikes this year. The expectations of a less accommodative Federal Reserve and quickly rising interest rates led to market volatility. As of 2/11/2022, the S&P 500 Index was down over 7%, while the tech concentrated NASDAQ 100 Index was down more than 12%. Both Value-oriented U.S. stocks and non-U.S. stocks have held up better than the S&P 500 Index.

Tighter monetary policy and higher interest rates could continue to generate above-average market volatility in the coming months. Therefore, we think it is important to keep a long-term perspective and assess your risk tolerance and objectives if you feel anxious about your portfolio.

What Past Market Declines Can Teach Us

Choppy markets can lead to anxiety and discomfort. When volatility increases, it is perfectly natural to worry about how fast—or how far—markets may fall, and beyond that, how long it might take for stocks to recover and get back to previous levels. Keeping a long-term perspective is always important, but it’s essential when markets are volatile and emotions are running high. A look at history shows that while markets react to news events in the short term, historically, they reward patient investors over long periods.

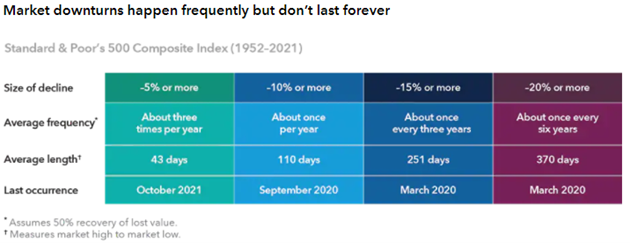

Looking back at data since 1952 shows that stock market declines have varied widely in intensity, length and frequency, but downturns don’t last forever (2).

Market corrections of 10% are surprisingly common and have happened on average once per year. More significant corrections of 20% or more, occurred about once every six years. Unfortunately, it is impossible to tell if this will turn into a larger correction. There have been 23 market corrections of 10% or more since November 1974, and only five of them became corrections of 20% or more (1980, 1987, 2000, 2007 and 2020) (3).

Sometimes averages and medians don’t give us the full picture. The difference in magnitude among past drawdowns is considerable and there is also significant dispersion in the length of the drawdowns and recoveries. For example, in 2020, we saw the fastest ever bear market and also one of the fastest recoveries ever. Of course, we know this doesn’t mean the next one will be similar. While easy to identify in hindsight, attempting to predict when markets will “peak” or “bottom” is unlikely to be a fruitful endeavor.

Please contact your advisor if you would like to review your accounts.

- U.S. Bureau of Economic Analysis

- Table from Capital Group

- Schwab: “Market Correction: What does it mean?” The market is represented by the S&P 500 Index.

Company News

Market Commentary

Retirement Planning

Tax Planning

Cyber Security

Important Disclosures

Leonard Rickey Investment Advisors, PLLC (“LRIA”), is an SEC registered investment adviser located in the State of Washington. Registration does not imply a certain level of skill or training. For information pertaining to the registration status of LRIA, please contact LRIA or refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov).

This is provided for general information only and contains information that is not suitable for everyone. As such, nothing herein should be construed as the provision of specific investment advice or recommendations for any individual. To determine which investments may be appropriate for you, consult your financial advisor prior to investing. There is no guarantee that the views and opinions expressed herein will come to pass. This newsletter contains information derived from third party sources. Although we believe these third-party sources to be reliable, we make no representations as to the accuracy or completeness of any information prepared by any unaffiliated third party incorporated herein and take no responsibility therefore.

Any projections, forecasts and estimates, including without limitation any statement using “expect” or “believe” or any variation of either term or a similar term, contained here are forward-looking statements and are based upon certain current assumptions, beliefs and expectations that LRIA considers reasonable or that the applicable third parties have identified as such. Forward-looking statements are necessarily speculative in nature, and it can be expected that some or all of the assumptions or beliefs underlying the forward-looking statements will not materialize or will vary significantly from actual results or outcomes. Some important factors that could cause actual results or outcomes to differ materially from those in any forward-looking statements include, among others, changes in interest rates and general economic conditions in the U.S. and globally, changes in the liquidity available in the market, change and volatility in the value of the U.S. dollar, market volatility and distressed credit markets, and other market, financial or legal uncertainties. Consequently, the inclusion of forward-looking statements herein should not be regarded as a representation by LRIA or any other person or entity of the outcomes or results that will be achieved by following any recommendations contained herein. While the forward-looking statements here reflect estimates, expectations and beliefs, they are not guarantees of future performance or outcomes. LRIA has no obligation to update or otherwise revise any forward-looking statements, including any revisions to reflect changes in economic conditions or other circumstances arising after the date hereof or to reflect the occurrence of events (whether anticipated or unanticipated), even if the underlying assumptions do not come to fruition. Opinions expressed herein are subject to change without notice and do not necessarily take into account the particular investment objectives, financial situations, or particular needs of all investors.

For additional information about LRIA, including fees and services, please contact us for our Form ADV disclosure brochure using our contact information herein. Please read the disclosure brochure carefully before you invest or send money.

2024 1st Quarter Investment Commentary