Apr 14, 2022 2022 1st Quarter Investment Commentary

• The war in Ukraine, high inflation, and rising interest rates increased volatility. Both stock and bonds fell during the quarter.

• Corporate balance sheets and earnings were on track to hit record highs in 2022.

• The risks to an economic slowdown increased but the U.S. economy still appeared on track to grow through the year.

• Portfolios were rebalanced toward more inflation sensitive assets to hedge against more persistent inflation. They remained overweight equities and underweight bonds.

Market Summary

Investors dealt with the highest inflation readings in 40 years, Russia’s invasion of Ukraine, and a tightening Federal Reserve during the quarter. Amidst this backdrop, stock market volatility dramatically picked up. As measured by the S&P 500 TR Index, US stocks were down as much as 13% during the quarter before rallying to finish the quarter down 4.6%. US small-cap stocks, bonds, and international stocks fell during the quarter. Commodities were one of the few places to hide. The S&P GSCI increased 33.1% for its best quarter since Q3 1990 when Iraq invaded Kuwait.

Value stocks outperformed growth stocks during the quarter. Energy and Utility sectors led value strategies higher and were the only sectors to post positive performance, while Communication Services and Consumer Discretionary led growth strategies lower. Many high growth, high valuations areas were down over 50% from their 52-week highs before bouncing back mid-quarter.

The significant jump in commodity prices put more upside pressure on inflation. To help get inflation under control, the Federal Reserve raised interest rates by .25%, its first rate hike since 2018, and signaled it would soon begin reducing its bond holdings. Higher interest rates drive up the cost of capital for corporations and consumers, which may help reduce inflation. This was the first step to remove the ultra-accommodative policies that have been in place since COVID began and

to get back to a more normal level of monetary policy.

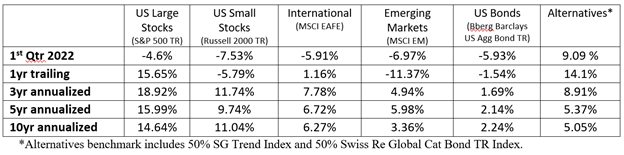

Early this year, the bond markets were expecting three rate hikes in 2022, but by the end of the quarter, markets expected the Fed to hike interest rates nine more times and bring the Fed funds rate to 2.5% by yearend (1). Investor expectations for higher rates pushed bond yields higher and prices lower, leading to the worst quarter for US bonds in more than 40 years. The Bloomberg Aggregate Bond Index was down nearly 6%, the most significant yearly decline since its 1977 inception. Below is a summary of the major benchmark returns (2).

Market Analysis

Across global financial markets, the first quarter was marked by large swings in prices. Stocks do not like uncertainty, and we had a lot of it during the quarter including:

- Inflation hit its highest level in 40 years

- The Federal Reserve is becoming more aggressive than markets had initially anticipated causing bond yields to spike

- Russia’s invasion of Ukraine caused commodity prices to spike and increased geopolitical risks

Investors were wrestling with the uncertainty of the evolving economic and market environment. As a result the quarter was over twice as volatile as the median quarter over the past three years (3). The unprecedented nature of COVID makes the analysis more difficult. The economic and market cycles have not been typical, with many market and economic measures going to extreme levels to the downside in 2020 and again during the recovery. On top of that, the Russia-Ukraine conflict accentuated some of these conditions further, namely higher energy prices leading to higher inflation and potentially further slowing economic growth.

Coming into the year, the market environment resembled mid-cycle, where the rate of US economic growth was slowing, earnings growth was slowing, and interest rates and inflation were rising. We saw some early warning signs during the quarter that we could be further along in the cycle and possibly nearing the late-cycle phase. For example, defensive and commodity sectors outperformed, and the 10-year yield was higher than the 2-year yield.

The inflation outlook was perhaps the most considerable uncertainty. Inflation is a large driver of interest rates and Fed policy, a potential drag on consumer spending, and a potential headwind for stock valuations. Inflation is also difficult to predict, particularly today with large geopolitical uncertainty in Europe and the complexity of the ongoing COVID effects on supply chains and the labor market.

Inflation has significant investment implications. Since the Global Financial Crisis of 2008, the investing backdrop has been marked by low inflation and low interest rates. US large-cap growth stocks benefited the most from this environment. For example, the S&P 500’s weighting in technology stocks went from 16% in 2008 to over 26% today, while Energy went from 12% to 4% today (4). In addition, as both inflation and interest rates increased over the last year, value strategies significantly outpaced growth strategies as seen the table below (5).

Earnings recovered spectacularly since the big declines in early 2020 and hit a new all-time high in 2021. Strong consumer demand and higher productivity supported earnings and high inflation has brought pricing power to many companies allowing them to expand profit margins to record highs.

Market expectations were for earnings to continue growing and reach new all-time highs in 2022. However, slower economic growth, higher wage costs, and higher interest rates may slow the growth rate to a more normal single-digit level.

For all the attention on stocks, bond performance was the bigger story. High-quality bonds have historically been an asset that offers positive returns when equity markets sell-off. This relationship did not hold up during the quarter as higher inflation, and expectations for a more aggressive rate increase cycle saw bonds sell-off simultaneously with equities. This was not just the case in the US. We saw similar performances across the globe. This limited the ability to rebalance into equity weakness because bonds were down as well. Although all segments of the bond market were down, diversification into short-term bonds and inflation-protected bonds helped with relative performance.

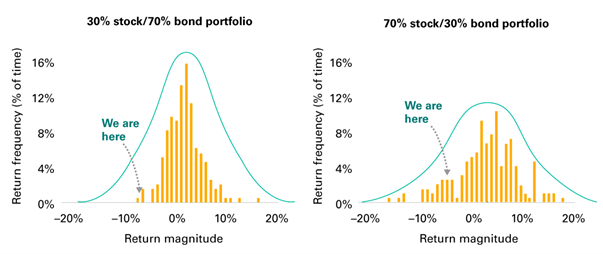

Typically, the greatest pain in a portfolio comes to those investors more heavily weighted towards equities and other risky assets. However, in the first quarter of 2022 US bonds were down more than US stocks (6). The conservative 30/70 investor experienced a return of -6.0% while the more aggressive 70/30 investor experienced a -5.2% return during the quarter. In fact, the 30/70 stock/bond investor has only experienced three worse quarters in the last 50 years while the 70/30 investor has seen 26 worse quarterly returns (see graph) (7).

After such a difficult period, and with expectations of more rate hikes, investors may ask why they own fixed income at all? First, rising interest rates can be beneficial for long-term bond investors and savers, as higher yields generate more income. Also, this type of performance from bonds has been exceedingly rare, and the pace of yield increases could moderate, which would help bond performance. Finally, bonds have been a good hedge against credit and equity market volatility, even if that hedge may not be as effective as it once was given the low absolute level of rates.

Economic Analysis

The US economy grew 5.7% after accounting for inflation in 2021, continuing its recovery from the COVID pandemic (8). While the fiscal and monetary stimulus was fading, both continued to have growth-enhancing effects. In the US, services make up an outsized portion of total consumer spending and were still below pre-pandemic levels indicating it may have further room to grow. The labor market was healthy with rising employment levels and nominal wages. Both consumers and businesses were in excellent shape and seemed ready and able to spend. The average worker was more productive – over the past two years, output per worker has grown at an annual rate of 2.7%, more than twice the 1.2% growth seen in the first two decades of this century (9).

While financial conditions were getting tighter on the margin, they remained accommodative. Central banks just started to normalize interest rates back to normal levels that neither stimulate nor restrain the economy. As a result, the risk of a policy mistake was higher, adding an additional layer of risk. Central banks may hurt economic growth and employment when they go beyond neutral. This can send risk assets, like stocks, downward. However, if they don’t hike enough then inflation can get out of control.

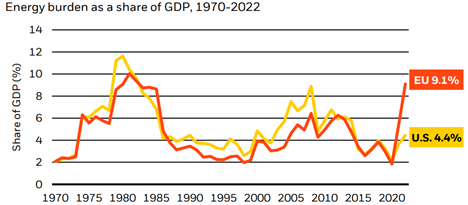

Even as the economy appeared to be on firm footing, the risks of an economic slowdown increased in the last quarter. Two indications that point to a higher probability of an economic slowdown were spiking energy prices and the flattening of the yield curve. Inflation was already high, and the Russia-Ukraine war’s impact on commodities presented an additional risk to inflation and growth.

All else equal, rising oil prices could push growth lower and inflation higher. But the economic impact of the Russia-Ukraine war is likely to be more profound in the euro area, given its greater dependence on Russian energy, than in the US (see chart (10)). Moreover, the growth in US shale oil in recent years means that the US is now essentially self-sufficient in oil, a stark contrast to the 1970s environment.

During the quarter, 2-year US Treasury bonds had a higher yield than 10-year US Treasury bonds. When this occurs, the market says the curve is inverted. In a ‘normal’ curve, long-term bonds have higher yields than shorter-term bonds. The past six times the 2Y/10Y part of the yield curve inverted, a recession followed an average 18 months later (see chart) . However, there are various ways to measure the shape of the yield curve, and only a few of them showed warning signs. For example, the spread between 3-month and 10-year Treasuries has historically been a more reliable indicator of an economic slowdown —and that spread wasn’t sending recessionary signals.

Portfolio Positioning

The uncertain investment backdrop highlights the importance of building diversified portfolios. Portfolios remained overweight equities and underweight bonds and cash relative to investors’ strategic allocations. We expect economic growth to continue to be positive and equity earnings to continue to grow, although at a slower pace.

Within equities, tilted further toward value strategies. We reduced bonds, growth equities, and non-U.S. equities and added an inflation-sensitive strategy to provide a hedge should inflationary pressures persist longer than expected, given heightened uncertainty.

In fixed income, exposure to shorter-duration bonds and inflation-protected bonds helped relative performance even though all bond positions were down on the quarter. We reduced core bond exposure slightly in favor of inflation-protected bonds. We believe bonds play a valuable role in portfolios despite low yields and now offer significantly higher yields than they did just a quarter ago.

Please reach out to your advisor if you have any questions or concerns.

- CME Group, as of 3/31/2022

- Morningstar Direct, as of 3/31/2022

- Morningstar

- Standard and Poors data, as of 3/31/2022

- Morningstar data, as of 3/31/2022

- As measured by the S&P 500 Index and the Bloomberg Barclays Aggregate Index

- Vanguard, as of March 28, 2022. See index definition in disclosures

- Bureau of Economic Analysis

- JPMorgan

- Blackrock

- LPL Financial, data from

- Leuthold Group based on correlation with one-year-forward real-GDP growth since 1978.

Company News

Market Commentary

Retirement Planning

Tax Planning

Cyber Security

Important Disclosures

Leonard Rickey Investment Advisors, PLLC (“LRIA”), is an SEC registered investment adviser located in the State of Washington. Registration does not imply a certain level of skill or training. For information pertaining to the registration status of LRIA, please contact LRIA or refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov).

This is provided for general information only and contains information that is not suitable for everyone. As such, nothing herein should be construed as the provision of specific investment advice or recommendations for any individual. To determine which investments may be appropriate for you, consult your financial advisor prior to investing. There is no guarantee that the views and opinions expressed herein will come to pass. This newsletter contains information derived from third party sources. Although we believe these third-party sources to be reliable, we make no representations as to the accuracy or completeness of any information prepared by any unaffiliated third party incorporated herein and take no responsibility therefore.

Any projections, forecasts and estimates, including without limitation any statement using “expect” or “believe” or any variation of either term or a similar term, contained here are forward-looking statements and are based upon certain current assumptions, beliefs and expectations that LRIA considers reasonable or that the applicable third parties have identified as such. Forward-looking statements are necessarily speculative in nature, and it can be expected that some or all of the assumptions or beliefs underlying the forward-looking statements will not materialize or will vary significantly from actual results or outcomes. Some important factors that could cause actual results or outcomes to differ materially from those in any forward-looking statements include, among others, changes in interest rates and general economic conditions in the U.S. and globally, changes in the liquidity available in the market, change and volatility in the value of the U.S. dollar, market volatility and distressed credit markets, and other market, financial or legal uncertainties. Consequently, the inclusion of forward-looking statements herein should not be regarded as a representation by LRIA or any other person or entity of the outcomes or results that will be achieved by following any recommendations contained herein. While the forward-looking statements here reflect estimates, expectations and beliefs, they are not guarantees of future performance or outcomes. LRIA has no obligation to update or otherwise revise any forward-looking statements, including any revisions to reflect changes in economic conditions or other circumstances arising after the date hereof or to reflect the occurrence of events (whether anticipated or unanticipated), even if the underlying assumptions do not come to fruition. Opinions expressed herein are subject to change without notice and do not necessarily take into account the particular investment objectives, financial situations, or particular needs of all investors.

For additional information about LRIA, including fees and services, please contact us for our Form ADV disclosure brochure using our contact information herein. Please read the disclosure brochure carefully before you invest or send money.

Celebrating Independence—Both National and Financial