Posts by Matt Hargreaves

Does It Still Make Sense to Hold I-Bonds?

Last year we wrote a blog on Series I Savings bonds, also known as I-Bonds. At the time, they offered an appealing interest rate of 9.62% due to the high inflation rate. We wrote, “If you have extra cash on the sidelines over your rainy-day fund, consider purchasing I-Bonds to help your money keep up…

Read More2023 2nd Quarter Investment Commentary

The S&P 500 broke out of its yearlong trading range, producing positive returns for the third quarter in a row. Excitement around artificial intelligence propelled growth stocks to outsized gains. Economic data came in better than expected as growth continued to be resilient, and inflation continued to moderate. Our technical indicators were positive while our…

Read MoreDebt Ceiling: Should Investors Worry?

The U.S. debt limit – commonly called the debt ceiling – is the total amount of money that the U.S. government is authorized to borrow. When the debt limit is reached, the government can no longer borrow money to cover its obligations. Congress has raised or suspended the debt ceiling over one hundred times since…

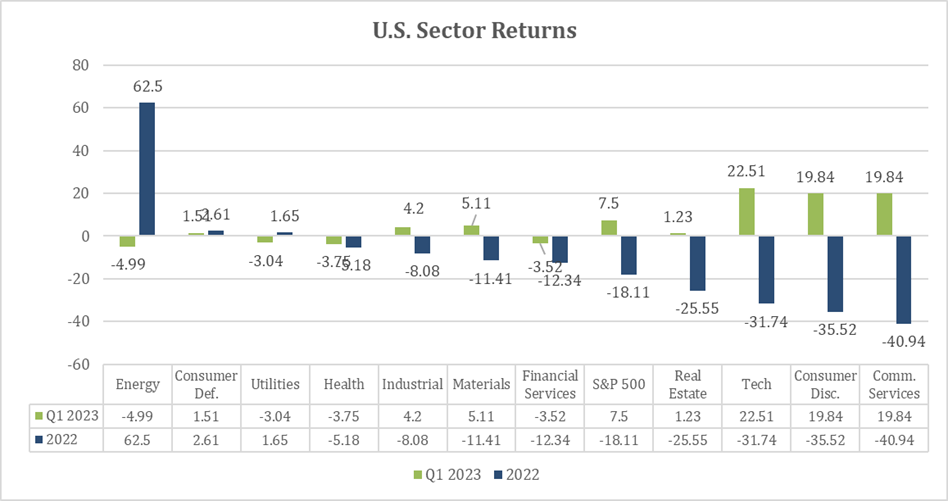

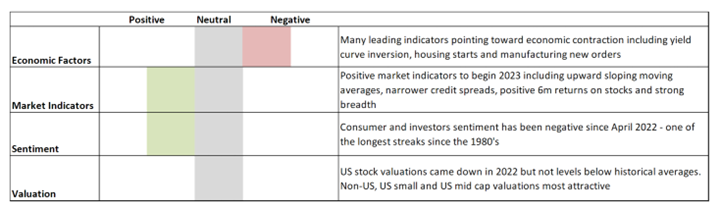

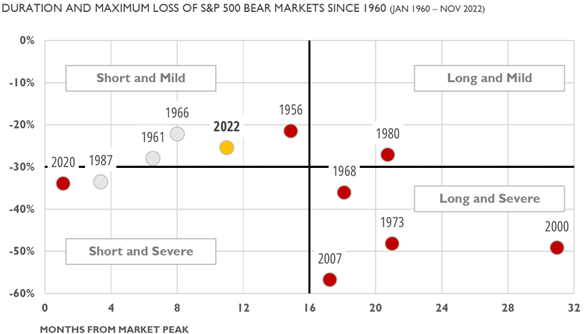

Read More2023 1st Quarter Investment Commentary

Stocks, as measured by the S&P 500, rose for the second quarter in a row but remain in a year-long trading range. The second largest bank failure in U.S. history quickly changed bond yields. Markets were priced for interest rate cuts by the end of 2023. The dramatic change in interest rate expectations caused a…

Read MoreBank Update

In light of recent events in the banking sector, we wanted to provide a recap and an overview of the impact to your accounts. Financial markets shook last week as Silicon Valley Bank (SVB), the California bank subsidiary of SVB Financial Group (SIVB), fell into FDIC receivership. SVB is the first FDIC-insured institution to fail…

Read MoreMarket Update: February 2023

It’s been an encouraging start to the year after a challenging 2022. Falling inflation, interest rates, and decent earnings have provided fuel for a nice market run to start the year. The S&P 500 is up over 8% this year and up over 15% since it bottomed in October 2022. Bonds (1) are up over…

Read More2022 4th Quarter Investment Commentary

Despite a fourth quarter rally, both U.S. stocks and bonds declined for the year causing a 60/40 portfolio to have its third-worst return since 1926. We expected better days ahead. Markets may be down, but most of the damage was done in the first half of the year. Since the end of June, stocks…

Read MoreWhat Do We Want in the New Year?

On Happiness, Meaning and Psychological Richness Written by: Hal Hershfield, Ph.D. How Do You Define Leading a ‘Good’ Life? As we look forward to this new year, we want to look at a fresh way to approach resolution-making. I suspect that what lies under the hood of many New Year’s resolutions is partly a desire…

Read MoreClient Question of the Month: Why do I still own bonds when their returns have been negative?

Bonds historically have helped stabilize portfolios when markets—particularly stock markets—grow volatile. The US bond market has recorded positive returns, before inflation, in all but four years since 1976. High-quality bonds, in particular, have typically held their value when stocks have endured their worst periods of performance. 2022 has been an outlier – bonds haven’t stabilized…

Read More2022 3rd Quarter Investment Commentary

The macroeconomic factors of rising interest rates and stubborn inflation remained chief concerns and weighed down both stocks and bonds. Despite a strong employment picture, economic data continued to moderate, and markets priced in a rising risk of recession in 2023. Stocks ended the quarter at reasonable valuations and bond yields were at their highest…

Read More