Aug 17, 2023 Does It Still Make Sense to Hold I-Bonds?

Last year we wrote a blog on Series I Savings bonds, also known as I-Bonds. At the time, they offered an appealing interest rate of 9.62% due to the high inflation rate. We wrote, “If you have extra cash on the sidelines over your rainy-day fund, consider purchasing I-Bonds to help your money keep up with inflation.”

As inflation cooled from its peak last year, the composite rate for I-Bonds decreased to 4.3%. The rate changes every six months (in May and November) and is currently comprised of a fixed .9% rate and a variable inflation rate of 3.4%. The previous rate was 6.89%, comprised of a 0% fixed rate and an inflation rate of 6.89%. The fixed rate applies for the 30-year life of the bond, and a semiannual inflation rate is calculated from a formula based on the six-month change in the non-seasonally adjusted Consumer Price Index (CPI).

While I-Bonds’s primary use case as a secure, non-volatile, inflation-hedged saving instrument remains the same as it always has, the new 4.3% I-Bond composite rate is now lower than many other fixed-income options. You can buy money market funds, US T-Bills, and certificates of deposits with yields of 5% and above for maturities of less than one year.

The picture is worse for I-Bonds purchased from May 2020 through October 2022 (which includes any that received the 9.62% rate). These bonds carry a 0% fixed rate, paying just the current inflation component of 3.4%. Below is a historical view of the fixed rate, inflation rate, and composite rate of newly issued I-Bonds from May 2004 (1). As you can see, the difference between the orange US T-Bill yield and the composite I-Bond yield significantly differs from last year in favor of T-Bills.

What to do with your current I-Bonds?

Option 1

While I-Bonds earn interest for 30 years or until they’re cashed in (whichever comes first), you can’t cash in until after one year. And if you cash in before five years, you lose three months of interest.

For those who purchased them less than a year ago, there’s not much to do but wait since the bonds must be held for at least that long. For those who have held I-Bonds for over a year, alternative options like US T-Bills, money market funds, and CDs offer better yields. While cashing out before five years means losing interest from the prior three months, opting for the higher yield still might make sense now.

If you decide to sell your I-Bonds after less than five years, you must be strategic about which three months of interest you will give up.

In May, the new, lower I-Bond rate was introduced. But that doesn’t necessarily mean your I-Bonds already accrue that lower rate. When you buy an I-Bond, you lock in the then-current interest rate for six months, which starts a six-monthly cycle unique to your purchase month (and the one six months before/after).

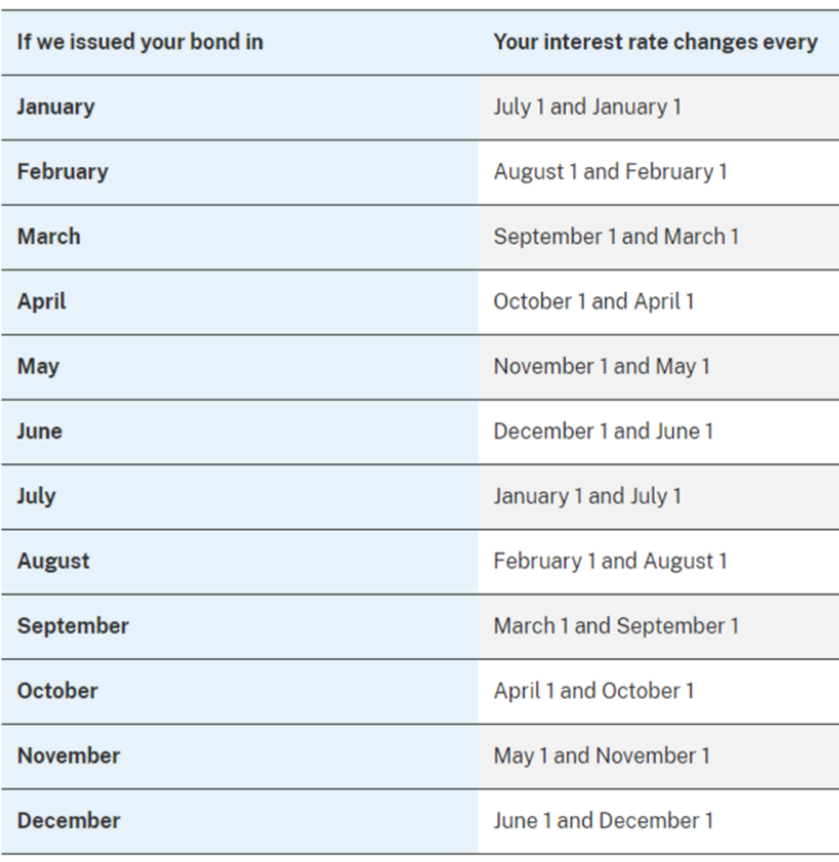

Consequently, previously purchased I-Bonds only started to accrue the new rate in May if they were bought in either May or November. Here is a table from the TreasuryDirect site showing when the new interest rate will begin for bonds purchased in any given month (2).

For example, if you purchased an I-Bond in April, you’ll still receive the 6.89% interest rate through October. Then, the rate will be 3.8%. If you wait three more months – until January – you’ll give up three months of the 3.8% interest instead of the 6.89% interest. For I-Bonds purchased in December, the new rate doesn’t kick in until June, so waiting to redeem until September might make sense.

That timeline will be different for everyone depending on their date of purchase, but it’s essential to think strategically about how to maximize your interest,

Option 2

Despite current lower yields, holding I-Bonds as an inflation-adjusted savings account is still a reasonable strategy for the long term. For those investors, swapping out any 0% fixed rate I-Bonds for higher fixed rate I-Bonds makes sense. Any I-Bonds you bought between May 2020 and October 2022 accrue a 0% fixed rate, which is locked in for the bond’s life. If you sell these bonds, you will give up three months of accrued interest, but if you buy back a new I-Bond, you will lock in the new 0.9% fixed rate. The permanence of the extra 0.9% means you will ultimately come out ahead, likely within a little over a year before taxes.

We expect the fixed rate to increase over the coming year based on the historical difference in yield between T-Bills and I-Bond fixed rates. Our best estimate is that the fixed rate could go higher next year, so you could wait until November 2023 to lock in the potentially higher fixed rate. Of course, no one knows what that rate will be, and it is subject to change every six months.

Sources:

[1] Data from TreasuryDirect. I-Bond rates change every May and November.

[2] https://www.treasurydirect.gov/savings-bonds/i-bonds/i-bonds-interest-rates/

Company News

Market Commentary

Retirement Planning

Tax Planning

Cyber Security

Important Disclosures

Leonard Rickey Investment Advisors, PLLC (“LRIA”), is an SEC registered investment adviser located in the State of Washington. Registration does not imply a certain level of skill or training. For information pertaining to the registration status of LRIA, please contact LRIA or refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov).

This is provided for general information only and contains information that is not suitable for everyone. As such, nothing herein should be construed as the provision of specific investment advice or recommendations for any individual. To determine which investments may be appropriate for you, consult your financial advisor prior to investing. There is no guarantee that the views and opinions expressed herein will come to pass. This newsletter contains information derived from third party sources. Although we believe these third-party sources to be reliable, we make no representations as to the accuracy or completeness of any information prepared by any unaffiliated third party incorporated herein and take no responsibility therefore.

Any projections, forecasts and estimates, including without limitation any statement using “expect” or “believe” or any variation of either term or a similar term, contained here are forward-looking statements and are based upon certain current assumptions, beliefs and expectations that LRIA considers reasonable or that the applicable third parties have identified as such. Forward-looking statements are necessarily speculative in nature, and it can be expected that some or all of the assumptions or beliefs underlying the forward-looking statements will not materialize or will vary significantly from actual results or outcomes. Some important factors that could cause actual results or outcomes to differ materially from those in any forward-looking statements include, among others, changes in interest rates and general economic conditions in the U.S. and globally, changes in the liquidity available in the market, change and volatility in the value of the U.S. dollar, market volatility and distressed credit markets, and other market, financial or legal uncertainties. Consequently, the inclusion of forward-looking statements herein should not be regarded as a representation by LRIA or any other person or entity of the outcomes or results that will be achieved by following any recommendations contained herein. While the forward-looking statements here reflect estimates, expectations and beliefs, they are not guarantees of future performance or outcomes. LRIA has no obligation to update or otherwise revise any forward-looking statements, including any revisions to reflect changes in economic conditions or other circumstances arising after the date hereof or to reflect the occurrence of events (whether anticipated or unanticipated), even if the underlying assumptions do not come to fruition. Opinions expressed herein are subject to change without notice and do not necessarily take into account the particular investment objectives, financial situations, or particular needs of all investors.

For additional information about LRIA, including fees and services, please contact us for our Form ADV disclosure brochure using our contact information herein. Please read the disclosure brochure carefully before you invest or send money.

Celebrating Independence—Both National and Financial