Oct 13, 2022 2022 3rd Quarter Investment Commentary

- The macroeconomic factors of rising interest rates and stubborn inflation remained chief concerns and weighed down both stocks and bonds.

- Despite a strong employment picture, economic data continued to moderate, and markets priced in a rising risk of recession in 2023.

- Stocks ended the quarter at reasonable valuations and bond yields were at their highest levels in over a decade, increasing our expectations for future returns.

- We think that now is not the time to reduce equities. Seasonal tailwinds, oversold market conditions and extreme bearish sentiment are potential catalysts.

Market Summary

Economic and market conditions remained very challenging in the third quarter. Geopolitical tensions, high inflation, and the fastest pace of central bank tightening in decades were headwinds contributing to an unusually uncertain economic environment. The Federal Reserve continued its 2022 pattern of aggressive interest rate increases in the quarter and projected more rate hikes to come, raising the risk of recession. As a result, nearly all major asset classes declined during the quarter.

After the S&P 500’s worst first half since 1970, we noted that in each previous year, when stocks had declined 20% or more by June 30, the next six months had seen positive returns. The S&P 500 rallied 17.4% from its June 16 low to its August 16 high, but persistently high inflation and rising interest rates took the steam out of the rally. The S&P 500 gave back all its gains, ending the quarter at new lows for the year. Year-to-date, the S&P 500 was down 24.8%, its worst first nine months since 2002 and fourth worst since 1926 (1).

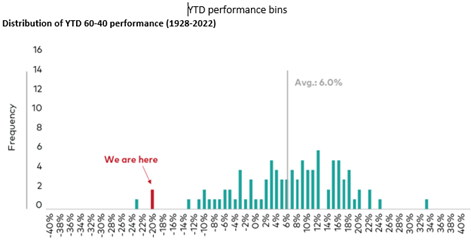

The bond market continued its worst and longest drawdown since the index’s inception in 1976, falling 14.6% year-to-date (2). During previous stock market declines, bonds did well. Unfortunately, that hasn’t been the case this year. A 60/40 portfolio of the S&P 500 and core US bonds was down 20.2% through September, its worst first nine months since 1974 and third worst since 1926 (3).

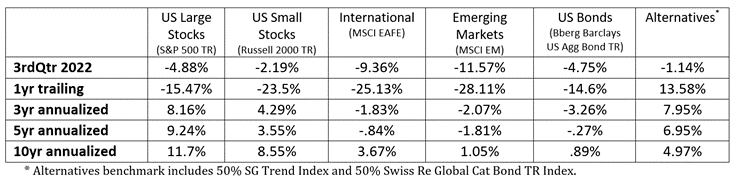

We expect volatility to remain high in the short term as markets look to form a bottom. The good news is that valuations for both stocks and bonds were at much more reasonable levels than at the start of the year, investor sentiment was near record lows, and we are approaching the fourth quarter. Below is a summary of the major benchmark returns (4).

Economic Analysis

The Federal Reserve’s continued aggressive policy stance raised further concerns over whether a US recession was on the horizon. Policymakers face a complex tradeoff between bringing down inflation or sustaining economic growth. Raising interest rates too much increases the possibility of a recession but keeping interest rates too low risks inflation becoming sticky, requiring even more significant pain down the road. It appeared that the Fed would rather see a recession than risk inflation becoming entrenched. They were forecasted to raise rates another 1.25% by year-end to 4.25% (5).

Last quarter we suggested the economy was mid-cycle, but we also noted there were indications that the business cycle was further along. As the quarter progressed, we saw economic reports deteriorate. While the slowdown remained modest so far, the risk of a 2023 recession increased further.

Not all signals were negative, however. The employment data showed strength and was not consistent with the economy being in a recession. For example, over the first eight months of 2022, the US economy added about 3.5 million jobs, and the unemployment rate finished the quarter at 3.7% (6). In addition, there were signs of falling inflation, including an easing of supply chains, falling breakeven inflation rates, and lower commodities.

It’s important to remember that economic data is a lagging indicator, and stock prices generally lead economic data. It may be helpful to think about stock prices as the engine of a train, positioned at the front of the train, and economic data as train cars toward the back of the train. When the train derails, the engine is first to go and it takes time for the back of the train to get off track. When the train begins to get on track, the engine moves long before the cars at the back.

The graph illustrates how this works in practice (7). Negative equity returns have been concentrated in the first half of recessions and have historically had positive returns in the second half of recessions as they anticipate the economic recovery. We don’t know exactly where we are in the current economic cycle, but the market has already priced in a lot of bad news. Moreover, the news tends to focus on the negatives. During the quarter, they focused on the poor market returns, and if we go into recession, they will focus on the poor economy, likely ignoring the engine up front that has started up the track again.

Market Analysis

Why have stocks been going down? To a large degree, it’s the same story as the first half of the year: stubbornly high inflation, aggressive Federal Reserve interest-rate increases, and a growing fear of recession. This narrative will likely stick around and contribute to volatility in the coming months. However, if inflation can begin to come down, that story can quickly change, even if it takes a recession. With both stocks and bonds down, a 60/40 portfolio of US stocks and bonds finished down three quarters in a row and was at its 3rd worst return at this point in the year (see chart) (8).

Bear markets that have overlapped with recessions have averaged -35% over 15 months (9). Using the S&P 500, this bear market has lasted 9 months and declined 25%, implying the potential for more downside risk in both time and price. We don’t know exactly where we were in the economic cycle, but we’ve already experienced most of a “normal” bear market.

We have been writing about US stocks’ superior performance for what seems like forever, particularly US large growth. The numbers for the past decade are striking: the S&P 500 has outperformed the MSCI All Country World ex US Index by 8.7% per year over the last ten years, and US growth has outperformed US value by 2.54% per year (10). While value has outperformed growth substantially this year, non-U.S. stocks continued to trail US stocks.

Early this year, it looked like international markets might begin to close the gap. Then the Ukraine war began, causing an energy crisis in Europe and the US dollar appreciated dramatically versus most foreign currencies. At the end of the quarter, international stocks were priced at a substantial discount to US stocks, and with the possibility of currency appreciation, they looked even more compelling. Although it is impossible to predict exactly when the tides will shift, we believe that international equities can provide both diversification and attractive returns in the future.

With all the doom and gloom, there were a few positive notes. First, while near-term conditions may pressure earnings in the short term, valuations were in line with recent averages and incorporated many economic headwinds. Bearish investor and consumer sentiment readings were at extreme negatives for much of the year, a historically positive sign of good future returns. There were many signs of extreme selling pressure in stocks, which typically have only occurred at or close to a market bottom. Also, the best quarters of the four-year election cycle are the next three. Finally, since WWII, the S&P 500 finished the year down more than 20% only three times (1972, 2002, 2008). The following year stocks gained 31.5%, 26.4%, and 23.5%.

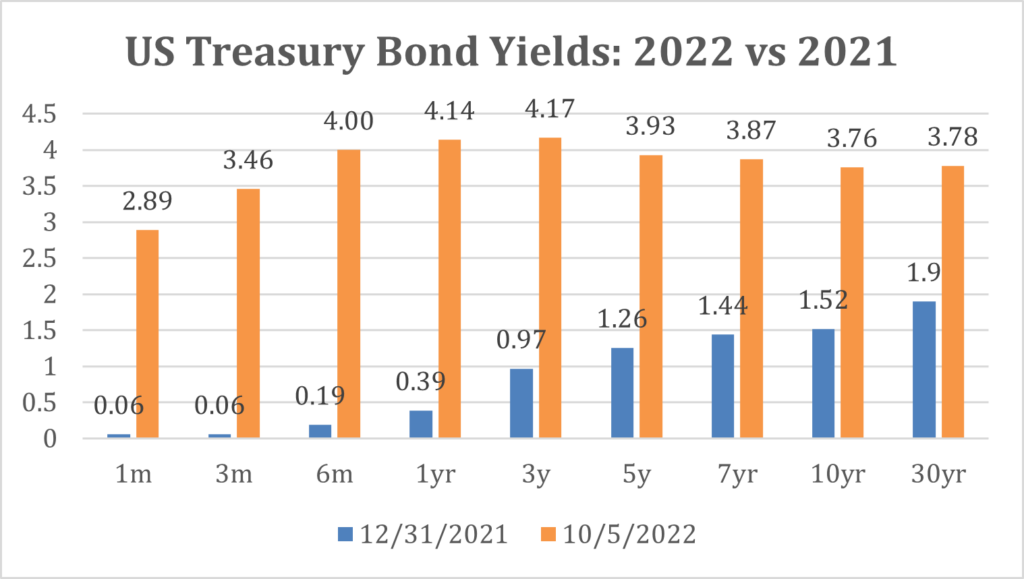

For bond investors, the series of unprecedented rate hikes were the catalyst for some of the worst bond fund losses on record. High-quality bonds have historically provided liquidity, diversification, and positive total returns to portfolios. Unfortunately, none of those features is 100% certain, as we’ve seen this year, but we think the value proposition for high-quality bonds has improved recently. Investing is a forward-looking exercise, and with the move higher in yields, investors were paid significantly more than they were at the beginning of the year (11). Yields were at the highest in over a decade and were above long-term inflation estimates, a good sign that bonds can again perform their risk-reducing role in a diversified portfolio.

Portfolio Positioning

Based on our view that a lot of the bad news has been priced into the market, we think now is not the time to reduce equity exposures. However, over the short term, we expect that the markets will remain under pressure and volatility will remain high.

We maintained our overweight to equities relative to bonds as we still see the overall risk proposition tilted more to the upside for investors able to tolerate increased volatility. Inflation has been slower to come down than anticipated, but seasonal tailwinds, oversold market conditions, historically bearish investor sentiment, and the likelihood that the Fed rate hike cycle is closer to its end than its beginning were all potential catalysts for a market rebound.

We understand how difficult it is to stay invested during periods of market volatility. Unfortunately, many investors have demonstrated the tendency to sell well after market declines and buy well after rallies. The result is that they dramatically underperform the market. While there may be continued volatility in the near term, we believe the surest path forward remains to stay true to your existing financial plan.

Please reach out to your advisor if you have any questions or concerns.

Footnotes

- Ned Davis Research

- Bloomberg Barclays U.S. Agg Bond Index through 9/30/2022

- LPL Financial, core bonds as represented by the Bloomberg Barclays U.S. Agg Bond Index

- Morningstar Direct, as of 9/30/2022

- CME Group

- Bureau of Labor Statistics

- Avantis Investors, data from 1973-2021

- Vanguard Research. Stocks as measured by S&P 500 Index and bonds as measure by the U.S. Aggregate Bond Index

- Data from 1948-2022

- Morningstar Direct, as of 9/30/2022. Growth and value as measured by Morningstar Indexes

- Chart using data from the U.S Treasury

Company News

Market Commentary

Retirement Planning

Tax Planning

Cyber Security

Important Disclosures

Leonard Rickey Investment Advisors, PLLC (“LRIA”), is an SEC registered investment adviser located in the State of Washington. Registration does not imply a certain level of skill or training. For information pertaining to the registration status of LRIA, please contact LRIA or refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov).

This is provided for general information only and contains information that is not suitable for everyone. As such, nothing herein should be construed as the provision of specific investment advice or recommendations for any individual. To determine which investments may be appropriate for you, consult your financial advisor prior to investing. There is no guarantee that the views and opinions expressed herein will come to pass. This newsletter contains information derived from third party sources. Although we believe these third-party sources to be reliable, we make no representations as to the accuracy or completeness of any information prepared by any unaffiliated third party incorporated herein and take no responsibility therefore.

Any projections, forecasts and estimates, including without limitation any statement using “expect” or “believe” or any variation of either term or a similar term, contained here are forward-looking statements and are based upon certain current assumptions, beliefs and expectations that LRIA considers reasonable or that the applicable third parties have identified as such. Forward-looking statements are necessarily speculative in nature, and it can be expected that some or all of the assumptions or beliefs underlying the forward-looking statements will not materialize or will vary significantly from actual results or outcomes. Some important factors that could cause actual results or outcomes to differ materially from those in any forward-looking statements include, among others, changes in interest rates and general economic conditions in the U.S. and globally, changes in the liquidity available in the market, change and volatility in the value of the U.S. dollar, market volatility and distressed credit markets, and other market, financial or legal uncertainties. Consequently, the inclusion of forward-looking statements herein should not be regarded as a representation by LRIA or any other person or entity of the outcomes or results that will be achieved by following any recommendations contained herein. While the forward-looking statements here reflect estimates, expectations and beliefs, they are not guarantees of future performance or outcomes. LRIA has no obligation to update or otherwise revise any forward-looking statements, including any revisions to reflect changes in economic conditions or other circumstances arising after the date hereof or to reflect the occurrence of events (whether anticipated or unanticipated), even if the underlying assumptions do not come to fruition. Opinions expressed herein are subject to change without notice and do not necessarily take into account the particular investment objectives, financial situations, or particular needs of all investors.

For additional information about LRIA, including fees and services, please contact us for our Form ADV disclosure brochure using our contact information herein. Please read the disclosure brochure carefully before you invest or send money.

2024 1st Quarter Investment Commentary