Posts by Matt Hargreaves

Spring Clean Your Documents

With Shred Day approaching and in the spirit of spring cleaning, we wanted to share some tips on organizing your files. Remember to dispose of your documents securely. Below is a summary of the key documents to keep and for how long: Income Tax Returns: Keep at least three years of state and federal tax…

Read More2023 4th Quarter Investment Commentary

Stocks ended the year on a nine-week winning streak, as the S&P 500 TR Index erased all the losses in 2022 reaching new all-time highs during the quarter. The year-end rally in stocks was one of the strongest ever and was based on the expectations of a Fed policy rate change and expectations of…

Read More2023 3rd Quarter Investment Commentary

After a strong first half, stocks, as measured by the S&P 500 TR, pulled back during a historically weak third quarter. Economic data continued to be stronger than expected and even showed signs of accelerating. This, amongst other factors, caused long term bond yields to increase significantly during the quarter. We ended the quarter…

Read MoreEmployee Spotlight: Chelsie Smith

This month we are featuring Chelsie Smith. Chelsie is a Certified Financial Planner (CFP®) and Advisor at Leonard Rickey. She has been with us for almost 5 years and works in our Yakima Office. What do you love most about your job? I love being able to put a client’s mind at ease when they…

Read MoreDoes It Still Make Sense to Hold I-Bonds?

Last year we wrote a blog on Series I Savings bonds, also known as I-Bonds. At the time, they offered an appealing interest rate of 9.62% due to the high inflation rate. We wrote, “If you have extra cash on the sidelines over your rainy-day fund, consider purchasing I-Bonds to help your money keep up…

Read More2023 2nd Quarter Investment Commentary

The S&P 500 broke out of its yearlong trading range, producing positive returns for the third quarter in a row. Excitement around artificial intelligence propelled growth stocks to outsized gains. Economic data came in better than expected as growth continued to be resilient, and inflation continued to moderate. Our technical indicators were positive while our…

Read MoreDebt Ceiling: Should Investors Worry?

The U.S. debt limit – commonly called the debt ceiling – is the total amount of money that the U.S. government is authorized to borrow. When the debt limit is reached, the government can no longer borrow money to cover its obligations. Congress has raised or suspended the debt ceiling over one hundred times since…

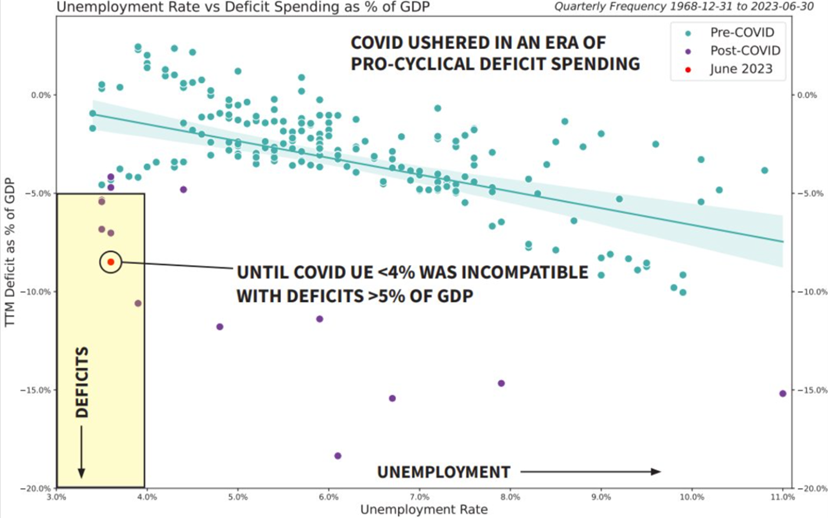

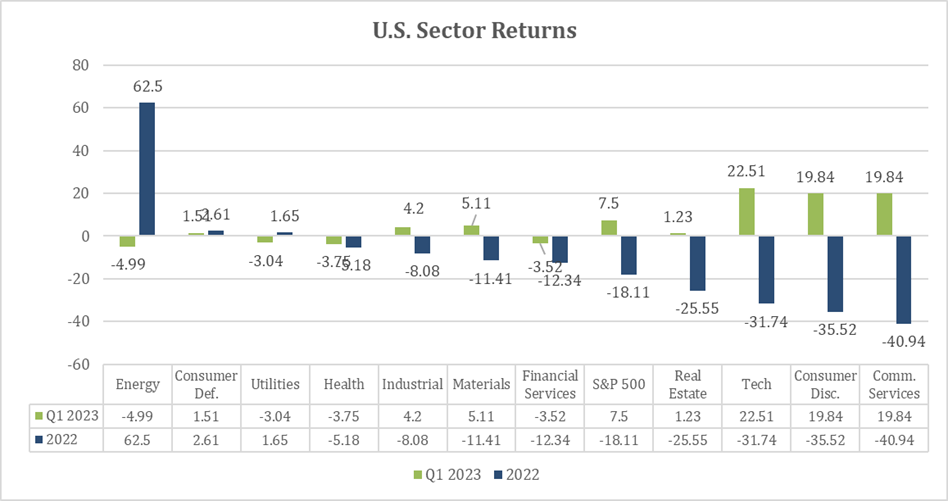

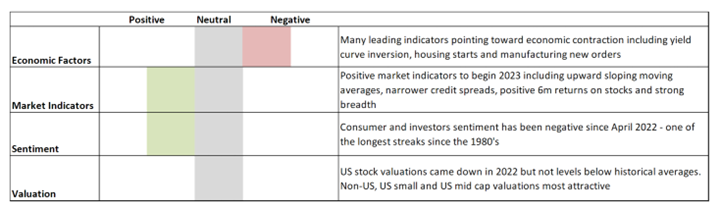

Read More2023 1st Quarter Investment Commentary

Stocks, as measured by the S&P 500, rose for the second quarter in a row but remain in a year-long trading range. The second largest bank failure in U.S. history quickly changed bond yields. Markets were priced for interest rate cuts by the end of 2023. The dramatic change in interest rate expectations caused a…

Read MoreBank Update

In light of recent events in the banking sector, we wanted to provide a recap and an overview of the impact to your accounts. Financial markets shook last week as Silicon Valley Bank (SVB), the California bank subsidiary of SVB Financial Group (SIVB), fell into FDIC receivership. SVB is the first FDIC-insured institution to fail…

Read MoreMarket Update: February 2023

It’s been an encouraging start to the year after a challenging 2022. Falling inflation, interest rates, and decent earnings have provided fuel for a nice market run to start the year. The S&P 500 is up over 8% this year and up over 15% since it bottomed in October 2022. Bonds (1) are up over…

Read More