Jan 13, 2023 2022 4th Quarter Investment Commentary

- Despite a fourth quarter rally, both U.S. stocks and bonds declined for the year causing a 60/40 portfolio to have its third-worst return since 1926. We expected better days ahead.

- Markets may be down, but most of the damage was done in the first half of the year. Since the end of June, stocks were positive as inflation declined and economic growth accelerated.

- An economic “soft landing” seems unlikely: We believe the most likely outcomes are either a recession occurs, hurting earnings growth, or economic growth slows which would keep interest rates higher and hurt equity valuations. We are currently looking to reduce equity positions on a market rally.

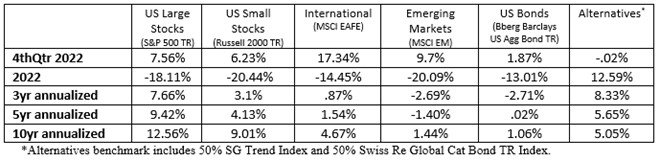

Market Summary

From all-time highs in January to a bear market in June – 2022 was challenging. An uncertain economic outlook, slowing corporate earnings, high inflation, and higher interest rates hurt portfolios in 2022. US large-cap stocks, as measured by the S&P 500, lost -18.1%, and US bonds lost -13%, making 2022 the fourth-worst 60/40 portfolio return since 1926 (1). Global diversification didn’t help, as non-U.S. stock indices also experienced double-digit losses.

After five straight years of growth outperformance, value outpaced growth by the most since 2000. The Russell 3000 Growth Index fell 28.97% versus a decline of 8.1% in the Russell 3000 Value Index (2). While all cycles are different, value outperformed growth seven straight years after the last growth crash (2000 to 2006).

The bond market had a disappointing year as prices fell and interest rates climbed to levels not seen in years. The Federal Reserve increased its Fed Funds rate from 0% to over 4%, the fastest pace in over 40 years. Although the Fed’s actions were painful for bond investors, they appeared to have some success in taming inflation. Inflation data came in significantly lower in the back half of the year and seemed to be on a declining trajectory for 2023.

As the calendar turns to 2023, many of the same themes continue to dominate markets. The difference is that they are further along their paths, and several could shift to market-friendly during the year. For example, inflation was coming down from its June peak, and the rate hike cycle appeared closer to the end than the beginning. While recession risks were high, it is not a foregone conclusion. A lot of damage has been done that may set markets up for recovery. The S&P 500 has logged successive down years only twice since the early 1940s. In addition, a 60/40 portfolio of US stocks and bonds has been down over 5% only three times in the last 48 years (3). Below is a summary of the major benchmark returns (4).

Market Analysis

While 2022’s performance was disappointing, if we zoom out beyond this single year to think about all that transpired since the onset of the COVID-19 pandemic, we are reminded of the resiliency of markets and the long-term opportunity for investors who stay the course.

Since COVID there has been plenty of news and changing conditions contributing to market volatility. The pandemic, the ensuing economic shutdown, the solid economic and market recovery, rising inflation after the restart, and the Federal Reserve’s actions to fight it were just a few memorable examples.

The data in the table highlights how quickly things can go in a different direction (5). We can see this by comparing the end of 2022 to the end of 2019. For example, expectations for stock market volatility are higher today, valuations for S&P 500 companies are lower, and the federal funds rate target is markedly higher along with the 10-year Treasury yield.

The full-period highs and lows help to unmask that the changes were anything but linear. Between these three years, we saw times of much higher volatility, much higher stock valuations and much lower interest rates than we saw at the end of 2022.

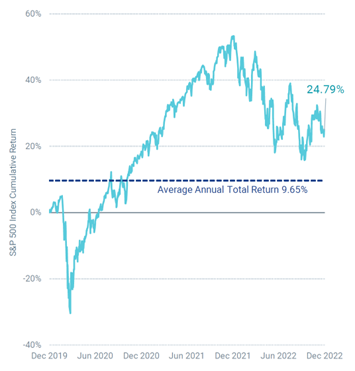

If you were given a crystal ball at the start of 2020 and told what would happen over the next three years, would you have wanted to invest in stocks? Likely not. Despite a down year in 2022, the S&P 500 Index had a cumulative return of 24.7% with an average annual return of 9.6% (see chart (6)).

If we give too much importance to a single year, we may feel that today’s picture is bleaker than the reality for a long-term investor. One year is a relatively short period in the context of an average investor’s investment horizon. Markets have overcome many tough times in the past and we expect this time will be similar. Taking account of the longer three-year period helps to remind us of this.

The S&P 500 Index peaked in the first week of 2022 and began its trend lower into October, falling -25% at its low point. However, most of the damage was done in the first half of the year. The S&P 500, along with most other major equity markets, was positive in the second half of the year, gaining over 2% since inflation peaked in June. In addition, corporate earnings continued to grow as many companies were able to pass on higher input costs and keep profit margins elevated.

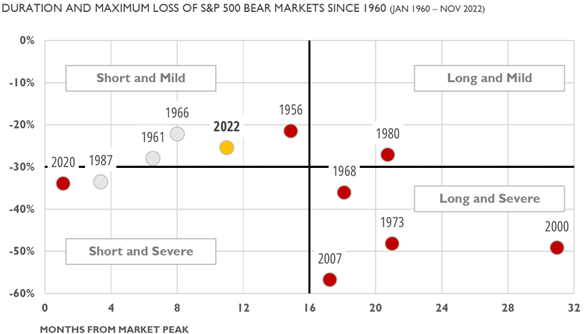

The current bear market was approaching 12 months and has had a maximum decline of 25%. This was near the average duration and the average maximum loss since 1960 (see chart) (7). Of course, not all financial declines are the same in length or severity. For example, the global financial crisis of 2008–2009 was an extreme anomaly. As challenging as that event was, it set up the longest stock market recovery in US history.

While this bear market could last longer and fall further, markets appeared to have already priced in a moderate recession. The chart shows drawdowns on the left axis and the number of months until the ultimate market bottom along the bottom axis. Red dots indicate the bear market was associated with a recession, grey dots are not associated with a recession, and the yellow dot is the current bear market.

Economic Analysis

We will likely face many of the same risks and uncertainties in 2023 as in 2022. For example, it is unclear how far the Federal Reserve will go in its campaign to curb inflation, how higher interest rates will affect consumer spending and company earnings or how the war in Ukraine will play out.

The US economy appeared to be in a late-cycle environment with the odds of recession elevated. On the positive side, inflation seemed to be on a downward trajectory. The indicators of lower inflation included lower commodity prices, gas prices, shipping costs, and rent prices. In fact, the 3-month annualized inflation rate fell to 1.9% (8). However, wage inflation remained elevated and could be challenging to squash without a recession and higher unemployment.

While markets may cheer the development of lower inflation and the end of rate hikes, there is a risk of a second phase of stock market declines where concerns about high inflation and high rates turn to worries about a recession. The key question is whether a slowing economy will end in a “soft landing”—with slower but still positive growth—or a “hard landing” – with a full fledged recession that drags down earnings and increases unemployment. Much depends on the Federal Reserve and the world’s other major central banks as they continue efforts to bring inflation under control by hiking interest rates and draining liquidity from the markets.

The foundations of the US economy—households and the banking system—were reasonably healthy, and the labor market was strong. Corporations have cleaned up their balance sheets and refinanced debt and low rates. While economic growth decreased in the first half of the year, it grew 2.9% in the third quarter and was on pace to grow 4.1% in the fourth quarter (9).

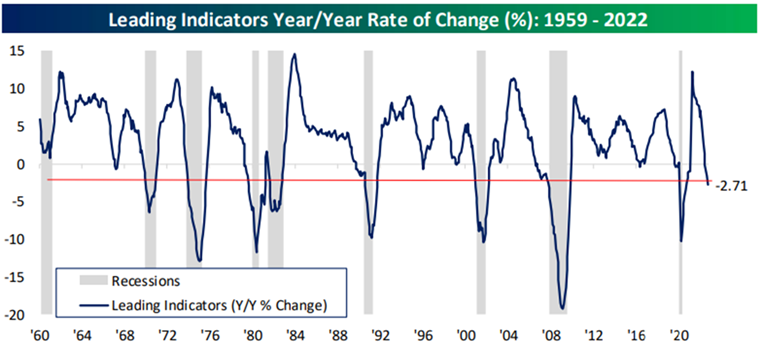

However, a growing list of leading indicators signaled a forthcoming recession. These include tightening of credit conditions, the Conference Board’s leading economic indicators contracting seven out of the last eight months (see chart) (10), an inverted yield curve, and rising unemployment claims (albeit from very low levels). All these signals typically occur ahead of a recession. While the labor market remained strong and cash in household bank accounts was high, most evidence supports a slowing economy.

The range of outcomes has widened in this new, higher inflation, higher interest rate regime. There is a chance that economic growth muddles through at a low rate but does not outright decline. This scenario may be suitable for economic growth but would likely keep inflation higher for longer. To bring down wage inflation would likely require higher unemployment and an outright recession., Overall, we forecast that 2023 will be a challenging year for the economy, with a recession more likely than not.

Portfolio Positioning

We maintained our overweight to equities relative to bonds during the quarter. This helped as stocks recovered from their October lows. At the October lows, markets appeared to be pricing in a mild recession. After a strong rally from those lows, markets now seem to be pricing in a soft landing that includes positive economic and earnings growth, lower inflation, and lower interest rates. This seems unlikely to us: either a recession hurts earnings growth or economic growth muddles through, which would keep interest rates higher and hurt equity valuations. For those reasons, we will be looking to reduce equity positions on a market rally. Cash and short-term bonds are yielding over 4%, so we can get a return while we wait.

Despite risks, we believe a balanced portfolio could outpace 2022’s dismal showing due to higher bond yields and better stock valuations. A few historical trading patterns also bode well for US stocks in 2023. 2023 is the third year of the Presidential Cycle (marked by well above-average annual returns regardless of what party holds the White House). Also, a solid start to January has historically led to above-average stock market returns. It is also rare for stocks to deliver two or more consecutive years of negative returns. Finally, investor sentiment remains very pessimistic, a contrarian indicator historically leading to strong returns.

We can likely expect more volatility in 2023 because it tends to persist and takes time to dissipate. Considering previous periods when economic uncertainty was high, we’ve seen that the market had historically rallied well before those uncertainties subsided. Once light appeared at the end of the tunnel, signs of improving conditions were apparent.

Please reach out to your advisor if you have any questions or concerns.

- Ned Davis Research. U.S. stocks as measured by S&P 500 and bond as measured by U.S. Government bonds

- Morningstar Direct, as of 12/31/2022

- Ned Davis Research

- Morningstar Direct, as of 12/31/2022

- Avantis Investors. Data from 12/31/2019 –12/31/2022

- Avantis Investors

- Dow Jones Indices, Athena Invest

- US CPI as of 1/12/23

- Atlanta Fed GDPNow

- Bespoke Investment Group

Company News

Market Commentary

Retirement Planning

Tax Planning

Cyber Security

Important Disclosures

Leonard Rickey Investment Advisors, PLLC (“LRIA”), is an SEC registered investment adviser located in the State of Washington. Registration does not imply a certain level of skill or training. For information pertaining to the registration status of LRIA, please contact LRIA or refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov).

This is provided for general information only and contains information that is not suitable for everyone. As such, nothing herein should be construed as the provision of specific investment advice or recommendations for any individual. To determine which investments may be appropriate for you, consult your financial advisor prior to investing. There is no guarantee that the views and opinions expressed herein will come to pass. This newsletter contains information derived from third party sources. Although we believe these third-party sources to be reliable, we make no representations as to the accuracy or completeness of any information prepared by any unaffiliated third party incorporated herein and take no responsibility therefore.

Any projections, forecasts and estimates, including without limitation any statement using “expect” or “believe” or any variation of either term or a similar term, contained here are forward-looking statements and are based upon certain current assumptions, beliefs and expectations that LRIA considers reasonable or that the applicable third parties have identified as such. Forward-looking statements are necessarily speculative in nature, and it can be expected that some or all of the assumptions or beliefs underlying the forward-looking statements will not materialize or will vary significantly from actual results or outcomes. Some important factors that could cause actual results or outcomes to differ materially from those in any forward-looking statements include, among others, changes in interest rates and general economic conditions in the U.S. and globally, changes in the liquidity available in the market, change and volatility in the value of the U.S. dollar, market volatility and distressed credit markets, and other market, financial or legal uncertainties. Consequently, the inclusion of forward-looking statements herein should not be regarded as a representation by LRIA or any other person or entity of the outcomes or results that will be achieved by following any recommendations contained herein. While the forward-looking statements here reflect estimates, expectations and beliefs, they are not guarantees of future performance or outcomes. LRIA has no obligation to update or otherwise revise any forward-looking statements, including any revisions to reflect changes in economic conditions or other circumstances arising after the date hereof or to reflect the occurrence of events (whether anticipated or unanticipated), even if the underlying assumptions do not come to fruition. Opinions expressed herein are subject to change without notice and do not necessarily take into account the particular investment objectives, financial situations, or particular needs of all investors.

For additional information about LRIA, including fees and services, please contact us for our Form ADV disclosure brochure using our contact information herein. Please read the disclosure brochure carefully before you invest or send money.

2025 1st Quarter Investment Commentary