Jan 13, 2023 What Do We Want in the New Year?

On Happiness, Meaning and Psychological Richness

Written by: Hal Hershfield, Ph.D.

How Do You Define Leading a ‘Good’ Life?

As we look forward to this new year, we want to look at a fresh way to approach resolution-making. I suspect that what lies under the hood of many New Year’s resolutions is partly a desire to be better versions of ourselves.

We want to exercise more, eat healthier, be more patient, and so on because we want to improve who we were in the prior year. We want to, in short, lead good lives, and one way to do so is to set new and loftier goals for ourselves. But before we go down that path yet again, it may be useful to contemplate what it even means to lead a “good” life.

Great thinkers have had a lot to say about the topic over the years, and the debate seems to boil down to two main definitions of “well-being”: lives that are marked by eudaimonic well-being, or purpose and meaning, and lives that are marked by hedonic well-being, or pleasure.

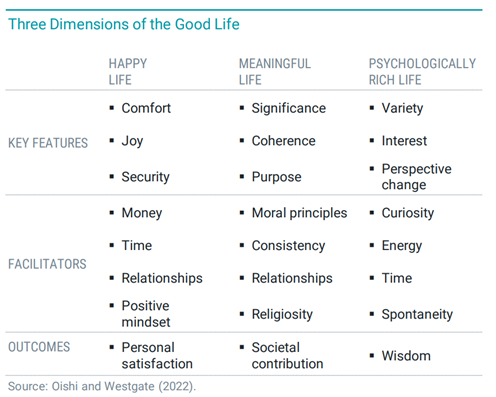

Recent ground-breaking research from psychologists Shigehiro Oishi and Erin Westgate, however, raises a third possibility: a psychologically rich life, or a life that is marked by “a variety of interesting and perspective changing experiences.”(1)

As you can see in the table, happy lives, meaningful lives, and psychologically rich lives differ in key features, facilitators, and major outcomes. For instance, psychologically rich lives, in contrast to happy and meaningful lives, are driven more by curiosity, energy, time and spontaneity compared to money or a positive mindset.

To investigate the viability of this third definition of a good life, Oishi and his colleagues conducted surveys and coded obituaries — in the New York Times, a local Charlottesville, Virginia, paper and a major Singaporean newspaper — and found that the three types of a good life were distinct.

Across research samples, there was a weak negative relationship between psychological richness and happiness: Lives that were rated more psychologically rich were also slightly less happy. People might have had experiences that could be deemed “unhappy” (e.g., losing a job and needing to change careers) but could nonetheless give rise to a psychologically rich life.

There was also a small but positive relationship between psychological richness and meaning. Here’s what all that means in plain terms: In rare cases, you can be happy, have meaning, and experience psychological richness. But often, the three components are independent contributors to what might be considered a good life.

What Contributes to a Psychologically Rich Life?

Oishi’s work has also found that those who are open to new experiences and more extroverted are also considerably more likely to lead psychologically rich lives. But more to the point, are there certain types of situations — rather than certain types of people — that are most strongly associated with psychologically rich lives?

Theoretically, a psychologically rich life contains “unexpectedness, novelty, complexity, and perspective change.” What experiences, then, might have those ingredients in spades? Studying abroad, as it turns out, is one classic example of an experience that can enhance psychological richness.

For example, students who studied in a foreign country returned home with lives that were self-rated as more psychologically rich, but they didn’t experience similar increases in happiness or perceptions of meaning. And the boost in psychological richness can be explained, in part, by regular engagement with artistic activities.

But we need not study abroad to experience such boosts in psychological richness. As Oishi and his colleagues have found, going to an escape room may be another way to inject some of the ingredients of a psychologically rich life into your own life.

None of this is to say, though, that you must aim for a psychologically rich life. Oishi and his collaborators emphasize that there’s no formula or perfect answer to the question of what we should strive for. Rather, a psychologically rich life may be one overlooked — but equally important — way of considering what it means to have a good life.

So, before thinking ahead to the goals you want to set for the next year, consider the bigger picture. Consider, in other words, what pursuits you’ll want to spend your time, money, and energy on and how such expenditures will enhance your happiness, meaning, and/or sense of psychological richness.

Written by: Hal Hershfield, Ph.D. Consultant to Avantis Investors Hal is a Professor of Marketing and Behavioral Decision Making in the Anderson School of Management at the University of California, Los Angeles

Company News

Market Commentary

Retirement Planning

Tax Planning

Cyber Security

Important Disclosures

Leonard Rickey Investment Advisors, PLLC (“LRIA”), is an SEC registered investment adviser located in the State of Washington. Registration does not imply a certain level of skill or training. For information pertaining to the registration status of LRIA, please contact LRIA or refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov).

This is provided for general information only and contains information that is not suitable for everyone. As such, nothing herein should be construed as the provision of specific investment advice or recommendations for any individual. To determine which investments may be appropriate for you, consult your financial advisor prior to investing. There is no guarantee that the views and opinions expressed herein will come to pass. This newsletter contains information derived from third party sources. Although we believe these third-party sources to be reliable, we make no representations as to the accuracy or completeness of any information prepared by any unaffiliated third party incorporated herein and take no responsibility therefore.

Any projections, forecasts and estimates, including without limitation any statement using “expect” or “believe” or any variation of either term or a similar term, contained here are forward-looking statements and are based upon certain current assumptions, beliefs and expectations that LRIA considers reasonable or that the applicable third parties have identified as such. Forward-looking statements are necessarily speculative in nature, and it can be expected that some or all of the assumptions or beliefs underlying the forward-looking statements will not materialize or will vary significantly from actual results or outcomes. Some important factors that could cause actual results or outcomes to differ materially from those in any forward-looking statements include, among others, changes in interest rates and general economic conditions in the U.S. and globally, changes in the liquidity available in the market, change and volatility in the value of the U.S. dollar, market volatility and distressed credit markets, and other market, financial or legal uncertainties. Consequently, the inclusion of forward-looking statements herein should not be regarded as a representation by LRIA or any other person or entity of the outcomes or results that will be achieved by following any recommendations contained herein. While the forward-looking statements here reflect estimates, expectations and beliefs, they are not guarantees of future performance or outcomes. LRIA has no obligation to update or otherwise revise any forward-looking statements, including any revisions to reflect changes in economic conditions or other circumstances arising after the date hereof or to reflect the occurrence of events (whether anticipated or unanticipated), even if the underlying assumptions do not come to fruition. Opinions expressed herein are subject to change without notice and do not necessarily take into account the particular investment objectives, financial situations, or particular needs of all investors.

For additional information about LRIA, including fees and services, please contact us for our Form ADV disclosure brochure using our contact information herein. Please read the disclosure brochure carefully before you invest or send money.

Celebrating Independence—Both National and Financial