Feb 16, 2023 Market Update: February 2023

It’s been an encouraging start to the year after a challenging 2022. Falling inflation, interest rates, and decent earnings have provided fuel for a nice market run to start the year. The S&P 500 is up over 8% this year and up over 15% since it bottomed in October 2022. Bonds (1) are up over 1% (through February 15th) this year and up over 5% since they bottomed in October (2).

However, the path of monetary policy and economic growth remains uncertain over the near term. Given the recent solid returns and an increasingly uncertain economic backdrop, we are reducing risk in portfolios. In equities, we favor U.S. mid cap, U.S. value and non-U.S. equities. In bonds, we favor short-term bonds.

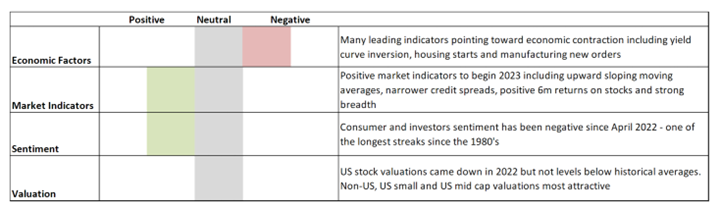

From an economic perspective, our indicators are negative. Leading indicators like an inverted yield curve point toward a recession. In addition, there remain restrictive monetary and fiscal conditions that may negatively affect economic growth although there don’t appear to be significant imbalances that could create a steep recession like in 2008. Despite the negatives, 2023 has begun with some promising signs. China’s reemergence from COVID lockdowns has helped global economic activity and in the U.S., inflation has been coming down since June, which may allow interest rate hikes to pause. However, even if U.S. economic growth rebounds, it doesn’t necessarily mean asset prices will also rebound. Stronger economic growth could put upward pressure on inflation and prompt the Fed to keep interest rates higher for longer, weighing on both stock and bond prices.

Our market indicators remain bullish as the rally that began in October has been decisive and broad-based across various stocks, industries, and global markets. Most of our market indicators point to further upside for stocks for the remainder of 2023. For example, major stock indexes are above their major moving averages, bond yields are lower, and riskier areas of the market are outperforming defensive areas.

Investor sentiment has been extremely negative for nearly a year now, one of the longest periods in recent history. Yet, when the majority of investors are pessimistic, future stock returns have historically been strong. Some optimism has returned to markets in 2023, but not enough to warrant a shift in our reading.

Valuations are somewhat elevated in U.S. large-cap stocks but not at a historically overvalued extreme. Non-U.S. equity and small-cap U.S. equity markets appear undervalued. Corporate fundamentals have softened, with earnings growth declining -2.8% over the last year (3), but balance sheets remain healthy. Higher wages and interest expenses are pressuring profit margins, but many companies are quickly adjusting to support margins.

Please reach out to your advisor for any questions or concerns.

- Barclays Aggregate Index

- Koyfin. Returns through 2/15/23 Stocks bottomed 10/12/22 & bonds bottomed 10/20/22

- Factset

Company News

Market Commentary

Retirement Planning

Tax Planning

Cyber Security

Important Disclosures

Leonard Rickey Investment Advisors, PLLC (“LRIA”), is an SEC registered investment adviser located in the State of Washington. Registration does not imply a certain level of skill or training. For information pertaining to the registration status of LRIA, please contact LRIA or refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov).

This is provided for general information only and contains information that is not suitable for everyone. As such, nothing herein should be construed as the provision of specific investment advice or recommendations for any individual. To determine which investments may be appropriate for you, consult your financial advisor prior to investing. There is no guarantee that the views and opinions expressed herein will come to pass. This newsletter contains information derived from third party sources. Although we believe these third-party sources to be reliable, we make no representations as to the accuracy or completeness of any information prepared by any unaffiliated third party incorporated herein and take no responsibility therefore.

Any projections, forecasts and estimates, including without limitation any statement using “expect” or “believe” or any variation of either term or a similar term, contained here are forward-looking statements and are based upon certain current assumptions, beliefs and expectations that LRIA considers reasonable or that the applicable third parties have identified as such. Forward-looking statements are necessarily speculative in nature, and it can be expected that some or all of the assumptions or beliefs underlying the forward-looking statements will not materialize or will vary significantly from actual results or outcomes. Some important factors that could cause actual results or outcomes to differ materially from those in any forward-looking statements include, among others, changes in interest rates and general economic conditions in the U.S. and globally, changes in the liquidity available in the market, change and volatility in the value of the U.S. dollar, market volatility and distressed credit markets, and other market, financial or legal uncertainties. Consequently, the inclusion of forward-looking statements herein should not be regarded as a representation by LRIA or any other person or entity of the outcomes or results that will be achieved by following any recommendations contained herein. While the forward-looking statements here reflect estimates, expectations and beliefs, they are not guarantees of future performance or outcomes. LRIA has no obligation to update or otherwise revise any forward-looking statements, including any revisions to reflect changes in economic conditions or other circumstances arising after the date hereof or to reflect the occurrence of events (whether anticipated or unanticipated), even if the underlying assumptions do not come to fruition. Opinions expressed herein are subject to change without notice and do not necessarily take into account the particular investment objectives, financial situations, or particular needs of all investors.

For additional information about LRIA, including fees and services, please contact us for our Form ADV disclosure brochure using our contact information herein. Please read the disclosure brochure carefully before you invest or send money.

Celebrating Independence—Both National and Financial