Nov 16, 2022 Client Question of the Month: Why do I still own bonds when their returns have been negative?

Bonds historically have helped stabilize portfolios when markets—particularly stock markets—grow volatile. The US bond market has recorded positive returns, before inflation, in all but four years since 1976. High-quality bonds, in particular, have typically held their value when stocks have endured their worst periods of performance.

2022 has been an outlier – bonds haven’t stabilized portfolios as bond prices have fallen along with stock prices. Bond prices in 2022 have been the worst in decades, and some may question their role in portfolios.

However, as bond prices have fallen, bond yields have improved significantly. The improved opportunity set in fixed income due to higher yields gives us confidence that bonds can play a stabilizing role in your portfolio and are worth keeping.

Why have my fixed-income funds lost money?

- The Federal Funds rate has increased nearly 4% this year. Higher Federal Funds rates make current bonds less attractive. This is because most bonds pay a fixed interest rate (or coupon), and if interest rates for newer bonds rise, investors will no longer prefer the lower interest rates provided by older bonds.

- Investors can then demand a higher yield of existing bonds by driving the price of the bonds down, resulting in negative performance for existing bondholders.

- In addition, inflation is near 40-year highs. Inflation is like kryptonite for bonds, whose interest payments are fixed and, therefore, cannot grow to keep pace with the rising cost of living.

- The graph below compares bond yields from the beginning of this year through October 31st, 2022(1). The prices of bonds issued at low-interest rates have decreased as yields have increased this year.

What role do bonds play and why should I continue to hold them?

- We believe bonds can continue to dampen volatility relative to equities, provide liquidity, and, after 15 years of extremely low-interest rates, finally generate reasonable income.

- Rates are much more attractive now, which can be positive for future returns and reinvestment. Moving from a low-rate environment to a high one can be painful, but we’ve seen it benefit investors in the long run. *

- Higher yields may lead to higher expected returns. Investors can think of this tradeoff as a pit stop in a Formula 1 race. The pit stop immediately causes the driver to fall back. However, fresh tires may help the driver win the race if enough laps are left to catch the leader.

- A gradual rate rise is not bad for bond investors if inflation is controlled. Over the long term, the total return of bonds depends much more on their income than price changes. Since 1976, just over 90% of the average annual return in the US bond market has come from interest and reinvestment(2).

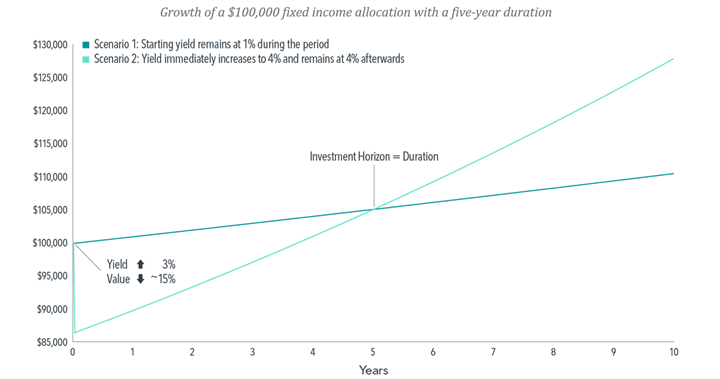

The below graph illustrates this concept using two scenarios for a $100,000 fixed income allocation with a five-year duration(3). Scenario 1 experiences a constant yield of 1% during the period. Scenario 2 is faced with a sudden spike in yield from 1% to 4% on Day 1 and sees its value immediately drop to a little over $86,000. However, the higher-yield environment accelerates Scenario 2’s recovery: With a 4% yield over the previous rate of 1%, Scenario 2’s portfolio value overtakes Scenario 1’s within five years—the time horizon determined by the duration of Scenario 2(4).

Bottom-line:

- Rates are more attractive now. Pain in the short-term doesn’t indicate that fixed income will be down in the long-term.

- Research tells us that trying to outguess the market by holding on to cash, or shortening duration, with the expectation of future yield increases may not help you achieve your long-term goals. Trying to outguess the market on future rates or inflation often leads to disappointment.

- Investors who maintain appropriate asset allocations, even after increases in bond yields, may have a more rewarding investment experience in the long run.

- Blackrock

- Loomis, Sayles & Co

- Dimensional Fund Advisors

- If the duration was shorter, then Scenario 2’s portfolio value would overtake Scenario 1’s sooner.

*Increasing rates does not guarantee an increase in total return

Company News

Market Commentary

Retirement Planning

Tax Planning

Cyber Security

Important Disclosures

Leonard Rickey Investment Advisors, PLLC (“LRIA”), is an SEC registered investment adviser located in the State of Washington. Registration does not imply a certain level of skill or training. For information pertaining to the registration status of LRIA, please contact LRIA or refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov).

This is provided for general information only and contains information that is not suitable for everyone. As such, nothing herein should be construed as the provision of specific investment advice or recommendations for any individual. To determine which investments may be appropriate for you, consult your financial advisor prior to investing. There is no guarantee that the views and opinions expressed herein will come to pass. This newsletter contains information derived from third party sources. Although we believe these third-party sources to be reliable, we make no representations as to the accuracy or completeness of any information prepared by any unaffiliated third party incorporated herein and take no responsibility therefore.

Any projections, forecasts and estimates, including without limitation any statement using “expect” or “believe” or any variation of either term or a similar term, contained here are forward-looking statements and are based upon certain current assumptions, beliefs and expectations that LRIA considers reasonable or that the applicable third parties have identified as such. Forward-looking statements are necessarily speculative in nature, and it can be expected that some or all of the assumptions or beliefs underlying the forward-looking statements will not materialize or will vary significantly from actual results or outcomes. Some important factors that could cause actual results or outcomes to differ materially from those in any forward-looking statements include, among others, changes in interest rates and general economic conditions in the U.S. and globally, changes in the liquidity available in the market, change and volatility in the value of the U.S. dollar, market volatility and distressed credit markets, and other market, financial or legal uncertainties. Consequently, the inclusion of forward-looking statements herein should not be regarded as a representation by LRIA or any other person or entity of the outcomes or results that will be achieved by following any recommendations contained herein. While the forward-looking statements here reflect estimates, expectations and beliefs, they are not guarantees of future performance or outcomes. LRIA has no obligation to update or otherwise revise any forward-looking statements, including any revisions to reflect changes in economic conditions or other circumstances arising after the date hereof or to reflect the occurrence of events (whether anticipated or unanticipated), even if the underlying assumptions do not come to fruition. Opinions expressed herein are subject to change without notice and do not necessarily take into account the particular investment objectives, financial situations, or particular needs of all investors.

For additional information about LRIA, including fees and services, please contact us for our Form ADV disclosure brochure using our contact information herein. Please read the disclosure brochure carefully before you invest or send money.

Celebrating Independence—Both National and Financial