Posts by Matt Hargreaves

Should I be Worried about Inflation?

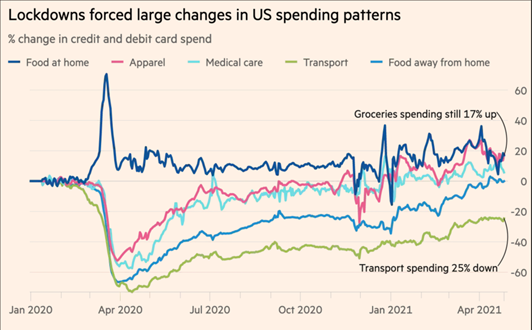

Rising inflation has been a growing concern over the last few months for many investors. U.S. consumer prices, as measured by the consumer price index (CPI) were up 6.9% for the year ending November 2021, the largest annual increase since 1982 (1). Policymakers (e.g., the Federal Reserve) pay closer attention to Core inflation, which is…

Read MoreChanges Coming in Early 2022 to Your Financial Portal

We are excited to announce that early next year, we will be upgrading your financial portal to provide a more consolidated and seamless experience. Here’s what you can expect: A New, Modern Interface: How we interact with the many screens around us is always evolving and improving. Our new interface takes advantage of the latest…

Read MoreCapital Gains FAQs

Capital Gains – FAQs What is a capital gain? A capital gain is the profit when you sell a capital asset, such as stocks, bonds, mutual funds or property. The profit is your gain over the original price you paid and you must pay tax on that gain. For example, if a stock is bought…

Read More2021 3rd Quarter Commentary

The S&P 500 finished the 3rd quarter flat, after suffering its first 5% correction since 2020. The economic recovery continued but increased concerns about the Delta variant, labor shortages and supply chain issues slowed growth. Corporate earnings were very strong and finished the quarter at higher levels than before the pandemic began. Higher corporate taxes…

Read MoreWelcome Gunnar Harrison!

All of us at Leonard Rickey Investment Advisors want to welcome and introduce our newest member of the team, Gunnar! Gunnar started working at Leonard Rickey Investment Advisors in August 2021. He graduated from Central Washington University in 2019 in Business with a specialization in personal financial planning. Here are some other fun…

Read MoreInvestment Question of the Month: What are some of the differences between ETFs and mutual funds?

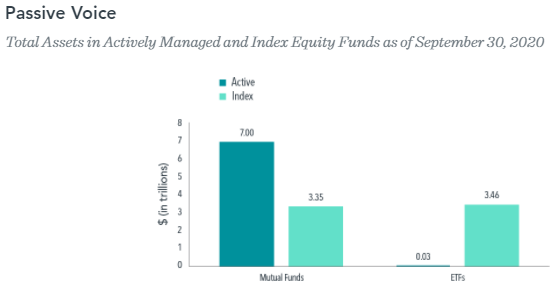

Mutual funds and exchange traded funds (ETFs) are arguably more similar than different. Both investment funds are registered with the SEC under the Investment Company Act of 1940 (40 Act), and most of the rules under the 40 Act apply to both. Both structures offer investors a way to pool their money in a fund…

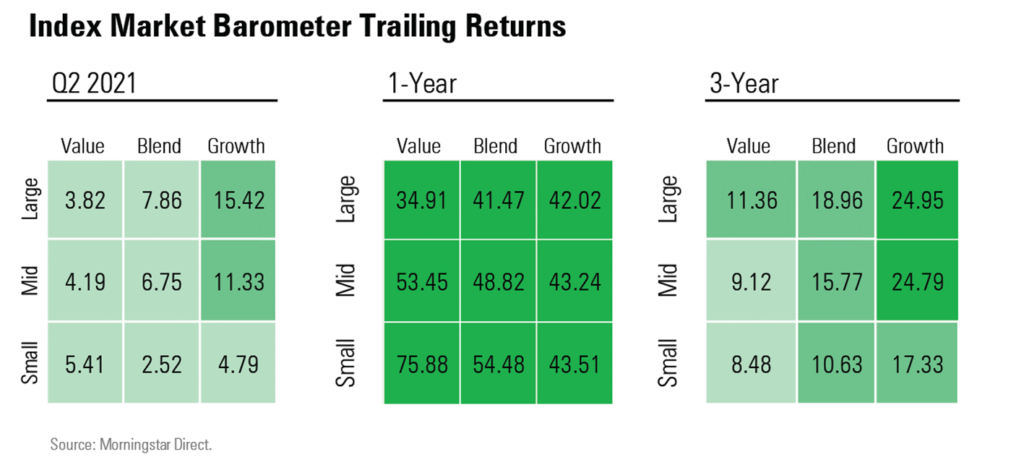

Read More2021 2nd Quarter Commentary

• The strong economic recovery drove corporate earnings growth and supported gains in stock prices. The S&P 500 finished the quarter and new all-time highs. U.S. valuations remained elevated. • In a reversal of the previous two quarters, growth stocks beat value stocks, bond yields decreased, and large cap stocks outperformed small cap stocks. •…

Read MoreNaming Your Beneficiaries: Avoid Common Mistakes

We get a lot of questions from clients on naming beneficiaries to their accounts. While the paperwork is relatively straightforward, it is important to pay attention to a few key areas to avoid some common mistakes. We’ve outlined a few key areas keep in mind when naming a beneficiary Updating your will is not enough…

Read MoreShould You Invest in Cryptocurrencies?

Cryptocurrency Background Before reading, our compliance team wanted me to emphasize that I am not an expert in cryptocurrencies and that nothing in here should be taken as investment advice. This is meant to be educational. Please do your own due diligence before investing. In broad terms, cryptocurrencies are a new type of asset that…

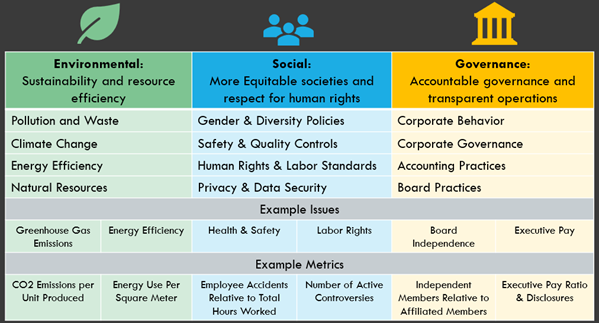

Read MoreWhat is ESG Investing?

Investors are increasingly aware of how certain business practices may potentially affect the environment and how that may impact future generations. As citizens, individuals can express their political preferences around sustainability through the ballot box. As investors, they also can express their preferences through their investments by allocating capital to companies that better align with…

Read More