Dec 17, 2021 Should I be Worried about Inflation?

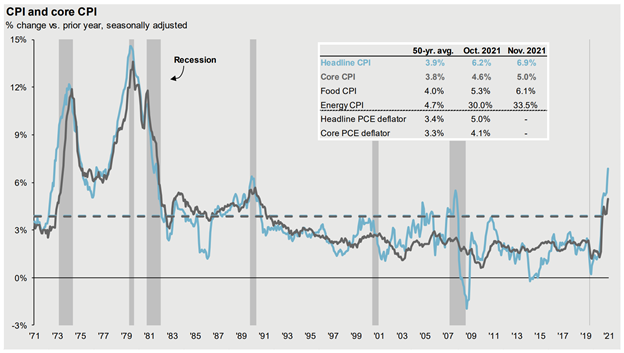

Rising inflation has been a growing concern over the last few months for many investors. U.S. consumer prices, as measured by the consumer price index (CPI) were up 6.9% for the year ending November 2021, the largest annual increase since 1982 (1). Policymakers (e.g., the Federal Reserve) pay closer attention to Core inflation, which is the overall inflation rate excluding Food and Energy. The Core inflation rate rose 5% for the year ending in November 2021 (see chart below)(2).

While this can be somewhat alarming, inflation from November 2019 to October 2020 was just 1.2%, so the two-year inflation was 4% and the two-year core inflation was 3.3% on an annualized basis. Yes, this is higher than it has been in recent years, but it is still nowhere near hyperinflation territory.

Background on CPI

The CPI measures a basket of goods and services which is meant to represent what people typically purchase. Items are given weights proportional to the amount spent on them. The composition of a basket of goods is not only dynamic, but it also considers that entirely new products enter the market and the changing quality of goods (for example a new TV today is much higher quality than a new TV 20 years ago thanks to technological advances).

What you spend money on is likely different from the index. For example, when gasoline prices skyrocket, a family with long car commutes suffers far more than a family with short subway commutes or retirees with no commute. Higher college tuition costs impact a college student tremendously whereas it has no effect on someone who isn’t paying for college. These dynamics can often create controversy over the inflation numbers because we all experience price increases differently.

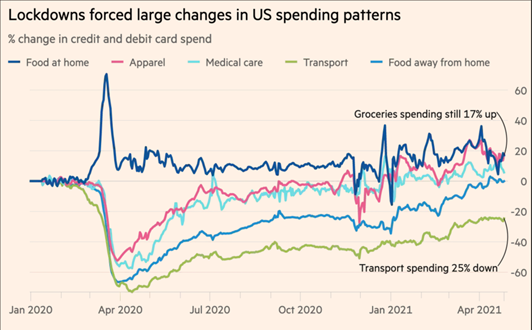

The effects of inflation are even more nuanced in the post-pandemic environment. The pandemic’s economic disruption suddenly and radically changed consumers’ spending patterns. People stopped spending on restaurants, airfares, and other lockdown-restricted activities practically overnight. As a result, real-world experiences of inflation differed from the official headline rate.

To illustrate the problem, the Financial Times broke down the changes in spending patterns around the pandemic. Higher grocery costs had a much larger real-world impact than higher restaurant costs. The CPI isn’t meant to quickly adjust to these changes in spending patterns.

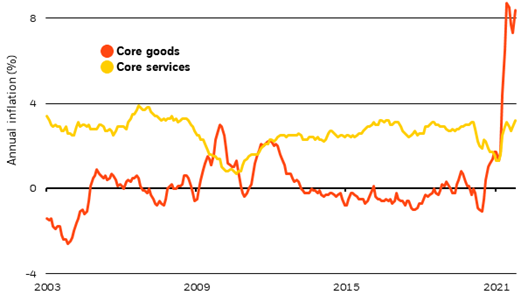

Data from Blackrock show something similar. Households have substantially increased their spending on goods versus services in this unusual pandemic economy. The share of goods spending in the total personal consumption expenditures jumped to around 36%, the highest level in 15 years (3). Prices of goods excluding food and energy – which had been in deflation for most of the past decade – have surged way beyond core services prices, reflecting the restart disruptions and shifts in spending patterns. We wouldn’t be surprised to see return to more normal levels in a post-COVID world.

Why does inflation matter?

In general, stronger economic growth risks higher inflation and low or negative economic growth risks deflation. Both deflation and high inflation are likely to create unfavorable economic outcomes. Ideally inflation would be kept at a reasonable level to keep the economy thriving. For example, the Fed has a 2% inflation target.

If deflation sets in, it can be hard to escape (think Great Depression). Purchases today can be postponed in anticipation of lower prices tomorrow, contributing to a spiral of lower economic activity and lower prices. Take, for example, a TV that costs $1,000 one year and the next year, the newer model costs $800. The theory is if prices are trending downwards, consumers will wait to make their purchases. TV manufacturers start making fewer TVs, and then start having to layoff their employees.

In addition, rising real debt burdens can become increasingly at risk of default when prices and economic activity fall. Under a deflationary scenario, over time, you may be paid less as the cost of living goes down, but your mortgage bill will stay the same. Debt can become unsustainable.

Periods of high and volatile inflation can also lead to bad economic outcomes but for different reasons. High inflation typically brings higher interest rates, and, given their sensitivity to rising rates, bonds often lose value. Higher interest rates threaten to slow the economy and a slowing economy hurts corporate profits and stock prices. High-duration stocks (particularly growth stocks) may be especially sensitive to increased interest rates.

Also, while companies can increase their prices to offset rising expenses, many companies can’t fully pass on the increased input costs. Margins often shrink as a result. For example, in a high inflation environment the TV manufacturer that was selling TVs for $1,000 saw their input costs go up $100. They could raise their price to $1,100 to make up for the increased costs but often they may only increase the cost to $1,050. (Note: we are not seeing this currently. Many businesses so far have been able to pass on higher input costs to consumers and as a result profit margins are near all-time highs).

Current Inflation Environment

There are many theories explaining why inflation is high and there are likely several factors converging at the same time. Unprecedented monetary and fiscal policies coupled with pent up demand and supply constraints are a few of the factors contributing to inflationary pressures.

Many investors are worried of a return to the 1970’s inflationary environment but there are several structural reasons for why inflation is different today. Expanding globalization has potentially reduced input costs and limited wage growth. Technological advances have increased productivity and allowed for great cost efficiencies. Finally, the 1970’s inflation was highly influenced by higher oil prices. Over the course of that decade, oil prices went from about $2 to $32. It’s difficult to see a 16-fold gain in oil prices happening again given the fact that the U.S. is now a net exporter of oil.

Sustained periods of elevated inflation are rare in U.S. history, particularly over the last 30 years. Recently, in the aftermath of the 2007–2009 global financial crisis, inflation has struggled to hit 2% on a sustained basis. And that’s despite unprecedented stimulus measures engineered by the Fed.

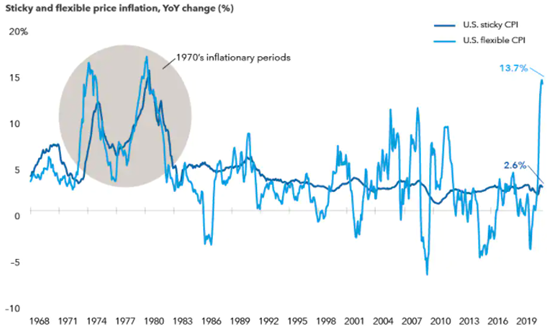

Investor’s current inflation expectations suggest that high inflation may be temporary. For example, investors’ expectations of inflation over the next 10 years is only 2.4% (4). In addition, most inflation is coming from flexible categories such as food, energy, and cars, where prices tend to be more volatile. For instance, prices for lumber, copper and soybeans skyrocketed this spring and have since come down. On the other hand, sticky inflation, currently around 2.6% annualized, tends to exhibit longer staying power. Sticky categories include wages, rent, owners’ equivalent rent, insurance costs and medical expenses (see chart below) (5).

One factor that is difficult to measures is consumer psychology. If consumers believe prices will continue to rise, then they may go buy products in excess today and additionally, could demand higher wages to reflect these inflationary expectations. As this mindset becomes more pervasive for both consumers and producers, it is likely to prolong inflation pressures. There is evidence of higher wage demand due to the fact that there is currently much more demand for labor than supply of labor.

Next month we will look at the possible investment implications of higher inflation.

- Bureau of Labor Statistics

- JP Morgan Guide to the Markets

- Blackrock Investment Institute

- Federal Reserve Economic Data, based on the 10-year breakeven inflation rate. As of 12/14/21

- Capital Group, as of August 2021

Company News

Market Commentary

Retirement Planning

Tax Planning

Cyber Security

Important Disclosures

Leonard Rickey Investment Advisors, PLLC (“LRIA”), is an SEC registered investment adviser located in the State of Washington. Registration does not imply a certain level of skill or training. For information pertaining to the registration status of LRIA, please contact LRIA or refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov).

This is provided for general information only and contains information that is not suitable for everyone. As such, nothing herein should be construed as the provision of specific investment advice or recommendations for any individual. To determine which investments may be appropriate for you, consult your financial advisor prior to investing. There is no guarantee that the views and opinions expressed herein will come to pass. This newsletter contains information derived from third party sources. Although we believe these third-party sources to be reliable, we make no representations as to the accuracy or completeness of any information prepared by any unaffiliated third party incorporated herein and take no responsibility therefore.

Any projections, forecasts and estimates, including without limitation any statement using “expect” or “believe” or any variation of either term or a similar term, contained here are forward-looking statements and are based upon certain current assumptions, beliefs and expectations that LRIA considers reasonable or that the applicable third parties have identified as such. Forward-looking statements are necessarily speculative in nature, and it can be expected that some or all of the assumptions or beliefs underlying the forward-looking statements will not materialize or will vary significantly from actual results or outcomes. Some important factors that could cause actual results or outcomes to differ materially from those in any forward-looking statements include, among others, changes in interest rates and general economic conditions in the U.S. and globally, changes in the liquidity available in the market, change and volatility in the value of the U.S. dollar, market volatility and distressed credit markets, and other market, financial or legal uncertainties. Consequently, the inclusion of forward-looking statements herein should not be regarded as a representation by LRIA or any other person or entity of the outcomes or results that will be achieved by following any recommendations contained herein. While the forward-looking statements here reflect estimates, expectations and beliefs, they are not guarantees of future performance or outcomes. LRIA has no obligation to update or otherwise revise any forward-looking statements, including any revisions to reflect changes in economic conditions or other circumstances arising after the date hereof or to reflect the occurrence of events (whether anticipated or unanticipated), even if the underlying assumptions do not come to fruition. Opinions expressed herein are subject to change without notice and do not necessarily take into account the particular investment objectives, financial situations, or particular needs of all investors.

For additional information about LRIA, including fees and services, please contact us for our Form ADV disclosure brochure using our contact information herein. Please read the disclosure brochure carefully before you invest or send money.

2025 1st Quarter Investment Commentary