Jul 20, 2021 2021 2nd Quarter Commentary

• The strong economic recovery drove corporate earnings growth and supported gains in stock prices. The S&P 500 finished the quarter and new all-time highs. U.S. valuations remained elevated.

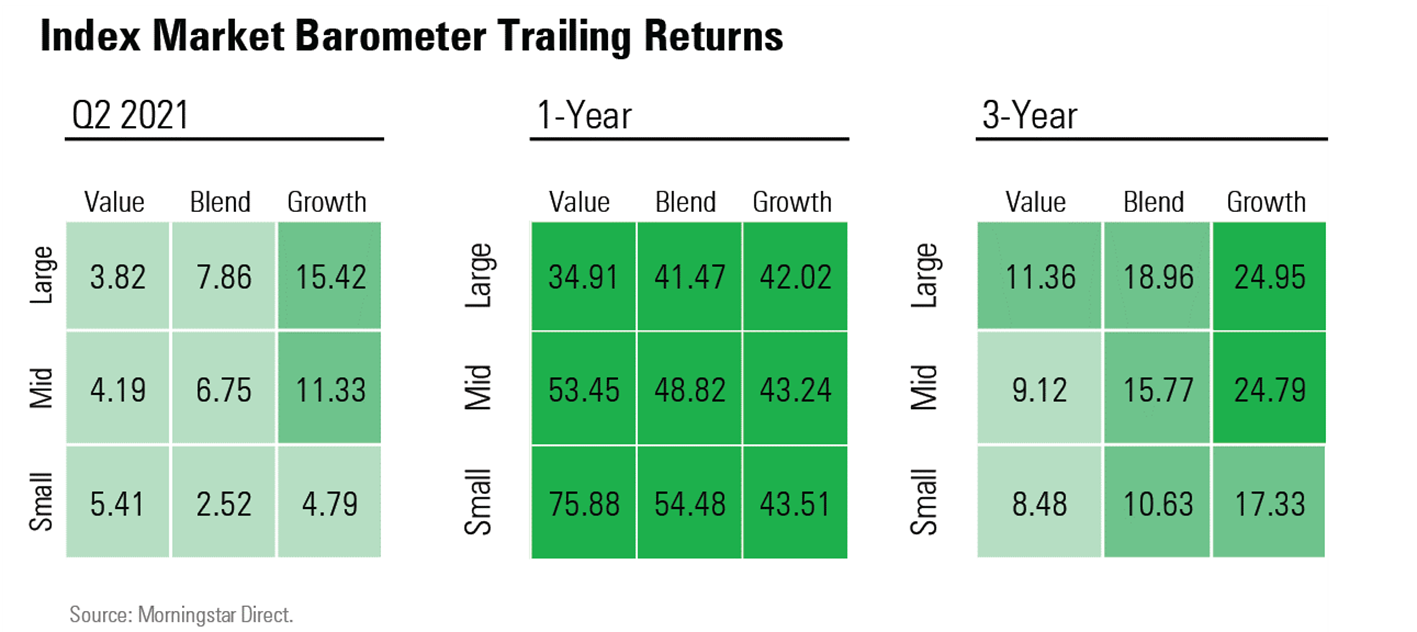

• In a reversal of the previous two quarters, growth stocks beat value stocks, bond yields decreased, and large cap stocks outperformed small cap stocks.

• The economic recovery may be nearing a peak in terms of the rate of improvement, but there was still plenty of momentum left to extend above-average growth into 2022.

• Inflation data was the highest since 1992 but many of the factors driving the high rate appeared to be related to a constrained supply chain and massive demand that should work itself out in the coming months.

Market Summary

Stocks, as measured by the S&P 500, continued their upward momentum and finished the quarter at new all-time highs as corporate earnings growth remained extremely strong and the economy continued its rebound from the pandemic. International stock indexes also hit new all-time highs during the quarter, however, they underperformed U.S. equities. Value stocks outperformed growth stocks in the previous two quarters but underperformed in the second quarter. All S&P 500 sectors except Utilities increased, with Energy, Real Estate and Technology performing best.

The worst of the pandemic appeared to be behind us as successful vaccines enabled further re-openings and boosted the economic recovery. Consumers were in good shape. Home prices continued to increase, household debt to disposal personal income was at its lowest since 1995 and financial obligations ratio was close to record lows (1). But the pace of reopening also created new risks: supply chains were stressed, some labor shortages emerged, inflation was heating up, and asset prices looked expensive compared to historical figures.

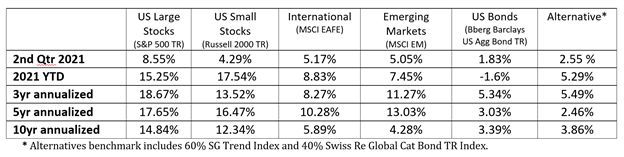

Despite this strong economic backdrop and a 5% inflation number in May, the Federal Reserve remained accommodative and kept short-term interest rates near zero. In their June meeting, Fed members indicated that they expect to begin hiking short-term rates in 2023, earlier than the market expected. This caught investors off guard and caused many intermarket relationships to change course. For example, bond prices increased, the U.S. dollar increased, large caps outperformed small caps and commodity prices fell after the announcement. Below is a summary of returns for the quarter. (2)

Market Analysis

Equities extended their year-to-date gains, and the S&P 500 finished the quarter at record highs, returning over 15% for the first half of the year. The strong economic recovery drove corporate earnings growth and supported gains in stock prices. The percentage of S&P 500 companies beating earnings per share expectations was the highest ever recorded (89% of companies beat). The three highest quarterly earnings beat rates since 1995 occurred in three of the last four quarters (3). Earnings estimates for 2021 were still strong and increased 12% this year, in line with the return from equities.

The strong outperformance of value stocks over growth stocks since October 2020 faded in the second quarter. Several factors that had been moving in value’s favor (higher long term interest rates, increasing inflation expectations) abruptly changed course following the Fed’s announcement that they may raise short term interest rates sooner than expected.

The second year of a bull market is often more challenging than the first. Investors often begin to price in the reality that the year over year economic and earnings growth rates in year one are difficult to repeat in year two. This transition can be a bumpy one. The average maximum drawdown for the S&P 500 in year two of bull market has been about 10%. Despite this headwind, we still see potential for upside as the economy continues to rebound grow. Economic expansions have historically been good for equity markets, with positive returns nearly 90% of the time (4).

Valuations

The current business cycle has been unprecedented. Last year’s recession was among the worst in U.S. history, but it lasted just two months. As a result, some imbalances weren’t worked off like we tend to see in a normal recession. Corporate debt levels remained high and stock valuations never reset.

In addition, this has been one of the strongest starts to a bull market in history – a nearly 90% gain off the March 23, 2020 lows through June 28, 2021. As a result, stock valuations were high and reflected a lot of good news. That means any negative news or setbacks could produce volatility should investors rethink some of their optimism. Forward returns from these valuations levels in the past have been modest. Equity markets outside the U.S. have higher long-term return expectations due to lower valuations.

In the short to intermediate term, equities can stay expensive for extended periods of time, particularly with relatively low interest rates and strong corporate profitability. For example, the S&P 500 has traded at top quintile cyclically adjusted price-to-earnings ratios (CAPE) for the last ten years and returned more than 250% in that period (5). However, higher inflation, corporate taxes, and wage pressures may put further pressure on equity valuations within the next few years.

Economic Analysis

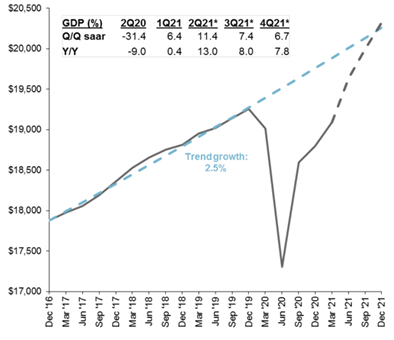

Overall, the fundamental backdrop for the economy remained positive. Massive pent-up demand, still supportive fiscal stimulus and the prospects of fully reopened economies were positive signs for continued economic growth. Thanks largely to rising consumer spending and trillions in government stimulus, U.S. gross domestic product rose an annualized 6.4% in the first three months of the year. The recovery in the economy has been one of the fastest on record, with real GDP likely to surpass its previous Q4-2019 record high by the end of 2021, years ahead of previous expectations.

There were signs that the economic recovery may be nearing a peak in terms of the rate of improvement, but there was still plenty of momentum left to extend above-average growth into 2022. Economists expected the second quarter to deliver the highest GDP growth since the 1980s, while future quarters were expected to have positive but declining growth. The months ahead may still see economic challenges with strained supply chains, rising inflation, and labor market distortions acting as headwinds for the U.S. recovery. In addition, pressures were mounting on the Federal Reserve to begin unwinding some of its pandemic-related stimulus. The good news is that since World War II, economic expansions have lasted an average of five years, with the four most recent cycles going even longer (6).

On employment, the U.S. was still 9 million jobs short compared to pre-pandemic levels, even though job openings were at record highs and many industries reported worker shortage. The mismatch of record high job openings and elevated unemployment highlights the shortcoming in job creation was really an issue of labor supply. Prolonged enhanced unemployment benefits, lingering pandemic worries, childcare responsibilities, and early retirements likely restrained labor supply. However, many of these pandemic effects should recede in the back half of 2021.

Inflation

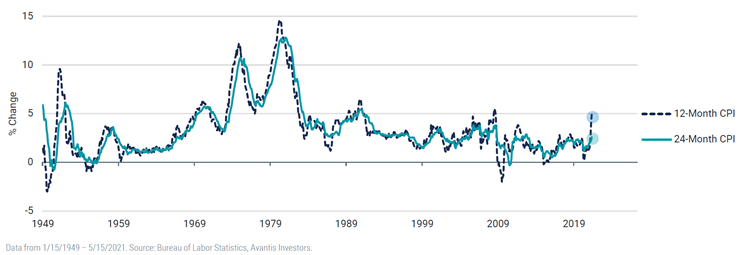

Inflation, as measured by the Consumer Price Index (CPI) spiked to 5.0% year over year in May, the most since 2008, while core CPI (excluding food & energy) hit 3.8%, the highest since 1992 (7).

While the 12-month number was high, the annualized inflation over the last two years was just over 2.5%. The dotted line plots the 12-month percentage change, and the solid line plots the 24-month percentage change. Because the 5% inflation was preceded by a period of no inflation, the inflation environment over the last two years remained well within the expected long-term annual range. It is also important to note that stronger economic growth is often accompanied by higher inflation. With the adoption of the Fed’s new average inflation-targeting policy, they have become more tolerant of inflation overshooting their 2% target for a period of time as long as employment improves.

It’s difficult to know how long the inflationary environment will persist. A lot of what we saw during the second quarter were supply side shortages stemming from the shutdown of the economy and strong demand from consumers who had large amounts of disposable income thanks to direct payments from the federal government. Investors and the Federal Reserve seemed to agree with this sentiment as long-term inflation expectations and bond yields were still low.

Diving further into inflation, a few specific items drove the bulk of the overall results. For example, in the May reading energy prices increased 28.5% for the past 12 months, the price of used cars climbed 29.7% and transportation services were up over 11%. If you were to exclude these three categories inflation was up 2.3% (8), in line with historical averages.

A significant risk is that inflation is not temporary and the unprecedented level of fiscal and monetary stimulus results in persistently high inflation. It’s difficult to know for certain, but one area to watch for more persistent inflation is in wage data. Over the last 24 months, wage growth rose to 4.6%, slightly above its 50-year average of 4% . If higher wages get embedded into inflation expectations this could present risks to corporate profits. On the other hand, once plants, manufacturing and global trade resume normal activity, supply should meet demand and prices may re-adjust accordingly.

Portfolio Changes

Portfolios continued to be overweight stocks and underweight bonds relative to investors’ investment objectives.

Given the uncertainty between short and longer-term inflation, our portfolios are positioned to account for a range of inflation outcomes. Currently we are overweight value-oriented stocks which may help hedge inflation risks. Blackrock analyzed data dating back to 1927 and found that value stocks have historically realized the greatest outperformance over their growth counterparts in periods of moderate to high inflation.

In fixed income, we expect bond yields to move higher over time. For this reason, portfolios remained positioned with a shorter duration than average. Shorter duration may also help protect against rising inflation.

Please reach out to your advisor if you have any questions or concerns.

Company News

Market Commentary

Retirement Planning

Tax Planning

Cyber Security

Important Disclosures

Leonard Rickey Investment Advisors, PLLC (“LRIA”), is an SEC registered investment adviser located in the State of Washington. Registration does not imply a certain level of skill or training. For information pertaining to the registration status of LRIA, please contact LRIA or refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov).

This is provided for general information only and contains information that is not suitable for everyone. As such, nothing herein should be construed as the provision of specific investment advice or recommendations for any individual. To determine which investments may be appropriate for you, consult your financial advisor prior to investing. There is no guarantee that the views and opinions expressed herein will come to pass. This newsletter contains information derived from third party sources. Although we believe these third-party sources to be reliable, we make no representations as to the accuracy or completeness of any information prepared by any unaffiliated third party incorporated herein and take no responsibility therefore.

Any projections, forecasts and estimates, including without limitation any statement using “expect” or “believe” or any variation of either term or a similar term, contained here are forward-looking statements and are based upon certain current assumptions, beliefs and expectations that LRIA considers reasonable or that the applicable third parties have identified as such. Forward-looking statements are necessarily speculative in nature, and it can be expected that some or all of the assumptions or beliefs underlying the forward-looking statements will not materialize or will vary significantly from actual results or outcomes. Some important factors that could cause actual results or outcomes to differ materially from those in any forward-looking statements include, among others, changes in interest rates and general economic conditions in the U.S. and globally, changes in the liquidity available in the market, change and volatility in the value of the U.S. dollar, market volatility and distressed credit markets, and other market, financial or legal uncertainties. Consequently, the inclusion of forward-looking statements herein should not be regarded as a representation by LRIA or any other person or entity of the outcomes or results that will be achieved by following any recommendations contained herein. While the forward-looking statements here reflect estimates, expectations and beliefs, they are not guarantees of future performance or outcomes. LRIA has no obligation to update or otherwise revise any forward-looking statements, including any revisions to reflect changes in economic conditions or other circumstances arising after the date hereof or to reflect the occurrence of events (whether anticipated or unanticipated), even if the underlying assumptions do not come to fruition. Opinions expressed herein are subject to change without notice and do not necessarily take into account the particular investment objectives, financial situations, or particular needs of all investors.

For additional information about LRIA, including fees and services, please contact us for our Form ADV disclosure brochure using our contact information herein. Please read the disclosure brochure carefully before you invest or send money.

Celebrating Independence—Both National and Financial