Oct 14, 2021 2021 3rd Quarter Commentary

- The S&P 500 finished the 3rd quarter flat, after suffering its first 5% correction since 2020.

- The economic recovery continued but increased concerns about the Delta variant, labor shortages and supply chain issues slowed growth.

- Corporate earnings were very strong and finished the quarter at higher levels than before the pandemic began. Higher corporate taxes may be a headwind in 2020.

- Given low bond yields and a positive economic backdrop, portfolios remained overweight stocks. Recent changes include reducing emerging markets, increasing developed markets, and increasing inflation hedges.

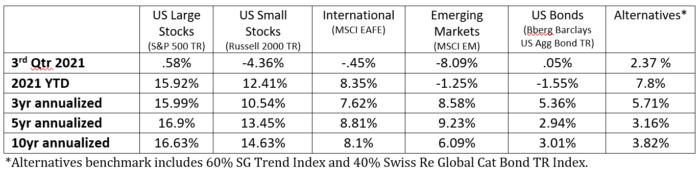

Market Summary

After hitting all-time highs on September 2nd, the S&P 500 declined 5.06% and finished the 3rd quarter little changed. September’s decline marked the first 5% correction in the S&P 500 since October 2020 and the first monthly loss since January 2021. The delta variant sent many investors back to their 2020 playbook – selling out of small-cap, international and value categories in favor of U.S. large-cap growth. The technology and financial sectors were the top performing S&P 500 sectors, while the industrials and materials sectors were the largest detractors during the quarter. Other major indexes fared worse than the S&P 500, particularly emerging markets. China faced increased regulatory pressures in several industries and the country’s largest property developer appeared on the verge of bankruptcy.

The cumulative effects of high interest rates, rising input costs related to supply chain bottlenecks, inflation concerns, and increased COVID-19 cases may have slowed economic normalization, but it did not halt the economic recovery. The growth rate of gross domestic product (GDP) for the third quarter was tracking to just 1%, down from 6% at the beginning of the quarter[1]. Rather than the start of a new downtrend, however, economists continued to forecast strong economic growth for the rest of this year and into 2022 as economies around the globe reopen fully and pent-up demand materializes.

In addition, many central banks indicated they may reduce liquidity and raise interest rates soon. The Federal Reserve indicated that they have seen “substantial progress” on the inflation and employment fronts, which means they can start slowing down their bond purchases and eventually raise interest rates. News from Congress seemed to point toward less spending and higher taxes going forward, which could pose challenges to near-term corporate earnings.

Interest rates bounced around before rising at the end of the quarter. They continued to hover near historic lows. Bond returns, like equity returns, were roughly flat for the quarter.[2]

Economic Analysis

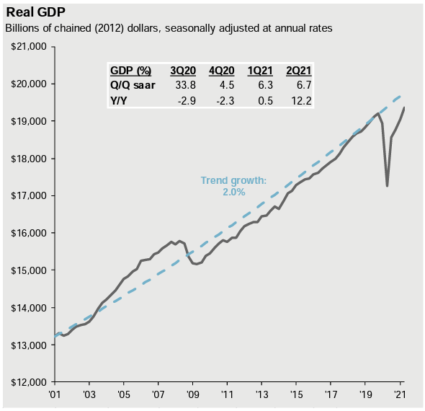

Heading into the third quarter, the global economy grew at its strongest pace in decades, helped by the combination of historical fiscal and monetary stimulus and households’ pent-up demand for consumption. These forces gave the economy a historically quick and strong recovery. In fact, most developed market economies were on track to fully recover economically in 2021 or 2022 (see graph for U.S. GDP recovery[3]).

During the third quarter, the economic recovery continued but concerns about the Delta variant, high inflation and strained supply chains likely slowed growth from the euphoric pace earlier this year. Historically, this loss of momentum is expected as the economy shifts from recovery to mid-cycle. Over the past several quarters, economic growth grew at is fastest pace in decades. 2021 is on pace to end the year with a growth rate of 5.9%[4]. Record amounts of consumer savings, wealth creation and pent-up demand continued to be significant tailwinds to the economy. Supply chain disruptions and inflation remained headwinds in the near term. As the economy progresses within the mid-cycle, lower amounts of fiscal and monetary stimulus may slow economic growth to its long-term trend of roughly 2% by late 2022.

Limited childcare services, back-to-school Delta variant issues, and a wave of early retirements continued to restrain the labor market. Vaccine hesitancy and those with health worries also added to labor market woes. Another element hampering the job market was the wealth effect working in reverse. In introductory economic courses, we learned when people feel wealthy, they spend more. In this post-pandemic world, when people feel wealthy, they don’t work. The Fed reported household net worth reached a record of $141.7 trillion, thanks to a $3.5 trillion and a $1.2 trillion gain in equities and real estate, respectively. In addition, the U.S. Household savings rate reached 9.4%, and the consumer average FICO credit score was 711, an all-time high[5].

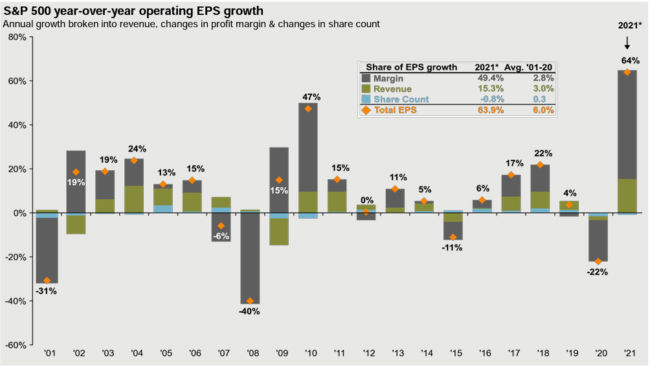

The strong economic fundamentals filtered into strong earnings results in just about every sector and region. Strong earnings have been an important driver of this year’s strong stock market performance and second quarter earnings season was very good. Companies beat analyst expectations on both earnings per share (EPS) and revenue growth by a wide margin. In fact, the S&P 500 in Q2 recorded the highest year-over-year earnings growth in over a decade[6]. Consumers were spending freely and willing to pay, which allowed companies to raise prices and push higher costs on to the end consumer. The ability for companies to successfully absorb higher input costs and pass them onto their customers will play an important role in future earnings results and thus the equity markets.

The data back to 2001 shows no historic precedent for sales and earnings growth to sustain at this level and we expect earnings to slow from here (see chart[7]). Higher inflation, corporate taxes and wage pressures may put further pressure on corporate earnings in the next year.

Market Analysis

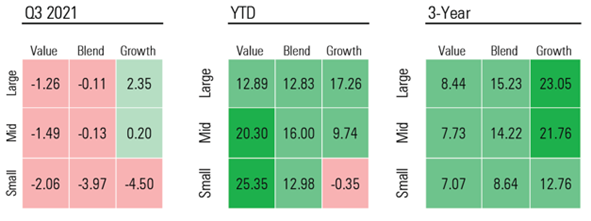

Throughout the course of the pandemic market sentiment has shifted back and forth between two very different types of trades. They include a “work-from-home” trade characterized by strength among large cap growth stocks (many of which are in the technology sector), lower interest rates and U.S. equity outperformance. At other times, we’ve seen a “reopening trade,” signified by strength from value stocks, higher interest rates and outperformance in small cap and non-U.S. equities. The reopening groups rallied in November 2020 into the first half of 2021 on the vaccine rollout, but performance patterns reverted during the third quarter as increased COVID-19 cases triggered a slowdown in economic reopening’s. Late in the quarter we saw some signs of potential rotation toward a reopening theme once again. Below are U.S. style box returns[8].

While moderating economic growth presented a headwind for stocks during the quarter, an overall supportive backdrop remained in place.

- Earnings were strong.

- Consumer income and balance sheets were in good shape.

- Interest rates remained exceptionally low.

- The market cycle is still only in year two.

Positive, but more muted return expectations are sensible at this stage of the market recovery.

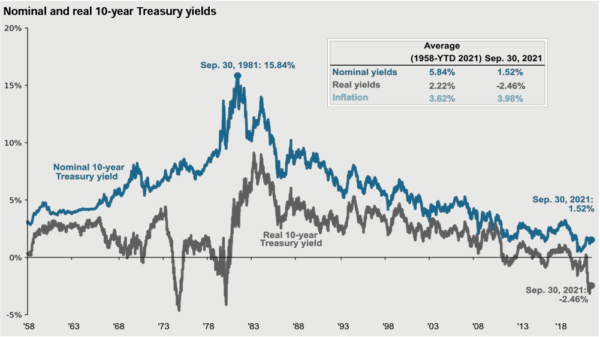

Despite consistent upside surprises on wages, home prices, and consumer prices, 10-year Treasury rates held steady around 1.5% nominal and -2.46% real (after inflation[9]). U.S. Treasury bonds have had negative real rates across all maturities since the 2020 recession. These low rates make stocks more attractive when compared to bonds.

In addition, technical signals remained positive and investor sentiment was not at an extreme. Much of the extreme investor sentiment we saw in early 2021 corrected during the summer months. U.S. valuations remained near their historic highs, particularly for growth stocks. Valuations were more attractive for U.S. value stocks and international markets. Both developed and emerging markets were selling at some of their cheapest levels relative to U.S. equities in the past 20 years.

Portfolio Changes – Themes

Portfolios continued to be overweight stocks and underweight bonds relative to investors’ investment objectives. We continue to expect above-trend growth and see further upside for equity earnings as economies around the globe reopen fully and pent-up demand materializes.

Given the uncertainty between short and longer-term inflation, our portfolios are positioned to account for a range of inflation outcomes. Housing and rent inflation, wage growth, rising commodity prices, and corporations with pricing power are all potentially durable drivers of inflation and is a risk to portfolios. Over the recent quarters, we have adjusted accounts for this risk.

In fixed income, we expect bond yields to move higher over time. For this reason, portfolios remained positioned with a shorter duration than average and we added a position in Treasury Inflation-Protected Securities (TIPS) in more moderate investment objectives. Both TIPS and shorter duration bonds may help against rising inflation. Despite low yields, bonds play a valuable role in portfolios by offsetting pro-risk positions taken in stocks.

In equities, we are overweight value-oriented stocks compared to growth-oriented stocks. Inflation and long-term interest rates could trend higher and provide a catalyst for value outperformance. During the quarter, we reduced exposure to emerging markets equity in favor of developed international equities across all investment objectives. The recent increase in regulatory actions from China gave us concern about the long-term earnings growth potential from Chinese companies, and China represents a large portion of the emerging markets universe.

Tax & Policy Update

While official legislation is still up in the air, it seems likely that we will see new tax laws passed before year-end. The backdrop of high fiscal spending and historically low tax rates is not sustainable. We expect tax rates to move higher for both high income earners and corporations. While tax changes may appear significant, market reactions tend to be one-off and short-lived. Ultimately, we think fundamentals matter more for markets. If tax policy changes, we will review the new laws to see if and how the changes affect your financial plan.

Please reach out to your advisor if you have any questions or concerns.

[1] Federal Reserve Bank of Atlanta

[2] Morningstar Direct, as of 9/30/2021

[3] JPMorgan Guide to the Markets, 9/30/2021

[4] Bloomberg Economic Forecasts. As measured by GDP

[5] James Research

[6] Blackrock

[7] JPMorgan Guide to the Markets, 9/30/2021

[8] Morningstar as of 9/30/2021

[9] JPMorgan Guide to the Markets, 9/30/2021

Company News

Market Commentary

Retirement Planning

Tax Planning

Cyber Security

Important Disclosures

Leonard Rickey Investment Advisors, PLLC (“LRIA”), is an SEC registered investment adviser located in the State of Washington. Registration does not imply a certain level of skill or training. For information pertaining to the registration status of LRIA, please contact LRIA or refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov).

This is provided for general information only and contains information that is not suitable for everyone. As such, nothing herein should be construed as the provision of specific investment advice or recommendations for any individual. To determine which investments may be appropriate for you, consult your financial advisor prior to investing. There is no guarantee that the views and opinions expressed herein will come to pass. This newsletter contains information derived from third party sources. Although we believe these third-party sources to be reliable, we make no representations as to the accuracy or completeness of any information prepared by any unaffiliated third party incorporated herein and take no responsibility therefore.

Any projections, forecasts and estimates, including without limitation any statement using “expect” or “believe” or any variation of either term or a similar term, contained here are forward-looking statements and are based upon certain current assumptions, beliefs and expectations that LRIA considers reasonable or that the applicable third parties have identified as such. Forward-looking statements are necessarily speculative in nature, and it can be expected that some or all of the assumptions or beliefs underlying the forward-looking statements will not materialize or will vary significantly from actual results or outcomes. Some important factors that could cause actual results or outcomes to differ materially from those in any forward-looking statements include, among others, changes in interest rates and general economic conditions in the U.S. and globally, changes in the liquidity available in the market, change and volatility in the value of the U.S. dollar, market volatility and distressed credit markets, and other market, financial or legal uncertainties. Consequently, the inclusion of forward-looking statements herein should not be regarded as a representation by LRIA or any other person or entity of the outcomes or results that will be achieved by following any recommendations contained herein. While the forward-looking statements here reflect estimates, expectations and beliefs, they are not guarantees of future performance or outcomes. LRIA has no obligation to update or otherwise revise any forward-looking statements, including any revisions to reflect changes in economic conditions or other circumstances arising after the date hereof or to reflect the occurrence of events (whether anticipated or unanticipated), even if the underlying assumptions do not come to fruition. Opinions expressed herein are subject to change without notice and do not necessarily take into account the particular investment objectives, financial situations, or particular needs of all investors.

For additional information about LRIA, including fees and services, please contact us for our Form ADV disclosure brochure using our contact information herein. Please read the disclosure brochure carefully before you invest or send money.

Celebrating Independence—Both National and Financial