Posts Tagged ‘investment commentary’

2024 2nd Quarter Investment Commentary

Stocks headed into the second half with impressive momentum. Historically, a strong first half tended toward above-average second-half returns. Market gains were heavily skewed towards the large-cap growth and technology companies. The S&P 500 became increasingly concentrated in, with just five companies accounting for 29% of the index. Economic growth moderated but remained resilient with…

Read More2024 1st Quarter Investment Commentary

The S&P 500 TR Index continued its strong momentum and reached new all-time highs. Momentum often creates momentum, which leaves us optimistic about stocks currently. However, a near-term pullback wouldn’t surprise us. The U.S. economy continued to grow due to a strong labor market, healthy consumer balance sheets, and robust services activity. Due to an…

Read More2023 3rd Quarter Investment Commentary

After a strong first half, stocks, as measured by the S&P 500 TR, pulled back during a historically weak third quarter. Economic data continued to be stronger than expected and even showed signs of accelerating. This, amongst other factors, caused long term bond yields to increase significantly during the quarter. We ended the quarter…

Read More2023 1st Quarter Investment Commentary

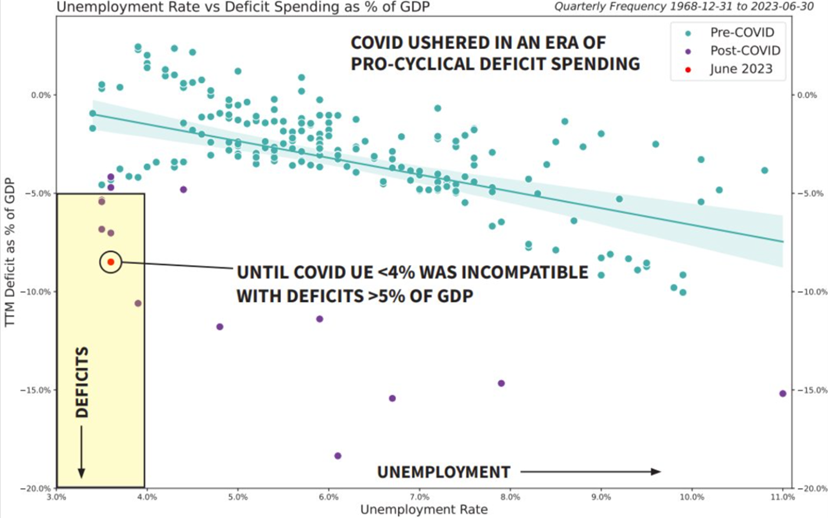

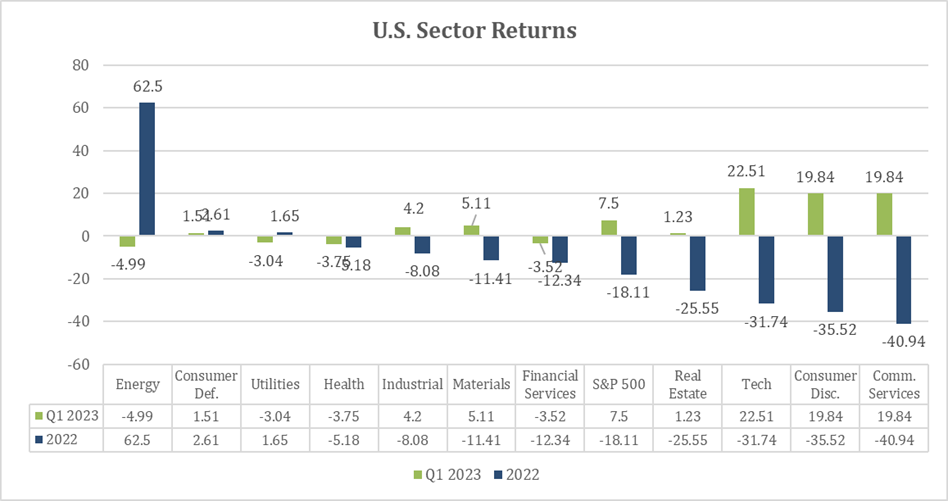

Stocks, as measured by the S&P 500, rose for the second quarter in a row but remain in a year-long trading range. The second largest bank failure in U.S. history quickly changed bond yields. Markets were priced for interest rate cuts by the end of 2023. The dramatic change in interest rate expectations caused a…

Read More2022 4th Quarter Investment Commentary

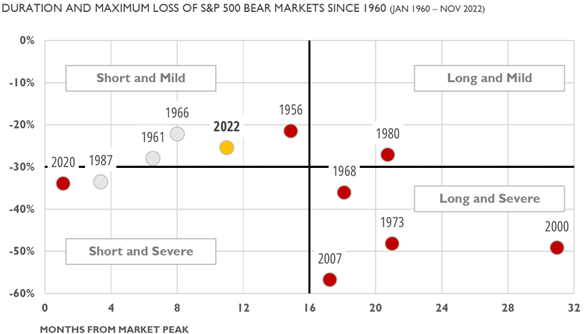

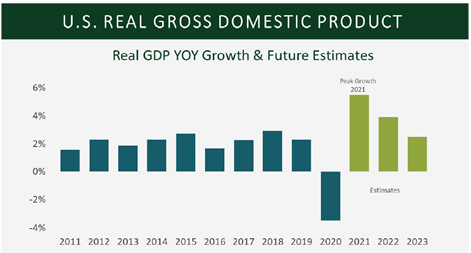

Despite a fourth quarter rally, both U.S. stocks and bonds declined for the year causing a 60/40 portfolio to have its third-worst return since 1926. We expected better days ahead. Markets may be down, but most of the damage was done in the first half of the year. Since the end of June, stocks…

Read More2021 4th Quarter Investment Commentary

• The S&P 500 Index gained 11% on the quarter and over 28% on the year, buoyed by strong corporate earnings growth. • The U.S. economic recovery remained on firmed footing despite inflation, COVID-19 and supply chain disruptions. Going forward, extreme fiscal and monetary support will likely be withdrawn in favor of the private…

Read More