Posts by Matt Hargreaves

Market Summary & Portfolio Changes

Market Summary Momentum from the second half of 2020 continued into 2021 as the new year mainly brought good news regarding returning to a more normal economic environment. An uptick in vaccine supply and distribution, an additional $1.9 trillion stimulus package, and continued monetary policy support improved the economic backdrop and boosted stock prices. Stocks…

Read MoreEconomic Analysis & A Note on Inflation

Economic Analysis As was the case in 2020, the pandemic’s course should dictate the course of the economic expansion in 2021. As vaccines continue to be administered, it seems likely that the economy will re-open and continue its recovery. This, along with massive stimulus, could propel the economy to growth not seen in decades. An…

Read MoreMarket Analysis

Market Analysis March marked the first anniversary of the bottom of the COVID bear market for the S&P 500 Index. Despite the turbulence of the past year, investors were rewarded by sticking with stocks. No one could have predicted this, but the S&P 500 completed its greatest one-year rally post-WWII, gaining over 74% from March…

Read More2021 1st Quarter Commentary

Economic growth prospects rose largely due to expanded vaccine distribution, strong manufacturing and housing data and supportive monetary and fiscal conditions. Despite bouts of volatility, stocks reached new all-time highs in many different markets. U.S. Treasury yields rose amid mounting inflation concerns, even as current inflation remained below 2%. Portfolios remained positioned for recovery and…

Read MoreInvestment Question of the Month: Should I invest my cash now or over time?

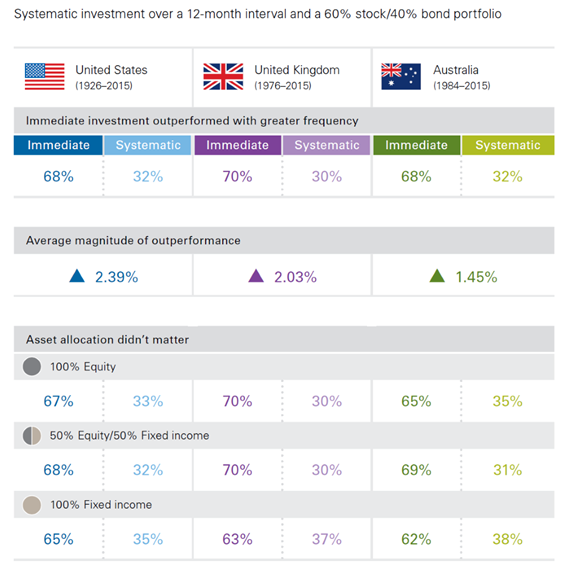

If you have cash sitting on the sidelines, you have options to get it invested. Here are three of the most common options to get it invested: Invest it right away (lump sum) Invest it over time (dollar-cost average) Invest when the market pulls back (time the market) Each option has pros and cons, but research suggests investing it right away has…

Read More2020 4th Quarter Commentary

Market Summary A strong fourth quarter capped a wild and turbulent year. 2020 marked the largest reversal in the S&P 500’s history, rebounding over 70% from the March lows and finishing the year up over 18%. During the fourth quarter, the major indexes reached all-time highs as investors welcomed greater political clarity and positive news…

Read MoreInvestment Question of the Month: IPO’s

INVESTMENT QUESTION OF THE MONTH: Should I invest in an Initial Public Offering (IPO)? Through November 16th of this year, we saw 223 companies[1] make the transition from private to public through way of IPOs, the most since 2014. And we could potentially see over $100 billion raised in IPOs by the end of 2020.…

Read MoreInvestment Question of the Month: Large Cap Tech Stock Dominance

Large technology stocks continue to dominate the market. Is this a new normal? The top 5 stocks in the S&P 500 – Apple, Amazon, Microsoft, Alphabet, and Facebook – have had an extraordinary run of returns. Year-to-date through August, the S&P 500 index returned 10% – with those five stocks returning 49% while the remaining…

Read MoreThanksgiving 2020’s Charts We Are Thankful For

We posted three scary charts on Halloween (See here) and wanted to post three charts we are thankful for on Thanksgiving. 1) Household Debt Service Ratio The household debt service ratio is the ratio of total required debt payments to total disposable income. Thanks to historically low interest rates, the ratio finished last quarter at…

Read MoreHappy Halloween: 2020’s Scary Charts

The financial world can be a scary place. It seems like there is always something to fear in the market. This is especially true in 2020 when investors have endured COVID-19, extreme stock market volatility, massive economic uncertainty and now a Presidential election. Fortunately, our worst fears usually don’t come to fruition. To get in…

Read More