Apr 13, 2021 Market Summary & Portfolio Changes

Market Summary

Momentum from the second half of 2020 continued into 2021 as the new year mainly brought good news regarding returning to a more normal economic environment. An uptick in vaccine supply and distribution, an additional $1.9 trillion stimulus package, and continued monetary policy support improved the economic backdrop and boosted stock prices.

Stocks encountered volatility but remained in an uptrend from the March 2020 lows. Participation was broad as many markets reached new all-time highs. Stock markets that reached new all-time highs during the quarter included: US large caps (S&P 500), US small caps (Russell 2000), emerging markets (MSCI EM), non-U.S. developed markets (MSCI EAFE), Dow Jones Industrials, and Dow Jones Transports to name a few.

The solid returns hid significant divergences within the indexes. In a reversal of last year’s pattern, investors rotated away from growth companies that did well in 2020 and into companies with earnings tied to the economy’s re-opening. Value-oriented, small-cap, and cyclical companies outperformed during the quarter while technology and defensive sectors lagged. The outperformance of value stocks did little to change their historically significant discounts to growth stocks. Portfolios remained positioned to benefit if value continues to outperform growth.

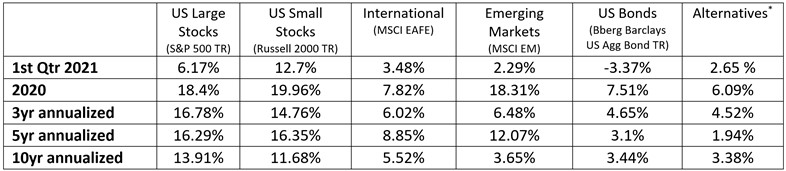

The improved economic growth expectations pushed up bond yields and increased inflation fears. The degree of the rate rise has been standard. Following the four previous recessions, the US 10-year Treasury rates rose an average of about 150 basis points within the expansion’s first four quarters. Four quarters after the onset of COVID, 10-year rates have moved up 107 basis points (1). Interest rates were only back to where they were before the pandemic, which had already been near historic lows. Below is a summary of market returns (2).

*Alternatives benchmark includes 60% SG Trend Index and 40% Swiss Re Global Cat Bond TR Index.

Portfolio Changes

Portfolios continued to be overweight stocks and underweight bonds relative to investors’ investment objectives.

Strong equity market performance pushed allocations to equities above strategic weightings during the quarter. As a result, we rebalanced portfolios away from equities and into bonds to correct this. At the same time, we increased stock positions in the market areas that may benefit from a surprise to the upside of continued economic recovery.

Specifically, we increased allocations to U.S. value stocks and non-U.S. stocks and decreased growth stock allocations. We believe they were trading at attractive historical valuations and may benefit from higher interest rates and a more normal economic environment. In some accounts, we also initiated a fund position that could potentially help if inflation continues to increase.

In fixed income, we expect bond yields to continue to move higher over time. For this reason, portfolios remained positioned with a shorter duration than average. We continue to believe bonds play an essential part in balanced portfolios. Although we don’t see an enormous return potential from bonds, their diversification can provide both spending and opportunity money when market corrections occur.

Please reach out to your advisor if you have any questions or concerns.

[1]Oakmark Commentary, as of 3/31/2021

[2]Morningstar Direct, as of 3/31/2021

INDEX DEFINITIONS

The Barclays Aggregate Bond Index represents securities that are SEC-registered, taxable, and dollar denominated. The index covers the US investment-grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities.

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. It cannot be invested into directly.

The Russell 2000 Index is an unmanaged index generally representative of the 2,000 smallest companies in the Russell Index, which represents approximately 10% of the total market capitalization of the Russell 3000 Index.

The MSCI Emerging Markets Index is a float-adjusted market capitalization index that consists of indices of approximately 800 stocks and is designed to measure equity market performance in 23 emerging economies: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Malaysia, Mexico, , Peru, Philippines, Poland, Qatar, Russia, South Africa, Taiwan, Thailand, Turkey, and the United Arab Emirates.

The MSCI EAFE (Europe, Australasia, Far East) Index is a free float-adjusted market capitalization index of approximately 900 stocks and is designed to measure equity market performance in 21 developed market countries outside of North America.

The SG Trend Index is a subset of the SG CTA Index, and follows traders of trend following methodologies. The SG CTA Index is equal weighted, calculates the daily rate of return for a pool of CTAs selected from the larger managers that are open to new investment.

Swiss Re Global Cat Bond Index tracks the aggregate performance of all catastrophe bonds issued offered under Rule 144A. The index captures bonds denominated in any currency, all rated and unrated cat bonds, outstanding perils, and triggers. The index is not exposed to currency risk from non-USD denominated cat bonds.

The Dow Jones Industrial Average® (The Dow®), is a price-weighted measure of 30 U.S. blue-chip companies. The index covers all industries except transportation and utilities.

The Dow Jones Transportation Average is a 20-stock, price-weighted index that represents the stock performance of large, well-known U.S. companies within the transportation industry.

Company News

Market Commentary

Retirement Planning

Tax Planning

Cyber Security

Important Disclosures

Leonard Rickey Investment Advisors, PLLC (“LRIA”), is an SEC registered investment adviser located in the State of Washington. Registration does not imply a certain level of skill or training. For information pertaining to the registration status of LRIA, please contact LRIA or refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov).

This is provided for general information only and contains information that is not suitable for everyone. As such, nothing herein should be construed as the provision of specific investment advice or recommendations for any individual. To determine which investments may be appropriate for you, consult your financial advisor prior to investing. There is no guarantee that the views and opinions expressed herein will come to pass. This newsletter contains information derived from third party sources. Although we believe these third-party sources to be reliable, we make no representations as to the accuracy or completeness of any information prepared by any unaffiliated third party incorporated herein and take no responsibility therefore.

Any projections, forecasts and estimates, including without limitation any statement using “expect” or “believe” or any variation of either term or a similar term, contained here are forward-looking statements and are based upon certain current assumptions, beliefs and expectations that LRIA considers reasonable or that the applicable third parties have identified as such. Forward-looking statements are necessarily speculative in nature, and it can be expected that some or all of the assumptions or beliefs underlying the forward-looking statements will not materialize or will vary significantly from actual results or outcomes. Some important factors that could cause actual results or outcomes to differ materially from those in any forward-looking statements include, among others, changes in interest rates and general economic conditions in the U.S. and globally, changes in the liquidity available in the market, change and volatility in the value of the U.S. dollar, market volatility and distressed credit markets, and other market, financial or legal uncertainties. Consequently, the inclusion of forward-looking statements herein should not be regarded as a representation by LRIA or any other person or entity of the outcomes or results that will be achieved by following any recommendations contained herein. While the forward-looking statements here reflect estimates, expectations and beliefs, they are not guarantees of future performance or outcomes. LRIA has no obligation to update or otherwise revise any forward-looking statements, including any revisions to reflect changes in economic conditions or other circumstances arising after the date hereof or to reflect the occurrence of events (whether anticipated or unanticipated), even if the underlying assumptions do not come to fruition. Opinions expressed herein are subject to change without notice and do not necessarily take into account the particular investment objectives, financial situations, or particular needs of all investors.

For additional information about LRIA, including fees and services, please contact us for our Form ADV disclosure brochure using our contact information herein. Please read the disclosure brochure carefully before you invest or send money.

2025 1st Quarter Investment Commentary