Mar 16, 2021 Investment Question of the Month: Should I invest my cash now or over time?

If you have cash sitting on the sidelines, you have options to get it invested. Here are three of the most common options to get it invested:

- Invest it right away (lump sum)

- Invest it over time (dollar-cost average)

- Invest when the market pulls back (time the market)

Each option has pros and cons, but research suggests investing it right away has been a prudent strategy. Investing it over time is also a sensible strategy and can help reduce the impact of the market dropping just after you invest. Investing when the market pulls back sounds nice but is very hard to do.

Timing the market is challenging. You may be waiting a long time for the market to pull back. You also run the risk that the market may never pull back to the level you could have initially invested. Further, if markets do pullback to that initial level, many investors find it difficult to buy due to the fear of further losses. What often ends up happening is that the cash stays uninvested for longer than intended, and you may end up with lower returns.

Investing right away has been the most profitable strategy in the past. Generally, the longer you wait to invest, the lower your returns will be. This makes sense because historical market returns of stocks and bonds are greater than returns on cash. By investing right away, you would have gained exposure to higher returning assets as soon as possible, resulting in higher returns on average. However, there were several periods right before a significant decline that this would not be the case.

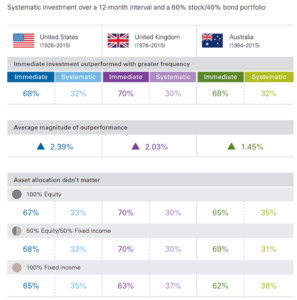

Research from Vanguard looked at different portfolios in the US, UK and Australia. Vanguard compared the one-year historical performances of an immediate lump sum investment against 12 equal monthly purchases. The lump-sum beat the dollar-cost averaging about two-thirds of the time. The average outperformance ranged from 1.45% in Australia to 2.39% in the US. This chart sums it up nicely. 1

While the data suggest investing your excess cash right away is the superior strategy on average, a dollar-cost averaging strategy may be best to combat the risk of an impending decline. Markets are volatile and large declines do occur. These declines can be psychologically challenging, particularly if the decline happens just after you invested a large amount of cash. An extreme decline can also permanently impair your financial plan.

Dollar-cost averaging can be appealing because it limits the loss in a worst-case scenario. If the market were to decline, not only do you lose less because you have cash waiting to be invested, but you are also able take advantage of the decline and buy at lower prices. The downside of this strategy, is that if markets go up while you are dollar cost averaging, you will be buying at higher prices compared to the lump sum strategy.

Overall, dollar-cost averaging can help you overcome the hurdle of mistiming your initial investment by stretching your buys out over multiple price points. It can give you peace of mind that you will not wholly mistime the market. And it gets your cash working in investments that have a higher expected return than cash. It is better to dollar-cost average than not start at all.

*Important Note: Dollar cost averaging does not increase your portfolio return. There can still be a risk of loss.

Disclosures: Vanguard methodology:

Our analysis uses monthly stock, bond, and cash returns in the United States, United Kingdom, and Australia to evaluate the historical performance of immediate and systematic implementation plans. For immediate implementation, we assume that local currency (USD, GBP, or AUD) is immediately invested into a stock/bond portfolio. For systematic implementation, we assume that the same sum starts in a portfolio of cash investments and is transferred in equal monthly increments into a portfolio over 12 months. Each portfolio consists of a 60% allocation to the local equity market and a 40% allocation to the local bond market using the indexes outlined below. We used total return for our calculations. Both portfolios are rebalanced monthly to the target allocation, and transaction costs are not factored into the analysis.

Once the systematic implementation period is complete, both portfolios have identical asset allocations. We then compare the ending portfolio values from each strategy to determine the relative percentage of outperformance and average magnitude of outperformance during rolling 12-month periods from 1926 to 2015 in the United States, 1976 to 2015 in the United Kingdom, and 1984 to 2015 in Australia.

Company News

Market Commentary

Retirement Planning

Tax Planning

Cyber Security

Important Disclosures

Leonard Rickey Investment Advisors, PLLC (“LRIA”), is an SEC registered investment adviser located in the State of Washington. Registration does not imply a certain level of skill or training. For information pertaining to the registration status of LRIA, please contact LRIA or refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov).

This is provided for general information only and contains information that is not suitable for everyone. As such, nothing herein should be construed as the provision of specific investment advice or recommendations for any individual. To determine which investments may be appropriate for you, consult your financial advisor prior to investing. There is no guarantee that the views and opinions expressed herein will come to pass. This newsletter contains information derived from third party sources. Although we believe these third-party sources to be reliable, we make no representations as to the accuracy or completeness of any information prepared by any unaffiliated third party incorporated herein and take no responsibility therefore.

Any projections, forecasts and estimates, including without limitation any statement using “expect” or “believe” or any variation of either term or a similar term, contained here are forward-looking statements and are based upon certain current assumptions, beliefs and expectations that LRIA considers reasonable or that the applicable third parties have identified as such. Forward-looking statements are necessarily speculative in nature, and it can be expected that some or all of the assumptions or beliefs underlying the forward-looking statements will not materialize or will vary significantly from actual results or outcomes. Some important factors that could cause actual results or outcomes to differ materially from those in any forward-looking statements include, among others, changes in interest rates and general economic conditions in the U.S. and globally, changes in the liquidity available in the market, change and volatility in the value of the U.S. dollar, market volatility and distressed credit markets, and other market, financial or legal uncertainties. Consequently, the inclusion of forward-looking statements herein should not be regarded as a representation by LRIA or any other person or entity of the outcomes or results that will be achieved by following any recommendations contained herein. While the forward-looking statements here reflect estimates, expectations and beliefs, they are not guarantees of future performance or outcomes. LRIA has no obligation to update or otherwise revise any forward-looking statements, including any revisions to reflect changes in economic conditions or other circumstances arising after the date hereof or to reflect the occurrence of events (whether anticipated or unanticipated), even if the underlying assumptions do not come to fruition. Opinions expressed herein are subject to change without notice and do not necessarily take into account the particular investment objectives, financial situations, or particular needs of all investors.

For additional information about LRIA, including fees and services, please contact us for our Form ADV disclosure brochure using our contact information herein. Please read the disclosure brochure carefully before you invest or send money.

Celebrating Independence—Both National and Financial