Oct 13, 2015 What’s the Difference? Time Weighted Return versus Internal Rate of Return

A common question we hear from our clients is “what is my rate of return?” The true answer is: there is more than one way to look at returns. Understanding the differences can help you make better informed financial decisions.

The two most acceptable methods to calculate returns are Time-Weight Return (TWR) and Internal Rate of Return (IRR). Here are the key differences:

Internal Rate of Return (also called Dollar Weighted Return)

IRR is the measurement of your portfolio’s actual performance between two dates, including all cash inflow and outflows. Because of this, the IRR of a portfolio can be significantly affected by both the timing and size of any contribution or distribution. Luck in the timing of your inflows or outflows can drastically swing numbers one way or the other.

Using this method can be appropriate to determine how your portfolio has performed relative to your financial goals. However, it’s not an effective measurement tool for analyzing the long term performance of your portfolio’s underlying assets or comparing your investment manager to another manager or index. This is where TWR becomes useful.

Time-Weight Return (TWR):

This method compounds the daily returns of your account from the time it was initially funded until the present. The big difference it that TWR does NOT consider when you deposit or withdraw cash from the account. Simply stated, the TWR is the return on the very first dollar invested in the portfolio. Because of this, TWR represents a more accurate reflection of manager performance.

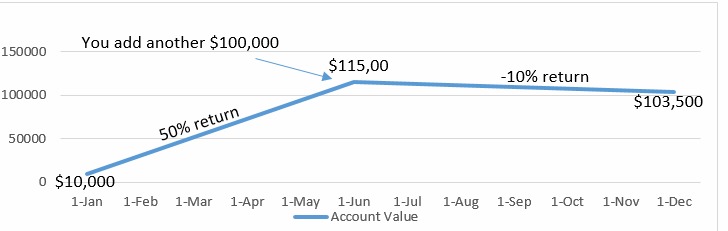

To really hammer home the difference, let’s look at an example. Say you invest $10,000 in an account on January 1st of this year. Your account increases in value 50% from January to June. You’re so pleased with performance that you put another $100,000 dollars into your account in June. Your account goes down 10% between June and the end of the year.

Since your account went up 50% for the first half of the year and then down only 10% the second half, your time weighted return is 35%. In contrast, your internal rate of return is a 5% loss. Why the difference? Most of your money was not invested until the middle of the year and missed the 50% rise. That money then declined and you ended up with less money than your total investment. Clearly, the timing of that $100,000 contribution was significant.

When looking at the performance of your accounts, it’s important to note how your returns are being calculated so you can understand what they are really telling you.

The opinions expressed in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investments may be appropriate for you, consult your financial advisor prior to investing. This information is not intended to be a substitute for specific individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax advisor. Investment Advice offered through Leonard Rickey Investment Advisors, PLLC (LRIA), a Registered Investment Advisor. To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LRIA is not an affiliate of and makes no representation with respect to such entity. Past performance is no guarantee of future results. Copyright © 2015* Leonard Rickey Investment Advisors – All rights reserved.

Company News

Market Commentary

Retirement Planning

Tax Planning

Cyber Security

Important Disclosures

Leonard Rickey Investment Advisors, PLLC (“LRIA”), is an SEC registered investment adviser located in the State of Washington. Registration does not imply a certain level of skill or training. For information pertaining to the registration status of LRIA, please contact LRIA or refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov).

This is provided for general information only and contains information that is not suitable for everyone. As such, nothing herein should be construed as the provision of specific investment advice or recommendations for any individual. To determine which investments may be appropriate for you, consult your financial advisor prior to investing. There is no guarantee that the views and opinions expressed herein will come to pass. This newsletter contains information derived from third party sources. Although we believe these third-party sources to be reliable, we make no representations as to the accuracy or completeness of any information prepared by any unaffiliated third party incorporated herein and take no responsibility therefore.

Any projections, forecasts and estimates, including without limitation any statement using “expect” or “believe” or any variation of either term or a similar term, contained here are forward-looking statements and are based upon certain current assumptions, beliefs and expectations that LRIA considers reasonable or that the applicable third parties have identified as such. Forward-looking statements are necessarily speculative in nature, and it can be expected that some or all of the assumptions or beliefs underlying the forward-looking statements will not materialize or will vary significantly from actual results or outcomes. Some important factors that could cause actual results or outcomes to differ materially from those in any forward-looking statements include, among others, changes in interest rates and general economic conditions in the U.S. and globally, changes in the liquidity available in the market, change and volatility in the value of the U.S. dollar, market volatility and distressed credit markets, and other market, financial or legal uncertainties. Consequently, the inclusion of forward-looking statements herein should not be regarded as a representation by LRIA or any other person or entity of the outcomes or results that will be achieved by following any recommendations contained herein. While the forward-looking statements here reflect estimates, expectations and beliefs, they are not guarantees of future performance or outcomes. LRIA has no obligation to update or otherwise revise any forward-looking statements, including any revisions to reflect changes in economic conditions or other circumstances arising after the date hereof or to reflect the occurrence of events (whether anticipated or unanticipated), even if the underlying assumptions do not come to fruition. Opinions expressed herein are subject to change without notice and do not necessarily take into account the particular investment objectives, financial situations, or particular needs of all investors.

For additional information about LRIA, including fees and services, please contact us for our Form ADV disclosure brochure using our contact information herein. Please read the disclosure brochure carefully before you invest or send money.

2024 1st Quarter Investment Commentary