Posts by Chelsie Smith

Reframing Your Resolution Mindset

Cleaning up personal finances remains one of the top resolutions every New Year. But we all know what happens to such self-promises … life gets busy, our motivation fades, and before you know it, the year is half over, and your goal is no closer than when you started. If you’ve found yourself in a…

Read MoreUnclaimed Property and Retirement Benefits

Unclaimed Property According to the National Association of Unclaimed Property Administrators, 1 in 10 has unclaimed property, and over $3 billion is returned each year. Unclaimed property can include uncashed paychecks, checking and savings accounts, stock, safety deposit box contents, insurance payments, etc. To search for your unclaimed property, follow these steps: Access the website:…

Read MoreReminders as you Prepare your 2021 Taxes

As you or your tax preparer start to work on your 2021 taxes, there are a few things we wanted to remind you. 1099s – TD Ameritrade is releasing 1099s in waves. The most recent wave of 1099s was released on February 11th and the final wave will be released on February 17th. There may…

Read MoreWashington State Long Term Care Tax on Pause

The Washington State Long Term Care Tax of 0.58% that was poised to start on January 1, 2022 has been paused until July 2023. Governor Inslee signed two bills relating to the tax, also referred to as the WA Cares Tax. Many questions and criticisms lead to the pause. Additional bills were introduced as well.…

Read More2021 1099 Release Information

TD Ameritrade 1099 Release Information TD Ameritrade is releasing 1099s in waves: The first wave will be released on January 21, 2022 The second wave will be released on February 4, 2022 The third wave will be released on February 11, 2022 The fourth wave will be released on February 17, 2022 You can find…

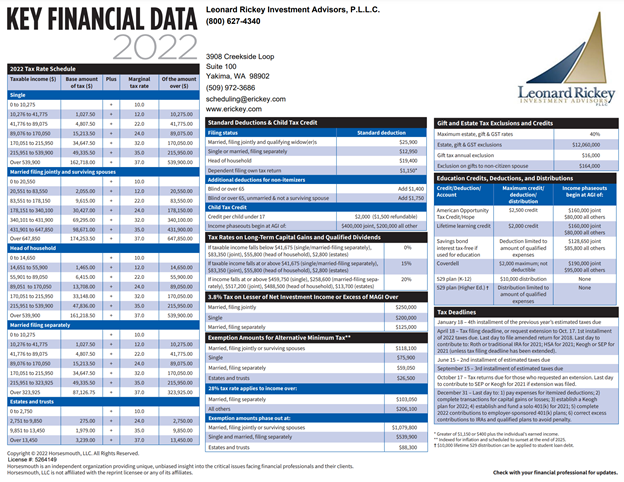

Read More2022 Key Financial Data

Follow this link to download the most recent copy of 2022 Key Financial Data. If you have any questions about the new rules or limits, feel free to schedule with an advisor.

Read More2021 Year-End Tax Planning

The window for many tax-saving opportunities closes on December 31st. It’s important to evaluate your tax situation, while there’s still time to affect your bottom line for the 2021 tax year. Your specific circumstances should be considered, so please reach out if you have any questions about 2021 Year-End Tax Planning. Charitable Contributions There are…

Read MoreWhat We are Thankful For

In the spirit of Thanksgiving, Leonard Rickey Investment Advisors wants to take a few moments to share how thankful we are for our great clients, our awesome team, and our loving families! Each member of the team has shared something they are thankful for as well below: Ben: I’m thankful for the opportunities I’ve had…

Read More2021 Turkey Trot

Thursday, November 25, 2021 – Thanksgiving Day! Join us for the 2021 Turkey Trot 5K Fun Run on Thanksgiving morning! Work up an appetite before the feast! Leonard Rickey Investment Advisors sponsors this event, and we invite you to help raise money to support Camp Prime Time and the Yakima Greenway. Prizes will be given for…

Read MoreWhat is my Tax Bracket?

We often hear the question, “what is my tax bracket?” Generally, a tax bracket is the income tax rate at which a taxpayer is taxed for a certain range of income. The income ranges vary, depending on filing status. We will look at the difference between marginal tax rate and effective tax rate. Marginal Tax…

Read More