Jul 16, 2021 What is my Tax Bracket?

We often hear the question, “what is my tax bracket?” Generally, a tax bracket is the income tax rate at which a taxpayer is taxed for a certain range of income. The income ranges vary, depending on filing status. We will look at the difference between marginal tax rate and effective tax rate.

Marginal Tax Rate

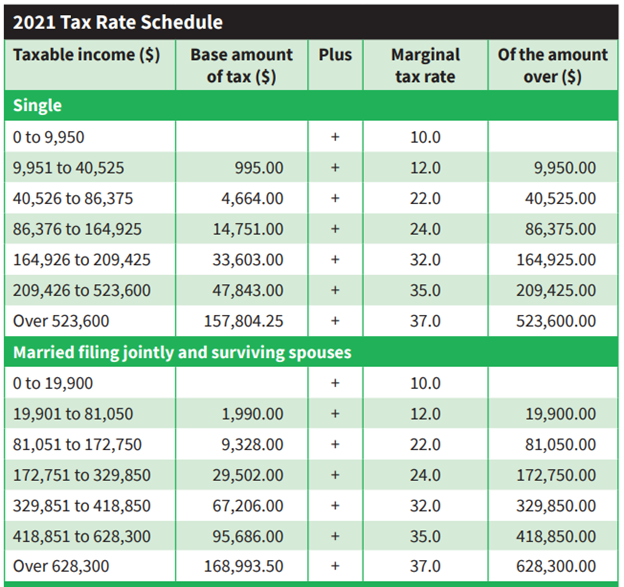

Tax brackets are named for their marginal tax rates, which refers to the rate at which a range of income will be taxed. There are seven marginal tax rates in 2021: 10%, 12%, 22%, 24%, 32%, 35%, and 37%.

The marginal tax rate is the rate at which the last dollar earned is taxed, not the amount that all dollars earned are taxed. Let’s calculate the marginal tax rate for a single individual earning $80,000 of W-2 income and taxable income of $67,450 after the standard deduction of $12,550. Taxes are calculated on the taxable income number of $67,450 which falls within the $40,526 to $86,375 Single tax bracket range as shown below. The last dollar earned was taxed at a 22% marginal tax rate so they are within the 22% marginal tax bracket. They would stay within this bracket until the individual’s taxable income increased to $86,376, at which they would move into the 24% marginal tax bracket. This is not the effective, or average, tax rate though. We will look at that next.

Year 2021 federal income tax rates for single and married taxpayers are as follows:

Click here to see the full tax rate schedule.

Effective Tax Rate

The effective tax rate is the average rate of tax paid on taxable income and not just the rate paid on the last dollar earned. We can look at the same example above to calculate the effective tax rate. By looking at the single tax schedule above and having an $80,000 W2, it may look like the income would be taxed at 22%, however, it is not quite that simple. First, deductions from income need to be subtracted from the income. For 2021, a single person under age 65 has a standard deduction against income of $12,550. Assuming no other deductions, the taxable income would be $67,450. To calculate total taxes owed to a Single taxpayer with taxable income of $67,450, tax needs to be calculated in each bracket.

The taxable income up to $9,950 will be taxed at 10% ($9,950 x 10%) which equals $995 of tax.

The taxable income over $9,950 and up to $40,525 ($40,525-$9,950=$30,575) will be taxed at 12% ($30,575 x 5%) which equals an additional $3,300 of tax.

The taxable income over $40,525 up to $67,450 ($67,450-$40,525=$26,925) will be taxes at 22% ($26,925 x 22%) with equals $5,923 additional tax.

All tax owed in each bracket is then added together; the $995 in the 10% bracket plus the $3,300 in the 12% bracket plus the $5,923 in the 22% bracket. This adds up to a total tax bill of $10,218.

The effective rate is the total tax of $10,218 divided by the taxable income of $67,450 to get a 15% effective tax rate. Much lower than the 22% marginal tax rate.

Other Income

Something to consider is that not all income is taxed at the above tax brackets. The most common difference can be found with long term capital gains and qualified dividends that are generally taxed at preferential tax rates. If you would like to better understand your marginal tax rate and your effective tax rate, you can talk with your CPA or ask your advisor.

Company News

Market Commentary

Retirement Planning

Tax Planning

Cyber Security

Important Disclosures

Leonard Rickey Investment Advisors, PLLC (“LRIA”), is an SEC registered investment adviser located in the State of Washington. Registration does not imply a certain level of skill or training. For information pertaining to the registration status of LRIA, please contact LRIA or refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov).

This is provided for general information only and contains information that is not suitable for everyone. As such, nothing herein should be construed as the provision of specific investment advice or recommendations for any individual. To determine which investments may be appropriate for you, consult your financial advisor prior to investing. There is no guarantee that the views and opinions expressed herein will come to pass. This newsletter contains information derived from third party sources. Although we believe these third-party sources to be reliable, we make no representations as to the accuracy or completeness of any information prepared by any unaffiliated third party incorporated herein and take no responsibility therefore.

Any projections, forecasts and estimates, including without limitation any statement using “expect” or “believe” or any variation of either term or a similar term, contained here are forward-looking statements and are based upon certain current assumptions, beliefs and expectations that LRIA considers reasonable or that the applicable third parties have identified as such. Forward-looking statements are necessarily speculative in nature, and it can be expected that some or all of the assumptions or beliefs underlying the forward-looking statements will not materialize or will vary significantly from actual results or outcomes. Some important factors that could cause actual results or outcomes to differ materially from those in any forward-looking statements include, among others, changes in interest rates and general economic conditions in the U.S. and globally, changes in the liquidity available in the market, change and volatility in the value of the U.S. dollar, market volatility and distressed credit markets, and other market, financial or legal uncertainties. Consequently, the inclusion of forward-looking statements herein should not be regarded as a representation by LRIA or any other person or entity of the outcomes or results that will be achieved by following any recommendations contained herein. While the forward-looking statements here reflect estimates, expectations and beliefs, they are not guarantees of future performance or outcomes. LRIA has no obligation to update or otherwise revise any forward-looking statements, including any revisions to reflect changes in economic conditions or other circumstances arising after the date hereof or to reflect the occurrence of events (whether anticipated or unanticipated), even if the underlying assumptions do not come to fruition. Opinions expressed herein are subject to change without notice and do not necessarily take into account the particular investment objectives, financial situations, or particular needs of all investors.

For additional information about LRIA, including fees and services, please contact us for our Form ADV disclosure brochure using our contact information herein. Please read the disclosure brochure carefully before you invest or send money.

2025 1st Quarter Investment Commentary