Blog Investment Management

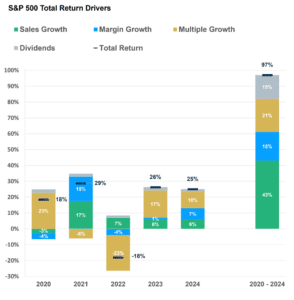

A post-election rally helped the S&P 500 gain 2.4% in the quarter and over 25% on the year. US growth companies continued to lead stocks while other sectors trailed. The US economy remained healthy on the backs of a strong consumer and profitable corporate sector, but there were signs of a downshift to a lower…

Read MoreThe S&P 500 gained 5.9% in the quarter and reached new all-time highs. Non-US markets saw a strong recovery, particularly in China. The Federal Reserve cut interest rates by 50 basis points in September to support economic growth, which boosted bond prices and led markets to anticipate further easing. The environment for equities remains favorable…

Read MoreInvestors in the S&P 500 Index who think they are getting exposure to a diversified basket of 500 companies are not. Money deployed into the S&P 500 is increasingly a wager on the health of just a few companies – with the fundamental of the other 490 carrying less weight. The outperformance of the largest…

Read MoreStocks headed into the second half with impressive momentum. Historically, a strong first half tended toward above-average second-half returns. Market gains were heavily skewed towards the large-cap growth and technology companies. The S&P 500 became increasingly concentrated in, with just five companies accounting for 29% of the index. Economic growth moderated but remained resilient with…

Read MoreThe S&P 500 TR Index continued its strong momentum and reached new all-time highs. Momentum often creates momentum, which leaves us optimistic about stocks currently. However, a near-term pullback wouldn’t surprise us. The U.S. economy continued to grow due to a strong labor market, healthy consumer balance sheets, and robust services activity. Due to an…

Read More Stocks ended the year on a nine-week winning streak, as the S&P 500 TR Index erased all the losses in 2022 reaching new all-time highs during the quarter. The year-end rally in stocks was one of the strongest ever and was based on the expectations of a Fed policy rate change and expectations of…

Read More After a strong first half, stocks, as measured by the S&P 500 TR, pulled back during a historically weak third quarter. Economic data continued to be stronger than expected and even showed signs of accelerating. This, amongst other factors, caused long term bond yields to increase significantly during the quarter. We ended the quarter…

Read MoreLast year we wrote a blog on Series I Savings bonds, also known as I-Bonds. At the time, they offered an appealing interest rate of 9.62% due to the high inflation rate. We wrote, “If you have extra cash on the sidelines over your rainy-day fund, consider purchasing I-Bonds to help your money keep up…

Read MoreThe U.S. debt limit – commonly called the debt ceiling – is the total amount of money that the U.S. government is authorized to borrow. When the debt limit is reached, the government can no longer borrow money to cover its obligations. Congress has raised or suspended the debt ceiling over one hundred times since…

Read More

Market Update: March 2025

As of March 13, the S&P 500 declined 10.1% from its all-time closing high in mid-February. Many investors have started to worry about the prospect of further declines. As of now, the decline appears to be fairly typical. Corrections are generally sharp and fast and serve to refresh fear. The current 10% decline in the…

Read More