Posts by Chelsie Smith

Employee Spotlight: Susan Van Tress

This month we are highlighting Susan Van Tress, our Chief Operations Officer. Susan has been with Leonard Rickey Investment Advisors for 23 years and works out of our Richland office. Get to know more about Susan below! If you could pick any superpower, what would it be and why? I would have the power to…

Read MoreEmployee Spotlight: Molly Hoff

If you haven’t had a chance to get to know Molly in our Yakima Office, here is your chance to learn some fun facts about her. She has been with Leonard Rickey Investment Advisors since 2005! Thank you for all you do! Q: What do you love most about your job? A: The people…

Read MoreWhen do I start my Required Minimum Distribution?

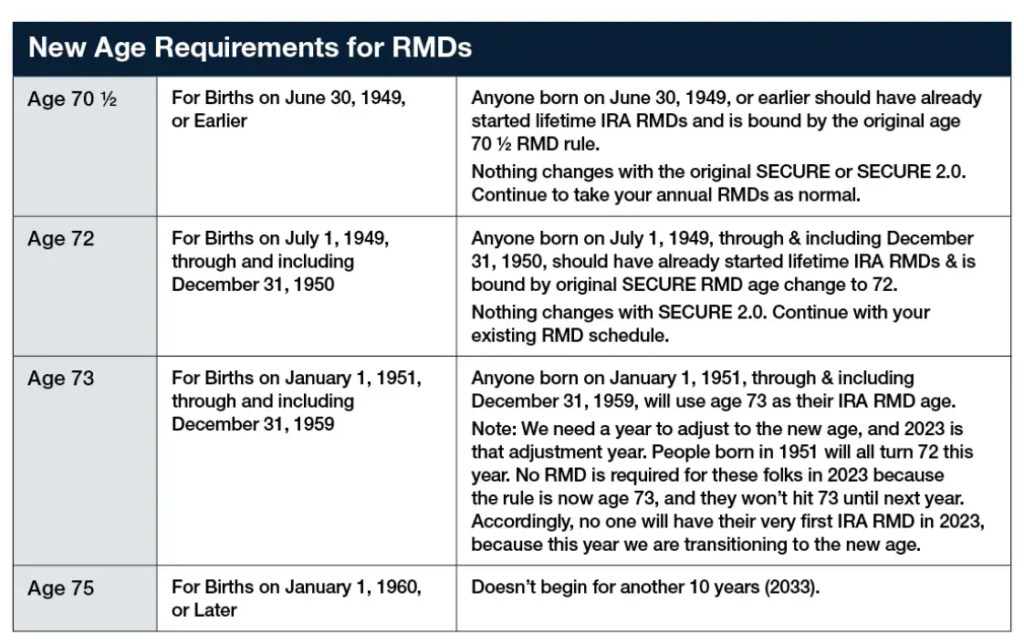

The Required Minimum Distribution (RMD) from an IRA or Employer-Sponsored retirement account began at age 70.5 for many years. It was then increased to age 72, then to age 73, and for some to age 75. So, the question remains for some; at what age will I start my Required Minimum Distribution? Below is a…

Read MoreUPDATE: Washington State Long Term Care Payroll Tax

A new payroll tax set to begin in 2022 to help fund Long Term Care for Washington residents was delayed 18 months. The WA Cares Fund is intended to provide some Long-Term Care benefits to residents and is funded by a .58% payroll tax. It is now set to begin in July 2023. Exemptions Workers…

Read MoreIntroducing our Kirkland Office!

We are excited to announce that we have joined the Kirkland, WA community! Our new office is located at 826 6th St. S, Suite 100, Kirkland, WA 98033 (by Google). Our Seattle office at Boeing field is closed. An advisor will be in our Kirkland office every week to meet with clients. We are also accepting…

Read MoreCharles Schwab and TD Ameritrade Update

As you may already know, Charles Schwab purchased TD Ameritrade in 2019. If your accounts are with TD Ameritrade, they will transition to Charles Schwab over Labor Day Weekend 2023. On or about Tuesday September 5, 2023, Charles Schwab will become the custodian of your accounts. Leonard Rickey Investment Advisors’ role will stay the same.…

Read MoreWelcome, Glenn!

All of us at Leonard Rickey Investment Advisors want to welcome and introduce our newest team member, Glenn McKee! Glenn started working at Leonard Rickey Investment Advisors in April. You will find him at our Yakima office working alongside Matt in investment analysis and trading. Glenn recently graduated from Central Washington University with a…

Read MoreForm 5498

If you made a contribution to an individual retirement account (IRA) in 2022, you will receive a Form 5498 in May 2023. By this time, you have likely already filed your taxes and reported any IRA contributions. You should keep the Form 5498 with your tax records. It is a copy of the form from…

Read MoreYakima Shreds & Meds Day – April 22nd

Mark your calendars! The next Shreds & Meds event will be held on Saturday, April 22, 2023 at the Valley Mall next to the old Bank of America Building from 9 a.m. – 1 p.m. You can safely dispose of your unused or unwanted medications and safely destroy your unwanted personal documents. Maximum two banker boxes or three grocery bags…

Read MoreWelcome, Vicky Aguilar!

All of us at Leonard Rickey Investment Advisors want to welcome and introduce our newest member of the team, Vicky! Vicky started working at Leonard Rickey Investment Advisors in February 2023. You will find Vicky at our Richland office! We asked Vicky to tell us a little bit about herself below: What is the…

Read More