Mar 19, 2025 Market Update: March 2025

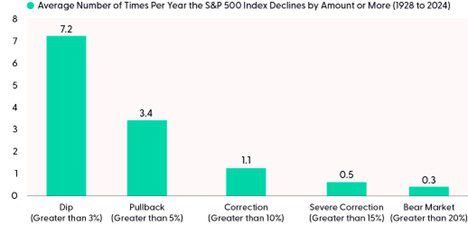

As of March 13, the S&P 500 declined 10.1% from its all-time closing high in mid-February. Many investors have started to worry about the prospect of further declines.

As of now, the decline appears to be fairly typical. Corrections are generally sharp and fast and serve to refresh fear. The current 10% decline in the S&P 500 has occurred over just 16 trading days, and sentiment data show extreme fear right now. Such rapid selloffs have led to a relief rally in the past. Current conditions point to an extremely oversold market so we wouldn’t be surprised to get a rally.

We expected the economy to slow and markets to experience more policy-driven volatility coming into 2025, and we reduced equity positions earlier in the year. What we did not anticipate was the extent to which recent policy decisions have emphasized tariffs, particularly regarding trade with neighboring countries. Current trade policies, along with changes in taxation, deregulation, fiscal spending, and monitory policy have contributed to market uncertainty and are influencing investor and business sentiment.

Signals and shifting policy stances heighten the uncertainty and leave investors struggling to gauge the long-term impact on global trade and economic stability. This uncertainty complicates corporate planning, supply chain decisions, and overall market sentiment, making it increasingly difficult to assess risk and strategize for the future. Altogether, the potential changes open a wide range of economic outcomes.

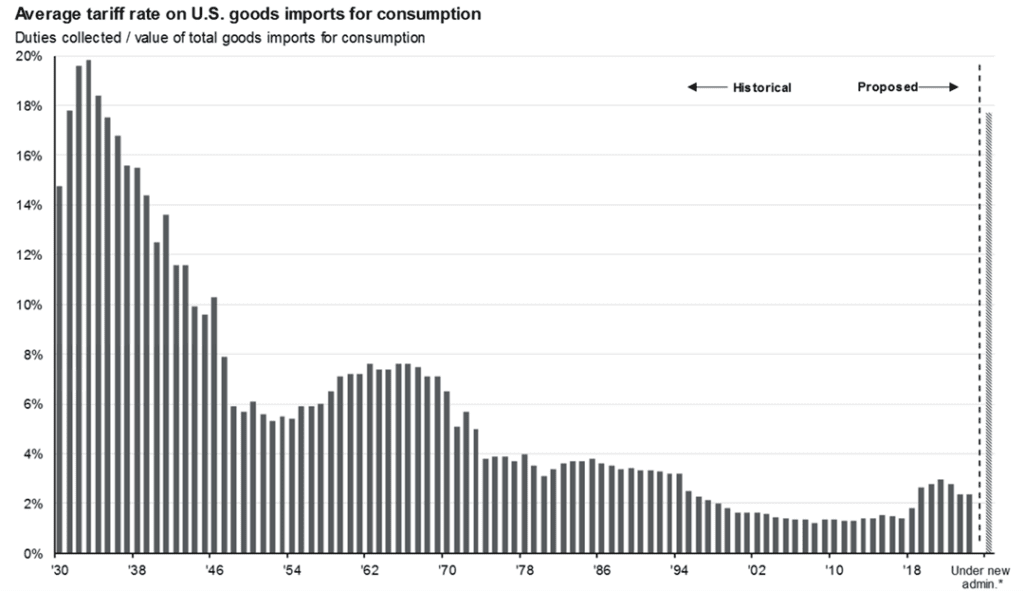

Tariffs & Potential Trade War

A main source of uncertainty is tariffs and the possibility of a global trade war. The future is always uncertain, but the path ahead is especially cloudy given the lack of clarity on the long-term strategy surrounding tariffs and their impacts.

Recent decades witnessed ever increasing globalization. For corporations, it has been a period with generally falling trade barriers and expanding global trade. Corporations were allowed to outsource labor and materials costs to less expensive regions of the world. These pro-growth trends spurred strong earnings growth and led to record-high corporate profit margins.

We could be entering into a period of decreasing globalization. One concern would be a potentially negative effect on corporate earnings. The reason for this is rather simple. Tariffs are paid by the importing company at the border to the government. So increased tariffs on China or Mexico would lead to higher prices paid by US companies at the border. Since companies must pay more to import, tariffs can protect domestic producers from foreign competition, raise revenues, and rebalance trade, amongst other things. To maintain profit margins, the importing corporations can pass the tariff fee on to the consumer to maintain their current profit margins or eat some of the tariff fee and lower profit margins.

An additional concern is that sharply raising tariffs lifts the odds of retaliation, which in turn threatens a global trade war (1). Retaliatory tariffs could affect exporters by increasing costs for foreign buyers. In the short term, the implications could be higher prices leading to lower demand. In the long term, the goal would be to reset competitiveness and bring home middle-class jobs.

Our base case is that the United States can weather changes to trade policies, though higher tariffs would likely dampen economic activity and raise import prices. The U.S. has the advantages of size, economic resilience and consumers with money to spend. Businesses have also ramped up investments in the U.S., both domestically and abroad from companies eager to maintain access to the world’s largest economy.

However, the ambiguity caused by shifting trade policies is already affecting business and consumer confidence, with potential negative consequences for the U.S. economy and markets.

For now, the numbers suggest that the US economy is still relatively resilient, but shifts could occur quickly – both to the upside and downside. There has been some slowing in the labor markets but worries about a recession are based primarily on projections rather than compelling data.

Market Implications

From an investment strategy perspective, the main issue is deciding if there’s a short-term disruption that soon gives way to a period when markets learn to adapt to a new world order. Or do higher tariffs lead to a trade war and usher in an era of higher risks and diminished returns? Our base case is that this is a reshuffling of trade policies, not an all-out trade war, but risks have certainly increased.

If 2024 was sunny skies, 2025 has brought in lots of fog. We aren’t overreacting to the clouds just yet, but we do have our umbrellas packed in case the clouds turn into thunderstorms. So far, the long-term primary trend continues to be positive. Even with this market decline, we are at levels where the S&P 500 reached an all-time high five months ago.

US stocks are bearing the brunt of the sell-off. The “Magnificent 7” group of mega-cap growth stocks has fallen almost 20% from its all-time high in December (2). Small-cap stocks, as measured by the Russell 2000, have also pulled back almost 20% from their all-time high set in November.

Portfolios that are globally diversified across asset classes are showing a degree of resilience. Non-US stocks, as measured by MSCI EAFE, were up over 8% through March 13. In addition, bonds, as measured by Bloomberg Aggregate Bond, and more defensive US equities have also provided benefits (3).

While corporate profits have remained strong recently, they are subject to change based on evolving market conditions. They grew 19% in the fourth quarter. A positive corporate earnings backdrop is important for two reasons: 1) Typically, employment remains strong as long as profits are on the upswing and 2) market corrections have tended to be contained if earnings were growing. This could change, perhaps quickly, but the current earnings backdrop still looks solid.

Corrections and volatility have always been the price that investors must pay to capture long-term market returns. While market declines are uncomfortable, historically, they have proven to be good investment opportunities. Not all downturns recover quickly. Past performance does not guarantee future results.

The S&P 500 historically has experienced three 5% declines per year, one 10% decline every year, one 15% decline every 2 years, and a 20% decline or more every 3 years (3).

There’s no bulletproof portfolio that will protect against all risks. A better aim may be to ensure that your portfolio continues to be well-suited to your goals, needs, risk tolerance, and time horizon. Since the market doesn’t go up in a straight line, it’s important for investors to remain disciplined and follow their plan even when challenging market environments arise.

Footnotes:

1 – See graph. Data from JPM Guide to the Markets as of 2/28/25

2 – Alphabet, Amazon, Apple Meta, Microsoft, NVIDIA and Tesla

3 – LPL Research, Index performance does not reflect fees or expenses and cannot be directly invested in.

Company News

Market Commentary

Retirement Planning

Tax Planning

Cyber Security

Important Disclosures

Leonard Rickey Investment Advisors, PLLC (“LRIA”), is an SEC registered investment adviser located in the State of Washington. Registration does not imply a certain level of skill or training. For information pertaining to the registration status of LRIA, please contact LRIA or refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov).

This is provided for general information only and contains information that is not suitable for everyone. As such, nothing herein should be construed as the provision of specific investment advice or recommendations for any individual. To determine which investments may be appropriate for you, consult your financial advisor prior to investing. There is no guarantee that the views and opinions expressed herein will come to pass. This newsletter contains information derived from third party sources. Although we believe these third-party sources to be reliable, we make no representations as to the accuracy or completeness of any information prepared by any unaffiliated third party incorporated herein and take no responsibility therefore.

Any projections, forecasts and estimates, including without limitation any statement using “expect” or “believe” or any variation of either term or a similar term, contained here are forward-looking statements and are based upon certain current assumptions, beliefs and expectations that LRIA considers reasonable or that the applicable third parties have identified as such. Forward-looking statements are necessarily speculative in nature, and it can be expected that some or all of the assumptions or beliefs underlying the forward-looking statements will not materialize or will vary significantly from actual results or outcomes. Some important factors that could cause actual results or outcomes to differ materially from those in any forward-looking statements include, among others, changes in interest rates and general economic conditions in the U.S. and globally, changes in the liquidity available in the market, change and volatility in the value of the U.S. dollar, market volatility and distressed credit markets, and other market, financial or legal uncertainties. Consequently, the inclusion of forward-looking statements herein should not be regarded as a representation by LRIA or any other person or entity of the outcomes or results that will be achieved by following any recommendations contained herein. While the forward-looking statements here reflect estimates, expectations and beliefs, they are not guarantees of future performance or outcomes. LRIA has no obligation to update or otherwise revise any forward-looking statements, including any revisions to reflect changes in economic conditions or other circumstances arising after the date hereof or to reflect the occurrence of events (whether anticipated or unanticipated), even if the underlying assumptions do not come to fruition. Opinions expressed herein are subject to change without notice and do not necessarily take into account the particular investment objectives, financial situations, or particular needs of all investors.

For additional information about LRIA, including fees and services, please contact us for our Form ADV disclosure brochure using our contact information herein. Please read the disclosure brochure carefully before you invest or send money.

2025 4th Quarter Investment Commentary