Oct 24, 2019 Leonard Rickey Investment Advisors: 3rd Quarter Commentary

Market Summary

Similar investment themes from the second quarter continued into the third, producing volatile trading but overall little movement in asset prices. These themes included the ongoing U.S.-China trade conflict, slowing global growth, an inverted yield curve, the lowering of interest rates by Central Banks around the world, and ongoing political uncertainties, including Brexit in the United Kingdom, rising geopolitical risks in the Middle East, and an impeachment inquiry in the United States. U.S. large cap stocks (as measured by the S&P 500 TR) gained 1.7% and finished less than 2% from all-time highs reached earlier in the quarter. Other major asset classes, such as U.S. small cap stocks (Russell 2000 TR) and non-U.S. stocks continued their relative underperformance and were slightly down on the quarter.

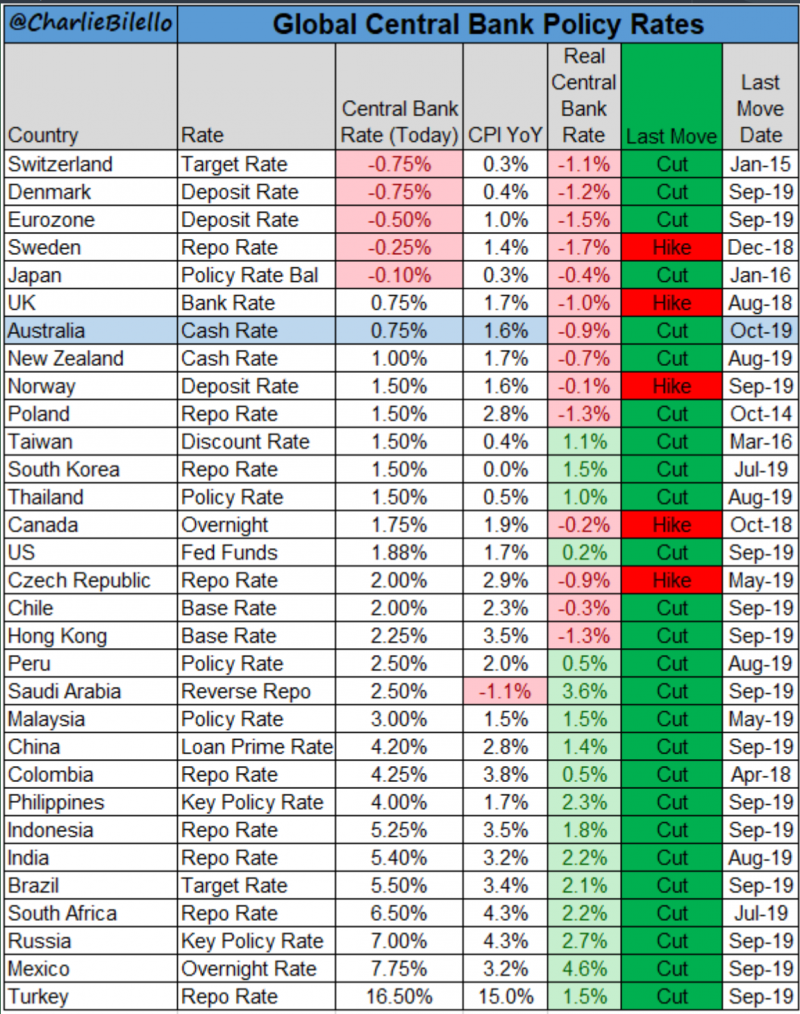

Low and falling global interest rates continued in the third quarter, as they have throughout 2019. Interest rates in many countries hit all-time lows as central banks tried to spur growth and ease investor concerns against mounting economic risks. The Federal Reserve cut interest rates twice to 2%, their first rate cut since 2008. In Europe, the European Central Bank reduced interest rates further into negative territory, joining Sweden, Japan and Switzerland with negative rates. The wide gap between U.S. and European bond yields helped push the dollar up to its highest level since 2017[1]. Below is a summary of returns for major asset classes[2].

Markets in Depth

Very little changed in the way of market leadership – U.S. large cap stocks continued to be the place to invest. Despite being near all-time highs and up over 20% in 2019, the S&P 500 was up just over 4% over the trailing 1 year and 8.5% since January 2018[4]. Other major market indexes, such as the Russell 2000 (small cap companies), MSCI EAFE (non-U.S. stocks) and MSCI EM, finished down on the quarter and below their January 2018 levels.

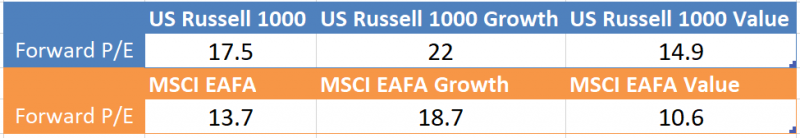

Underneath the surface there were signs of a significant shifts within asset classes and styles. U.S. Value stocks outperformed U.S. Growth stocks during the quarter and over the past 12 months[5] (see graph below). This was significant because Growth has beaten Value for the better part of the last 10 years[6]. As a result, the valuation differential between Value and Growth stocks remained wide by historical standards: the Russell 1000 Value traded at 14.9 times forward earnings compared to 22.0 times for the Russell 1000 Growth[7]. Many of our models are positioned with a Value overweight relative to Growth.

Turning to sector performance, due to concerns over slowing growth, stocks that have been perceived as more “defensive”—such as Real Estate, Utilities, and Consumer Staples—outperformed during the quarter and over the last year.

Turning to sector performance, due to concerns over slowing growth, stocks that have been perceived as more “defensive”—such as Real Estate, Utilities, and Consumer Staples—outperformed during the quarter and over the last year.

The two worst-performing sectors were Health Care, where there was concern about regulatory policies, and Energy, which faced geopolitical tensions in the Middle East.

Over the past ten years, U.S. equities have significantly outperformed International equities due to higher earnings growth, increased valuations and an appreciating U.S. dollar. The S&P 500 Index returned 247% compared to 61% for the MSCI EAFE over the period, and as a result, the current valuation spread between U.S. and International equity markets finished the quarter near a 15-year high[8].

Within the International space, Value stocks have lagged Growth stocks. The MSCI EAFE Growth Index outpaced the MSCI EAFE Value Index by 51%[9]. Consequently, International Value stocks are now exceptionally inexpensive and the valuation gap between Value and Growth stocks has widened significantly: 18.7 times forward earnings for MSCI EAFE Growth versus 10.6 times for MSCI EAFE Value. The table summarizes valuations as of the end of the quarter[10].

Historically, lower starting valuations have produced more attractive long-term returns. Because of that we continue to believe International equities and U.S. Value equities represent excellent long-term opportunities.

Economic Update

Economic data released during the quarter provided evidence that U.S. economic growth, while healthy, was decelerating. The labor market remained solid, with a 50-year low 3.5% unemployment rate and wage growth at a cycle high of 3.5%[11]. However, the pace of job growth trended lower: over the past three months 156,000 jobs were created on average, down from a monthly average of over 200,000 in 2018[12]. Other data was mixed – consumer spending remained healthy, but the manufacturing sector was weak due to trade concerns. In addition, the treasury yield curve remained inverted over the quarter, potentially signaling a recession to many investors.

Further adding to the worries of investors was the continued trade tensions between the Unites States and China. The U.S. imposed additional tariffs on $300 billion of Chinese imports and China retaliated with more tariffs on U.S. goods. The trade tensions weighed on corporate earnings, particularly those that have high revenue exposure outside the U.S. In addition, without a clear picture of the economic landscape, many companies were in a ‘wait and see’ mode before investing in additional capital expenditures.

Central banks took notice of all these risks and moved toward more accommodative policy. The Federal Reserve cut interest rates by 50 basis points during the quarter in a precautionary effort to protect the economy against further decline. Fed Chairman Jerome Powell described the cuts as a “midcycle adjustment” and “not the beginning of a long series of rate cuts.” Most Central banks around the world have cut interest rates this year making monetary policy very accommodative and potentially stimulating economic growth.

Investors pushed down the 10-year US Treasury to 1.47% before it retraced upward to end the quarter at 1.65%. The 30-year US Treasury breached the 2% threshold and hit an all-time low of 1.94%. In fact, after accounting for inflation, a 10-year US Treasury yielded negative .71%[13]. Normally this late into an economic expansion, high interest rates would be curtailing both business investment and home buying. This was not the case as the quarter came to an end. Central Banks continued to be willing to experiment with unconventional monetary policy to fight against fears of low inflation and slow growth. This is generally a positive for markets and the economy, but the unconventional nature worries some.

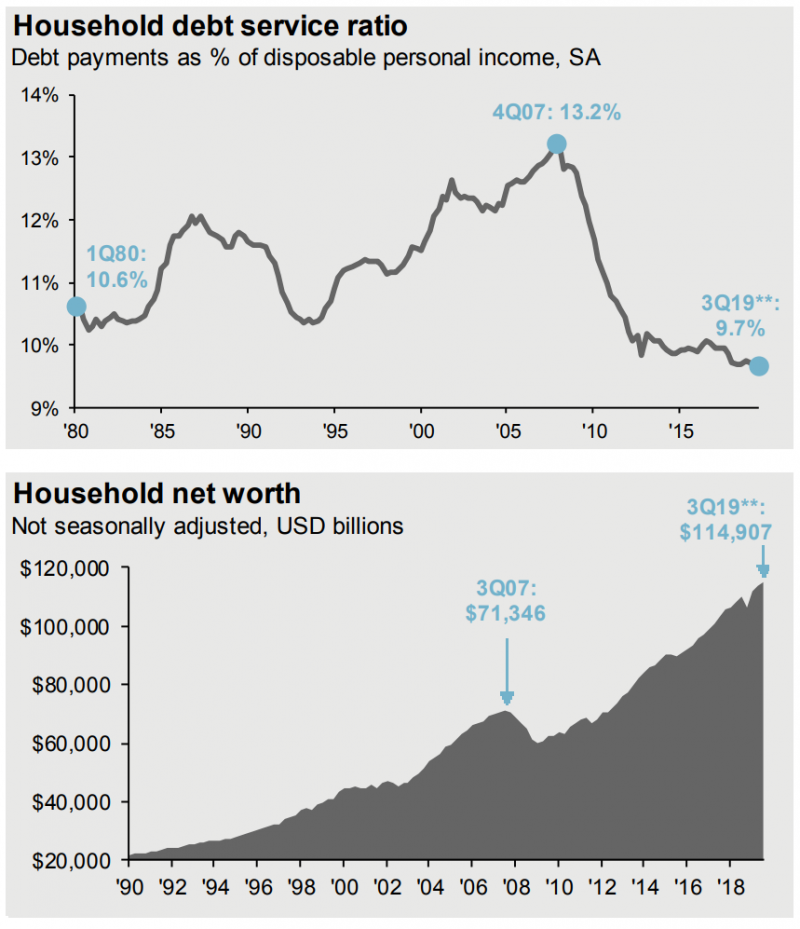

Importantly, the U.S. consumer appeared to be in good shape. Consumption is the bedrock of the U.S. economy, accounting for two-thirds of U.S. GDP. And retail sales, which were up 4.1% year-over-year[14], comprise 43% of consumption. In addition, household net worth in the U.S continued to trend upward, reaching new highs. At the same time, household debts as a percentage of income fell to record lows[15].

This economic recovery has been the slowest on record and has often felt like it could end any moment. But without a boom, it’s hard to generate a bust. This has also been the longest recovery on record, which has made some investors nervous. Although some imbalances were apparent, they didn’t seem extreme enough to derail U.S. economic growth in the near term. None of the cyclical sectors of the economy – such as autos, housing, business investment, spending or inventories – appeared to be overextended. Nor did there appear to be any particularly dangerous area of financial excess.

As always, please call if you have any questions or would like to discuss your account in more detail.

IMPORTANT DISCLOSURES

Leonard Rickey Investment Advisors, PLLC (“LRIA”), is an SEC registered investment adviser located in the State of Washington. Registration does not imply a certain level of skill or training. For information pertaining to the registration status of LRIA, please contact LRIA or refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov).

This newsletter is provided for general information only and contains information that is not suitable for everyone. As such, nothing herein should be construed as the provision of specific investment advice or recommendations for any individual. To determine which investments may be appropriate for you, consult your financial advisor prior to investing. All performance referenced herein is historical in nature and is not an indication of or a guarantee of future results. All indices are unmanaged and cannot be invested into directly. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment.

*Your experience may vary according to your individual circumstances and there can be no assurance that LRIA will be able to achieve similar results for all clients in comparable situations or that any particular strategy or investment will prove profitable. As investment returns, inflation, taxes and other economic conditions vary, your actual results may vary significantly. The economic forecasts set forth in the presentation may not develop as predicted and there can be no guarantee that strategies promoted will be successful. There is no guarantee that the views and opinions expressed herein will come to pass. This newsletter contains information derived from third party sources. Although we believe these third-party sources to be reliable, we make no representations as to the accuracy or completeness of any information prepared by any unaffiliated third party incorporated herein, and take no responsibility therefore.

Stock investing includes numerous specific risks including the fluctuations of dividend, loss of principal, and potential illiquidity of the investment in a falling market. International and emerging markets investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. Small cap stocks may be subject to a higher degree of risk than more established companies’ securities. The illiquidity of the small cap market may adversely affect the value of these investments. Information presented herein is subject to change without notice and should not be considered as a solicitation to buy or sell any security. This newsletter should not be regarded as a complete analysis of the subjects discussed. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values and yields will decline as interest rates rise and bonds are subject to availability and change in price. The risks associated with investment-grade corporate bonds are considered significantly higher than those associated with first-class government bonds. The difference between rates for first-class government bonds and investment-grade bonds is called investment-grade spread. The range of this spread is an indicator of the market’s belief in the stability of the economy. The fast price swings in commodities and currencies can result in significant volatility in an investor’s holdings. There is no assurance that the techniques and strategies discussed are suitable for all investors or will yield positive outcomes. The Value investments can perform differently from the market as a whole. They can remain undervalued by the market for long periods of time.

Any projections, forecasts and estimates, including without limitation any statement using “expect” or “believe” or any variation of either term or a similar term, contained here are forward-looking statements and are based upon certain current assumptions, beliefs and expectations that LRIA considers reasonable or that the applicable third parties have identified as such. Forward-looking statements are necessarily speculative in nature, and it can be expected that some or all of the assumptions or beliefs underlying the forward-looking statements will not materialize or will vary significantly from actual results or outcomes. Some important factors that could cause actual results or outcomes to differ materially from those in any forward-looking statements include, among others, changes in interest rates and general economic conditions in the U.S. and globally, changes in the liquidity available in the market, change and volatility in the value of the U.S. dollar, market volatility and distressed credit markets, and other market, financial or legal uncertainties. Consequently, the inclusion of forward-looking statements herein should not be regarded as a representation by LRIA or any other person or entity of the outcomes or results that will be achieved by following any recommendations contained herein. While the forward-looking statements here reflect estimates, expectations and beliefs, they are not guarantees of future performance or outcomes. LRIA has no obligation to update or otherwise revise any forward-looking statements, including any revisions to reflect changes in economic conditions or other circumstances arising after the date hereof or to reflect the occurrence of events (whether anticipated or unanticipated), even if the underlying assumptions do not come to fruition. Opinions expressed herein are subject to change without notice and do not necessarily take into account the particular investment objectives, financial situations, or particular needs of all investors. For additional information about LRIA, including fees and services, please contact us for our Form ADV disclosure brochure using our contact information herein. Please read the disclosure brochure carefully before you invest or send money.

INDEX DEFINITIONS

The Barclays Aggregate Bond Index represents securities that are SEC-registered, taxable, and dollar denominated. The index covers the U.S. investment-grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities.

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. It cannot be invested into directly.

The Russell 2000 Index is an unmanaged index generally representative of the 2,000 smallest companies in the Russell Index, which represents approximately 10% of the total market capitalization of the Russell 3000 Index.

The MSCI Emerging Markets Index is a float-adjusted market capitalization index that consists of indices of approximately 800 stocks and is designed to measure equity market performance in 23 emerging economies: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Malaysia, Mexico, , Peru, Philippines, Poland, Qatar, Russia, South Africa, Taiwan, Thailand, Turkey, and the United Arab Emirates.

The MSCI EAFE (Europe, Australasia, Far East) Index is a free float-adjusted market capitalization index of approximately 900 stocks and is designed to measure equity market performance in 21 developed market countries outside of North America.

Morningstar US Large Value measures the performance of large-cap stocks with relatively low prices given anticipated per-share earnings, book value, cash flow, sales and dividends.

Morningstar US Large Growth measures the performance of large-cap stocks that are expected to grow at a faster pace than the rest of the market as measured by forward earnings, historical earnings, book value, cash flow and sales

The MSCI EAFE Growth Index captures large and mid-cap securities exhibiting overall growth style characteristics across Developed Markets countries* around the world, excluding the US and Canada. The growth investment style characteristics for index construction are defined using five variables: long-term forward EPS growth rate, short-term forward EPS growth rate, current internal growth rate and long-term historical EPS growth trend and long-term historical sales per share growth trend.

The MSCI EAFE Value Index measures the performance of large-cap stocks that are expected to grow at a faster pace than the rest of the market as measured by forward earnings, historical earnings, book value, cash flow and sales

The Russell 1000 Index measures the performance of the 1,000 largest companies in the Russell 3000 Index, which represents approximately 92% of the total market capitalization of the Russell 3000 Index.

The Russell 1000 Growth Index measures the performance of those Russell 1000 companies with higher price-to-book ratios and higher forecasted growth values.

The Russell 1000 Value Index measures the performance of those Russell 1000 companies with lower price-to-book ratios and lower forecasted growth values.

[1] Data from Morningstar

[2] Through September 30, 2019. All Returns in U.S. dollars. Data from Morningstar

[3] Alternatives benchmark includes 60% SG Trend Index and 40% Swiss Re Global Cat Bond TR Index.

[4] Data from Morningstar. 1/24/2018 – 9/30/2019

[5] Using Morningstar Indexes

[6] The Russell 1000 Growth Index had a total annualized return of 302.3% from 9/30/09 – 9/30/19 compared to 195.8% for the Russell 1000 Value.

[7] Data from Dodge & Cox

[8] Data from Morningstar

[9] The MSCI EAFE Growth Index had a total return of 88.0% compared to 37.4% for the MSCI EAFE Value Index from September 30, 2009 through September 30, 2019

[10] The forward P/E ratio (or forward price-to-earnings ratio) divides the current share price of a company by the estimated future (“forward”) earnings per share. Data from Dodge & Cox.

[11] JPMorgan Guide to the Markets, Q3 2019

[12] Bureau of Labor Statistics

[13] JPMorgan Guide to the Markets, Q3 2019

[14] Advisor Perspectives. Data as of August 2019

[15] JPMorgan Guide to the Markets, Q3 2019

Company News

Market Commentary

Retirement Planning

Tax Planning

Cyber Security

Important Disclosures

Leonard Rickey Investment Advisors, PLLC (“LRIA”), is an SEC registered investment adviser located in the State of Washington. Registration does not imply a certain level of skill or training. For information pertaining to the registration status of LRIA, please contact LRIA or refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov).

This is provided for general information only and contains information that is not suitable for everyone. As such, nothing herein should be construed as the provision of specific investment advice or recommendations for any individual. To determine which investments may be appropriate for you, consult your financial advisor prior to investing. There is no guarantee that the views and opinions expressed herein will come to pass. This newsletter contains information derived from third party sources. Although we believe these third-party sources to be reliable, we make no representations as to the accuracy or completeness of any information prepared by any unaffiliated third party incorporated herein and take no responsibility therefore.

Any projections, forecasts and estimates, including without limitation any statement using “expect” or “believe” or any variation of either term or a similar term, contained here are forward-looking statements and are based upon certain current assumptions, beliefs and expectations that LRIA considers reasonable or that the applicable third parties have identified as such. Forward-looking statements are necessarily speculative in nature, and it can be expected that some or all of the assumptions or beliefs underlying the forward-looking statements will not materialize or will vary significantly from actual results or outcomes. Some important factors that could cause actual results or outcomes to differ materially from those in any forward-looking statements include, among others, changes in interest rates and general economic conditions in the U.S. and globally, changes in the liquidity available in the market, change and volatility in the value of the U.S. dollar, market volatility and distressed credit markets, and other market, financial or legal uncertainties. Consequently, the inclusion of forward-looking statements herein should not be regarded as a representation by LRIA or any other person or entity of the outcomes or results that will be achieved by following any recommendations contained herein. While the forward-looking statements here reflect estimates, expectations and beliefs, they are not guarantees of future performance or outcomes. LRIA has no obligation to update or otherwise revise any forward-looking statements, including any revisions to reflect changes in economic conditions or other circumstances arising after the date hereof or to reflect the occurrence of events (whether anticipated or unanticipated), even if the underlying assumptions do not come to fruition. Opinions expressed herein are subject to change without notice and do not necessarily take into account the particular investment objectives, financial situations, or particular needs of all investors.

For additional information about LRIA, including fees and services, please contact us for our Form ADV disclosure brochure using our contact information herein. Please read the disclosure brochure carefully before you invest or send money.

Celebrating Independence—Both National and Financial