Posts Tagged ‘Market Commentary’

2024 1st Quarter Investment Commentary

The S&P 500 TR Index continued its strong momentum and reached new all-time highs. Momentum often creates momentum, which leaves us optimistic about stocks currently. However, a near-term pullback wouldn’t surprise us. The U.S. economy continued to grow due to a strong labor market, healthy consumer balance sheets, and robust services activity. Due to an…

Read More2023 2nd Quarter Investment Commentary

The S&P 500 broke out of its yearlong trading range, producing positive returns for the third quarter in a row. Excitement around artificial intelligence propelled growth stocks to outsized gains. Economic data came in better than expected as growth continued to be resilient, and inflation continued to moderate. Our technical indicators were positive while our…

Read More2022 3rd Quarter Investment Commentary

The macroeconomic factors of rising interest rates and stubborn inflation remained chief concerns and weighed down both stocks and bonds. Despite a strong employment picture, economic data continued to moderate, and markets priced in a rising risk of recession in 2023. Stocks ended the quarter at reasonable valuations and bond yields were at their highest…

Read More2022 2nd Quarter Investment Commentary

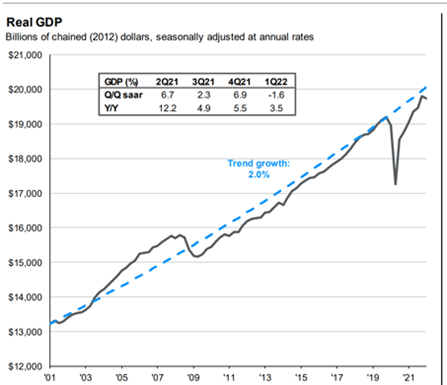

• Stocks and bonds had a difficult start to 2022, falling together through the first half of the year. Rising interest rates amid an inflation spike was the main catalyst. • The economic backdrop remained uncertain with the U.S. economy contracting in the 1st quarter. Data was mixed but recessions risks increased. • Better…

Read More2022 1st Quarter Investment Commentary

• The war in Ukraine, high inflation, and rising interest rates increased volatility. Both stock and bonds fell during the quarter. • Corporate balance sheets and earnings were on track to hit record highs in 2022. • The risks to an economic slowdown increased but the U.S. economy still appeared on track to grow through…

Read MoreLeonard Rickey Investment Advisors: 3rd Quarter Commentary

Market Summary Similar investment themes from the second quarter continued into the third, producing volatile trading but overall little movement in asset prices. These themes included the ongoing U.S.-China trade conflict, slowing global growth, an inverted yield curve, the lowering of interest rates by Central Banks around the world, and ongoing political uncertainties, including Brexit…

Read More