Oct 31, 2018 Happy Halloween: It’s time for some scary charts

The financial world can be a scary place. It seems like there is always something to fear in the market. Fortunately, our worst fears usually don’t come to fruition. To get in the Halloween spirit however, we have posted five scary charts to keep you up tonight. Stay tuned in the coming weeks for the “charts we are thankful for.”

1) Corporate Debt

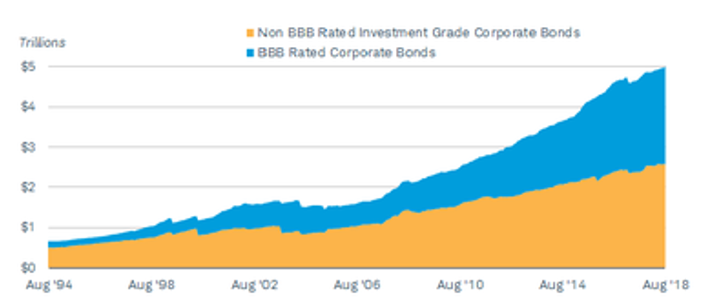

U.S. corporate debt is at an all-time high of over 45% of GDP[1]. Corporations have taken advantage of historically the low interest rate environment and loaded up on debt.

Secondly, lower credit quality bonds make up a much large share of the investment-grade corporate bond market. BBB or Baa ratings are the lowest rung of the investment-grade rating scale, so these ratings imply a greater risk of default than investment-grade issues with higher ratings, like those rated “A” or above. This increase in low credit bonds poses significant credit risk to investors.

What’s been driving these trends? It’s likely due to the low interest-rate environment of the past nine years. For years after the financial crisis of 2008 and 2009, interest rates and bond yields hovered at or near all-time lows. U.S. corporations took advantage of this by issuing more and more debt with low coupon rates. However, notably, much of this is long-term debt. This helped lower firms’ interest expenses but also helped push back the risk of default. With fewer bonds coming due in the near term, corporations were able to reduce their refinancing risk.

But this does pose a risk in the long run—that mountain of debt needs to be repaid or refinanced at some point. If refinanced, the debt could potentially be refinanced at higher yields and increase firms’ interest expense.

2) Rising Interest Rates

The 10-year Treasury yield recently reached a seven year high of 3.23% and has broken out of a 30-year trend of falling interest rates. The chart above shows the 10-year US Treasury Yield from 1062 through today. The blue line highlights the upper and lower points 30 years. Recently the yield has broken out. Could this be a sign of a new trend?

3) Stock Trend Break Down

The 200-day moving average is a popular trend indicator that investors use to determine the longer-term trend of a specific market or stock. It is a simple metric – it averages the closing price of a specific asset over the last 200 days. In the chart above[2], the blue line represents the S&P 500 Index and the dash lined is the 200-day moving average of that index. The recent correction has taken the S&P 500 index below its 200-day moving average, indicating a breakdown of the positive trend that has taken place over the last two and half years in U.S. stocks.

4) U.S. Stock Valuations

The cyclically-adjusted price-to-earnings ratio (or CAPE) shows that the S&P 500 is hovering near 1929 valuations and is the most overvalued it has been since the late-1990s Dot-com bubble. The CAPE ratio divides the current price by the average of the last 10-years of earnings. Other valuations measures come to the same conclusion: valuations in the U.S. stock market are near their highest levels in history.

5) Federal Debt

Gross federal debt stands at a massive $21.2 trillion[3] and it is expected to get worse before it gets better. In June, the Congressional Budget Office estimated federal debt held by the public will rise from 78% of GDP at the end of this year to 96% in 2028. That would mark the highest percentage since 1946. The report warned such high and rising debt due to higher spending and lower revenues would have “serious negative consequences for the budget and the nation.”

Happy Halloween!

[1] Federal Reserve Economic Data. Shaded areas represent recessions.

[2] Ned Davis Research

[3] CNBC, July 2018

IMPORTANT DISCLOSURES

Leonard Rickey Investment Advisors, PLLC (“LRIA”), is an SEC registered investment adviser located in the State of Washington. Registration does not imply a certain level of skill or training. For information pertaining to the registration status of LRIA, please contact LRIA or refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov).

This newsletter is provided for general information only and contains information that is not suitable for everyone. As such, nothing herein should be construed as the provision of specific investment advice or recommendations for any individual. To determine which investments may be appropriate for you, consult your financial advisor prior to investing. All performance referenced herein is historical in nature and is not an indication of or a guarantee of future results. All indices are unmanaged and cannot be invested into directly. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment.

Your experience may vary according to your individual circumstances and there can be no assurance that LRIA will be able to achieve similar results for all clients in comparable situations or that any particular strategy or investment will prove profitable. As investment returns, inflation, taxes and other economic conditions vary, your actual results may vary significantly. The economic forecasts set forth in the presentation may not develop as predicted and there can be no guarantee that strategies promoted will be successful. There is no guarantee that the views and opinions expressed herein will come to pass. This newsletter contains information derived from third party sources. Although we believe these third party sources to be reliable, we make no representations as to the accuracy or completeness of any information prepared by any unaffiliated third party incorporated herein, and take no responsibility therefore.

Stock investing includes numerous specific risks including the fluctuations of dividend, loss of principal, and potential illiquidity of the investment in a falling market. International and emerging markets investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. Small cap stocks may be subject to a higher degree of risk than more established companies’ securities. The illiquidity of the small cap market may adversely affect the value of these investments. Information presented herein is subject to change without notice and should not be considered as a solicitation to buy or sell any security. This newsletter should not be regarded as a complete analysis of the subjects discussed. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values and yields will decline as interest rates rise and bonds are subject to availability and change in price. The risks associated with investment-grade corporate bonds are considered significantly higher than those associated with first-class government bonds. The difference between rates for first-class government bonds and investment-grade bonds is called investment-grade spread. The range of this spread is an indicator of the market’s belief in the stability of the economy. The fast price swings in commodities and currencies can result in significant volatility in an investor’s holdings. There is no assurance that the techniques and strategies discussed are suitable for all investors or will yield positive outcomes. The Value investments can perform differently from the market as a whole. They can remain undervalued by the market for long periods of time.

Any projections, forecasts and estimates, including without limitation any statement using “expect” or “believe” or any variation of either term or a similar term, contained here are forward-looking statements and are based upon certain current assumptions, beliefs and expectations that LRIA considers reasonable or that the applicable third parties have identified as such. Forward-looking statements are necessarily speculative in nature, and it can be expected that some or all of the assumptions or beliefs underlying the forward-looking statements will not materialize or will vary significantly from actual results or outcomes. Some important factors that could cause actual results or outcomes to differ materially from those in any forward-looking statements include, among others, changes in interest rates and general economic conditions in the U.S. and globally, changes in the liquidity available in the market, change and volatility in the value of the U.S. dollar, market volatility and distressed credit markets, and other market, financial or legal uncertainties. Consequently, the inclusion of forward-looking statements herein should not be regarded as a representation by LRIA or any other person or entity of the outcomes or results that will be achieved by following any recommendations contained herein. While the forward-looking statements here reflect estimates, expectations and beliefs, they are not guarantees of future performance or outcomes. LRIA has no obligation to update or otherwise revise any forward-looking statements, including any revisions to reflect changes in economic conditions or other circumstances arising after the date hereof or to reflect the occurrence of events (whether anticipated or unanticipated), even if the underlying assumptions do not come to fruition. Opinions expressed herein are subject to change without notice and do not necessarily take into account the particular investment objectives, financial situations, or particular needs of all investors. For additional information about LRIA, including fees and services, please contact us for our Form ADV disclosure brochure using our contact information herein. Please read the disclosure brochure carefully before you invest or send money.

INDEX DEFINITIONS

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. It cannot be invested into directly.

Company News

Market Commentary

Retirement Planning

Tax Planning

Cyber Security

Important Disclosures

Leonard Rickey Investment Advisors, PLLC (“LRIA”), is an SEC registered investment adviser located in the State of Washington. Registration does not imply a certain level of skill or training. For information pertaining to the registration status of LRIA, please contact LRIA or refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov).

This is provided for general information only and contains information that is not suitable for everyone. As such, nothing herein should be construed as the provision of specific investment advice or recommendations for any individual. To determine which investments may be appropriate for you, consult your financial advisor prior to investing. There is no guarantee that the views and opinions expressed herein will come to pass. This newsletter contains information derived from third party sources. Although we believe these third-party sources to be reliable, we make no representations as to the accuracy or completeness of any information prepared by any unaffiliated third party incorporated herein and take no responsibility therefore.

Any projections, forecasts and estimates, including without limitation any statement using “expect” or “believe” or any variation of either term or a similar term, contained here are forward-looking statements and are based upon certain current assumptions, beliefs and expectations that LRIA considers reasonable or that the applicable third parties have identified as such. Forward-looking statements are necessarily speculative in nature, and it can be expected that some or all of the assumptions or beliefs underlying the forward-looking statements will not materialize or will vary significantly from actual results or outcomes. Some important factors that could cause actual results or outcomes to differ materially from those in any forward-looking statements include, among others, changes in interest rates and general economic conditions in the U.S. and globally, changes in the liquidity available in the market, change and volatility in the value of the U.S. dollar, market volatility and distressed credit markets, and other market, financial or legal uncertainties. Consequently, the inclusion of forward-looking statements herein should not be regarded as a representation by LRIA or any other person or entity of the outcomes or results that will be achieved by following any recommendations contained herein. While the forward-looking statements here reflect estimates, expectations and beliefs, they are not guarantees of future performance or outcomes. LRIA has no obligation to update or otherwise revise any forward-looking statements, including any revisions to reflect changes in economic conditions or other circumstances arising after the date hereof or to reflect the occurrence of events (whether anticipated or unanticipated), even if the underlying assumptions do not come to fruition. Opinions expressed herein are subject to change without notice and do not necessarily take into account the particular investment objectives, financial situations, or particular needs of all investors.

For additional information about LRIA, including fees and services, please contact us for our Form ADV disclosure brochure using our contact information herein. Please read the disclosure brochure carefully before you invest or send money.

2025 4th Quarter Investment Commentary