Blog Tax Planning

What Are Retirement Gap Years? Timing Social Security, Roth Moves, and Medicare When people hear “gap year,” they often think of the year between high school and college. But there’s another kind of gap year that can have a big financial impact: the years between retiring and starting Social Security or pension income. These retirement…

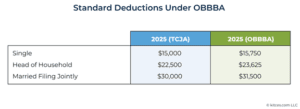

PART 1 The One Big Beautiful Bill (OBBB), signed into law on July 4, 2025, covers a broad spectrum of tax issues concerning individuals and businesses. Some changes are retroactive to the beginning of 2025, some take effect next year in 2026, and some are temporary, while some are permanent. In this series over the…

If you’re planning a significant asset sale, there’s a new update from Olympia you should know about. Washington State has recently passed important changes to its capital gains tax that could affect your 2025 tax bill—especially if you’re among the state’s high earners. Let’s break it down. What’s Changing? On May 20, 2025, Governor Bob…

You still have time to contribute to your Traditional IRA, Roth IRA, SEP IRA, and HSA accounts for 2024. Contributions are due by the earlier of April 15, 2025, or the filing date of your tax return. For 2024, you can contribute up to $7,000 to your Traditional or Roth IRA and an additional $1,000…

Social Security recipients are getting a 2.5% increase in their 2025 benefits. The Medicare Part B premium is increasing from $174.70 to $185.00 per month. The annual exclusion for gifts increases to $19,000 from $18,000 per year per individual. The limitation on deferrals for 401(k), 403(b), and most 457 plans is increased to $23,500 for…

The current tax code enacted in 2017 by the first Trump administration is called the Tax Cuts and Jobs Act and is scheduled to sunset in 2025. This means that starting in 2026, we will revert to the pre-Tax Cuts and Jobs Act tax code unless some or all the provisions extended. We could get…

Schwab uses a phased approach to get tax forms out quickly and minimize corrections. All original tax forms will be available between January 31, 2025, and February 28, 2025. 1099 Composites for Brokerage accounts will be available on the following dates depending on the holding in your account: January 31st February 14th February 28th 1099-R…

The window for many tax-saving opportunities closes on December 31st. It’s important to evaluate your tax situation while there’s still time to affect your bottom line for the 2024 tax year. Your specific circumstances should be considered, so please reach out if you have any questions. Charitable Contributions There are a couple of ways to…

Social Security recipients are getting a 3.2% increase in their 2024 benefits. The Medicare Part B premium is increasing from $164.90 to $174.70 per month. The annual exclusion for gifts increases to $18,000 from $17,000 per year per individual. The limitation on deferrals for 401(k), 403(b), and most 457 plans is increased to $23,000 for…

Charles Schwab and TD Ameritrade Charles Schwab and TD Ameritrade will be releasing 1099s in waves beginning Mid-January. If you started 2023 with your accounts at TD Ameritrade and now have Charles Schwab accounts, you will most likely receive multiple 1099s. TD Ameritrade and Charles Schwab forms will be available through your Charles Schwab login.…