Posts by Matt Hargreaves

2025 4th Quarter Investment Commentary

Markets were strong, but narrow in the U.S. The S&P 500 TR rose 2.66% in Q4 and 17.88% in 2025. However, gains were driven by a small group of large AI-focused companies, and most stocks did not keep pace with the index. International markets had a standout year. Developed international stocks and emerging markets outpaced…

Read More2025 3rd Quarter Client Investment Commentary

Global equities surged to record highs as the Fed’s rate cut, strong earnings, and large-scale spending in AI-related spending fueled the rally. The S&P 500 gained over 8% in Q3, with leadership concentrated in growth stocks, leaving valuations historically high and breadth narrow. Economic growth stayed resilient, with solid consumption and wage growth despite…

Read More2025 3rd Quarter Investment Commentary

Global equities surged to record highs as the Fed’s rate cut, strong earnings, and large-scale spending in AI-related spending fueled the rally. The S&P 500 gained over 8% in Q3, with leadership concentrated in growth stocks, leaving valuations historically high and breadth narrow. Economic growth stayed resilient, with solid consumption and wage growth despite labor…

Read MorePrice Return vs. Total Return: Why a Statement’s “Gain/Loss” Isn’t the Whole Story

When you open an account statement or portal, the “gain/loss” next to a holding can look like the final verdict on performance. In most cases, that figure reflects price return only—how the market value of your shares changed since purchase—not the total return of the investment. Total return includes price changes plus the income the…

Read MoreProtected: 2025 2nd Quarter Investment Commentary

There is no excerpt because this is a protected post.

Read More2025 2nd Quarter Investment Commentary

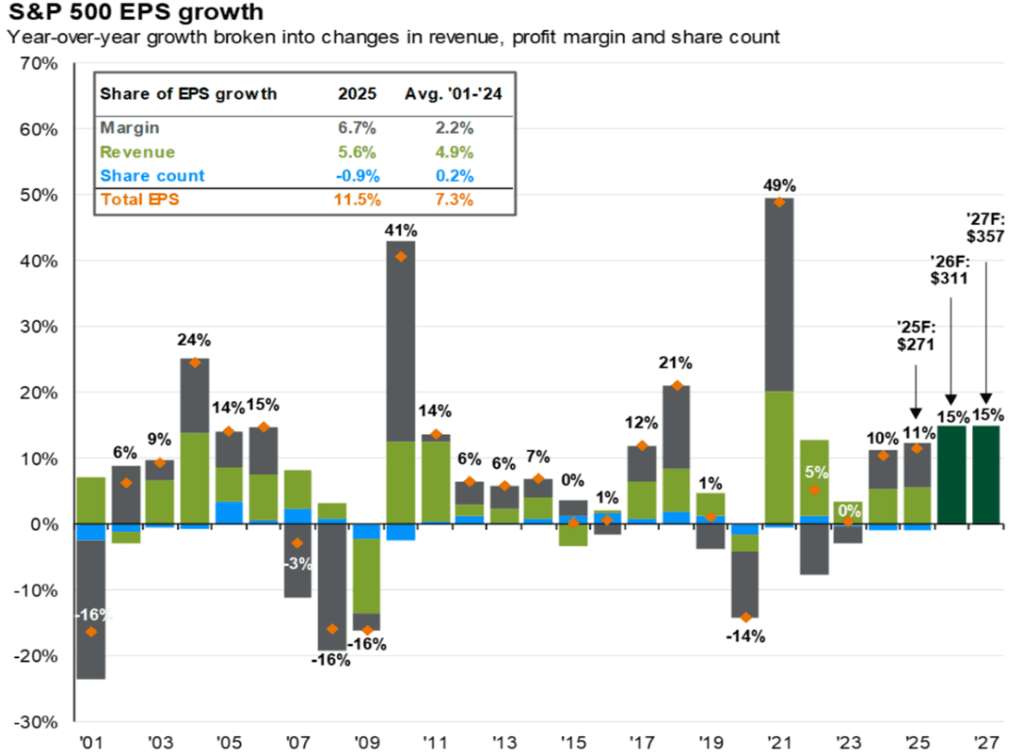

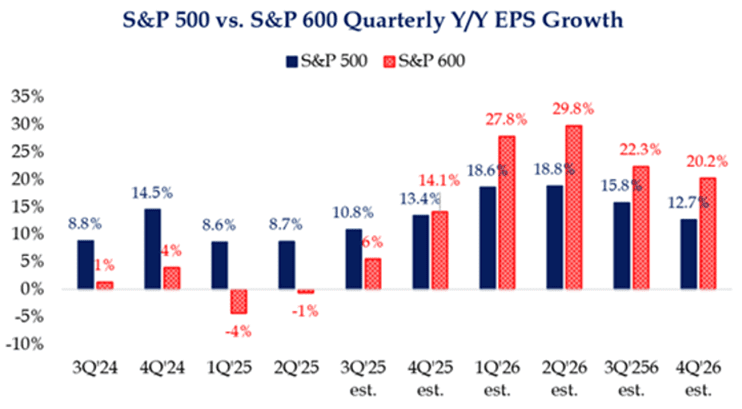

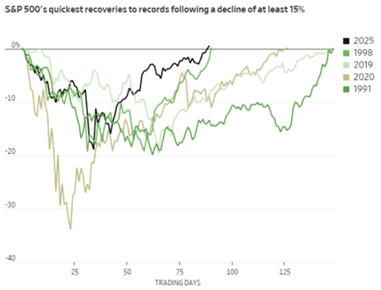

Historic V-shaped rebound: U.S. large-cap stocks, as measured by the S&P 500, staged the fastest recovery from a 15%+ correction on record and finished the quarter at new all-time highs. Growth stocks led the rally in the U.S., but performance broadened globally as U.S. dollar weakness boosted international returns3. Economy cooling, not cracking: The economy…

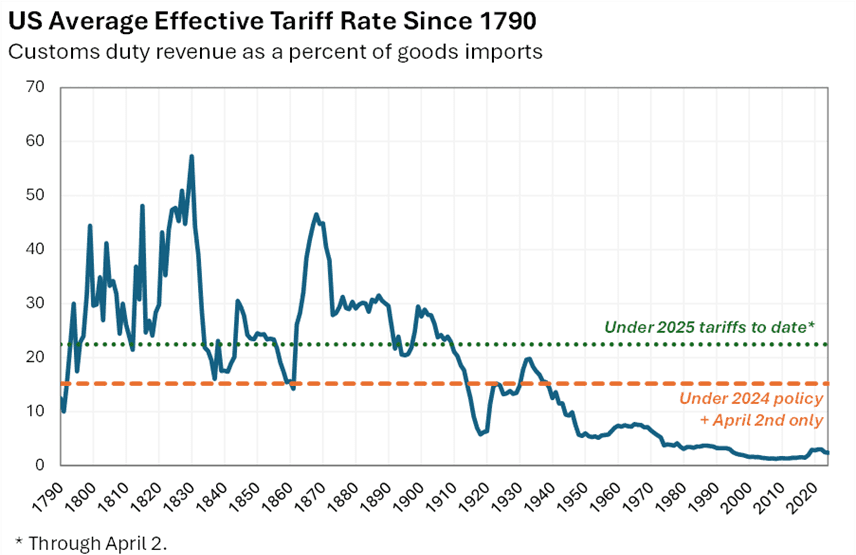

Read More2025 1st Quarter Investment Commentary

Uncertainty around tariffs sent the S&P 500 down more than 4% in the 1st quarter Technology stocks posted their worst quarter since 2020, while non-US stocks, value stocks, and defensive sectors led other sectors. Bonds also provided safety. On April 2nd, US tariffs were announced that exceeded investor expectations. This led to a market decline…

Read MoreMarket Update: March 2025

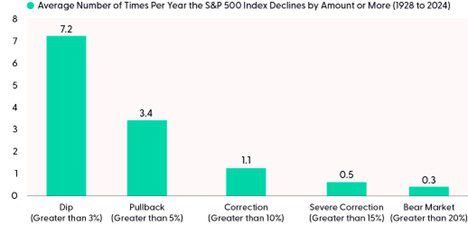

As of March 13, the S&P 500 declined 10.1% from its all-time closing high in mid-February. Many investors have started to worry about the prospect of further declines. As of now, the decline appears to be fairly typical. Corrections are generally sharp and fast and serve to refresh fear. The current 10% decline in the…

Read More2024 4th Quarter Investment Commentary

A post-election rally helped the S&P 500 gain 2.4% in the quarter and over 25% on the year. US growth companies continued to lead stocks while other sectors trailed. The US economy remained healthy on the backs of a strong consumer and profitable corporate sector, but there were signs of a downshift to a lower…

Read MoreNew Statements – Launching 1st Quarter of 2025

We’re excited to announce the release of your new quarterly statements, designed to be more concise and streamlined. By cutting down on excess details, we’ve made it easier to stay informed without the clutter. We hope you find this new format helpful and look forward to any feedback you may have! Click here to preview…

Read More