Posts by Chelsie Smith

What Are Retirement Gap Years?

What Are Retirement Gap Years? Timing Social Security, Roth Moves, and Medicare When people hear “gap year,” they often think of the year between high school and college. But there’s another kind of gap year that can have a big financial impact: the years between retiring and starting Social Security or pension income. These retirement…

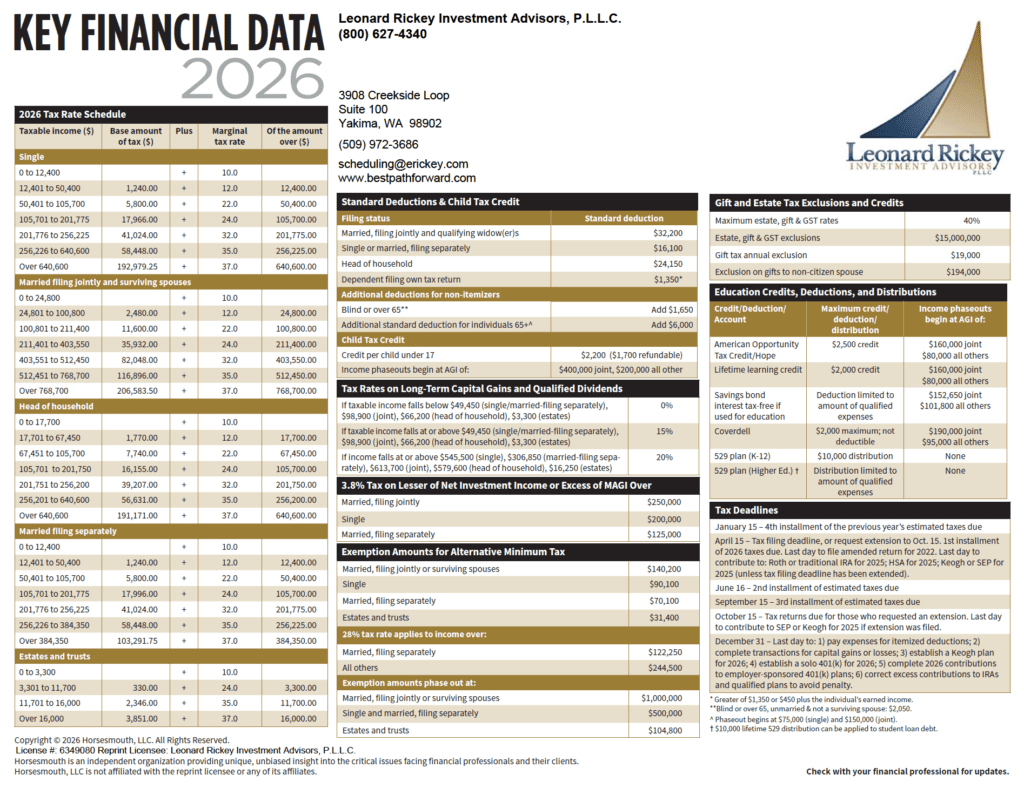

Read More2026 Key Financial Changes

The annual exclusion for gifts remained at $19,000 for 2026. The limitation on deferrals for 401(k), 403(b), and 457 plans is increased to $24,500 for 2026, up from $23,500 in 2025. The catch-up for those over age 50 was increased to $8,000 from $7,500, so if you are maxing out your plan and over age…

Read MoreNew Retirement Rule Coming in 2026 for High-Income Earners: Roth Catch-Up Contribution

Starting January 1, 2026, a change under the SECURE 2.0 Act will affect how some employees age 50 and older make catch-up contributions to their workplace retirement plans. What’s Changing? If you turn 50 or older in 2026 and your 2025 FICA wages (Box 3 of your W-2) with your current employer were over $150,000*,…

Read MoreSocial Security and Medicare Changes for 2026

Starting in January 2026, Social Security beneficiaries will receive a 2.8% cost-of-living adjustment (COLA) designed to help benefits keep pace with inflation. The adjustment is based on the Consumer Price Index, reflecting changes in the cost of goods and services over the past year. Beneficiaries will be notified of their new benefit amounts by mail…

Read MoreHealth Insurance Open Enrollment Season Is Here

It’s that time of year again — Open Enrollment season! Whether you’re covered through Medicare, the Marketplace, or a Group/Employer plan, this is your opportunity to review your benefits and make sure you’re prepared for 2026. Health insurance plan details, provider networks, and prescription coverage can change each year — and your own health or…

Read MoreWelcome, Kayla!

Join us in welcoming our newest team member, Kayla Parker! Kayla joins us in the Yakima office as part of our client service team. She graduated from Washington State University (WSU) with a bachelor’s degree in Elementary Education. We asked Kayla to share a little about herself below: 1. What would your perfect weekend look…

Read MoreHappy Retirement, Molly!

It is with appreciation and warm wishes that we share the news of Molly Hoff’s retirement from Leonard Rickey Investment Advisors. Molly’s last day with us will be November 7th 2025. Molly has been a part of our team since 2005, bringing her professionalism, warmth, and deep commitment to both clients and colleagues. Her presence…

Read MoreCongratulations, Glenn!

We’re excited to celebrate Glenn McKee’s achievement of his Master of Science in Financial Management, with a concentration in Investment Analysis, from Boston University. Glenn is a research analyst on our investment and trading team, and this milestone is a testament to his hard work, dedication, and commitment to excellence. Your perseverance has truly paid…

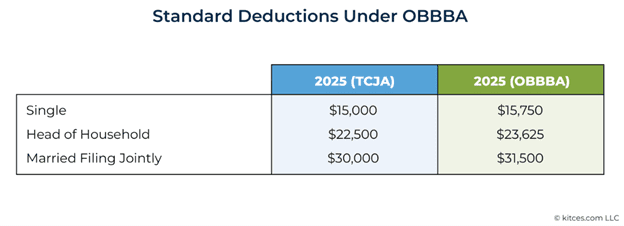

Read MoreThe One Big Beautiful Bill – Bite by Bite

PART 1 The One Big Beautiful Bill (OBBB), signed into law on July 4, 2025, covers a broad spectrum of tax issues concerning individuals and businesses. Some changes are retroactive to the beginning of 2025, some take effect next year in 2026, and some are temporary, while some are permanent. In this series over the…

Read MoreCongratulations to Gunnar & Ellie!

Congratulations to Gunnar Harrison for passing his Accredited Financial Counselor® exam. He constantly strives to expand his knowledge and skills to serve clients better. Great job, Gunnar! Congratulations to Ellie Buntin for passing her Series 65 test and becoming an advisor. Ellie has been studying hard, transitioning from the accounting world to financial advising!…

Read More