Jan 29, 2026 2025 4th Quarter Investment Commentary

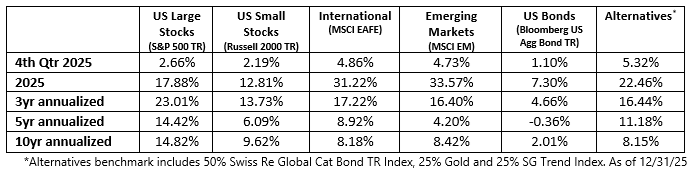

- Markets were strong, but narrow in the U.S. The S&P 500 TR rose 2.66% in Q4 and 17.88% in 2025. However, gains were driven by a small group of large AI-focused companies, and most stocks did not keep pace with the index.

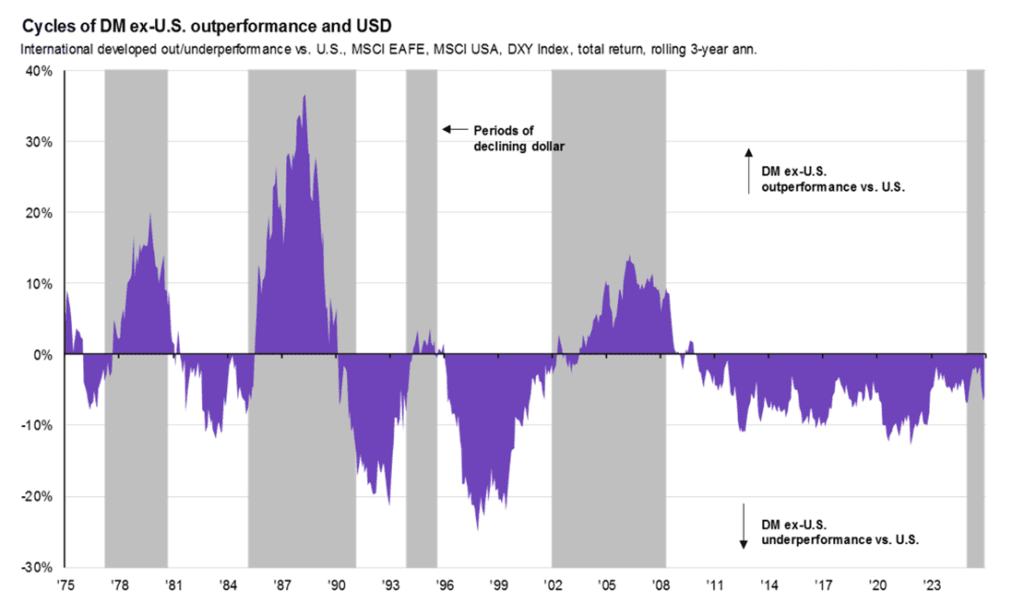

- International markets had a standout year. Developed international stocks and emerging markets outpaced the U.S. by the widest margin since 2009. This was supported by a U.S. dollar that fell more than 9% during the year.

- As we look ahead to 2026, supportive policy tailwinds remain, but valuation and late-cycle risks matter. The Federal Reserve has cut interest rates 1.75% since 2024, easing financial conditions and supporting markets. Elevated U.S. equity valuations and a slowing labor market argue for balance.

Market and Economic Summary

Despite a weak finish in December, U.S. stocks, as measured by the S&P 500 TR*, still delivered another strong year, gaining nearly 18%. The index gained over 2% during the quarter, but December’s pullback ended the S&P 500’s seven-month winning streak. It marked the first month since May that the index failed to record a new all-time-high monthly close. (*All S&P performance referenced is for the S&P 500 Total Return (TR)).

The S&P 500 has now delivered double-digit returns in six of the past seven years, demonstrating the resilience of long-term investing. In addition, nearly every major asset delivered positive returns for the year. Both developed international and emerging market stocks outperformed the S&P 500 by the widest margin since 2009 in part because the U.S. Dollar lost over 9% of its value during the year. AI was a dominant market driver of U.S. stocks and continues to influence market leadership. The AI-driven rally led to historic levels of market concentration. The technology sector represented 36% of the S&P 500, exceeding the prior peak reached during the dot-com era. Just five stocks accounted for nearly 45% of the S&P 500’s total return in 2025 (1). Additionally, fewer than one-third of S&P 500 companies outperformed the index (2).

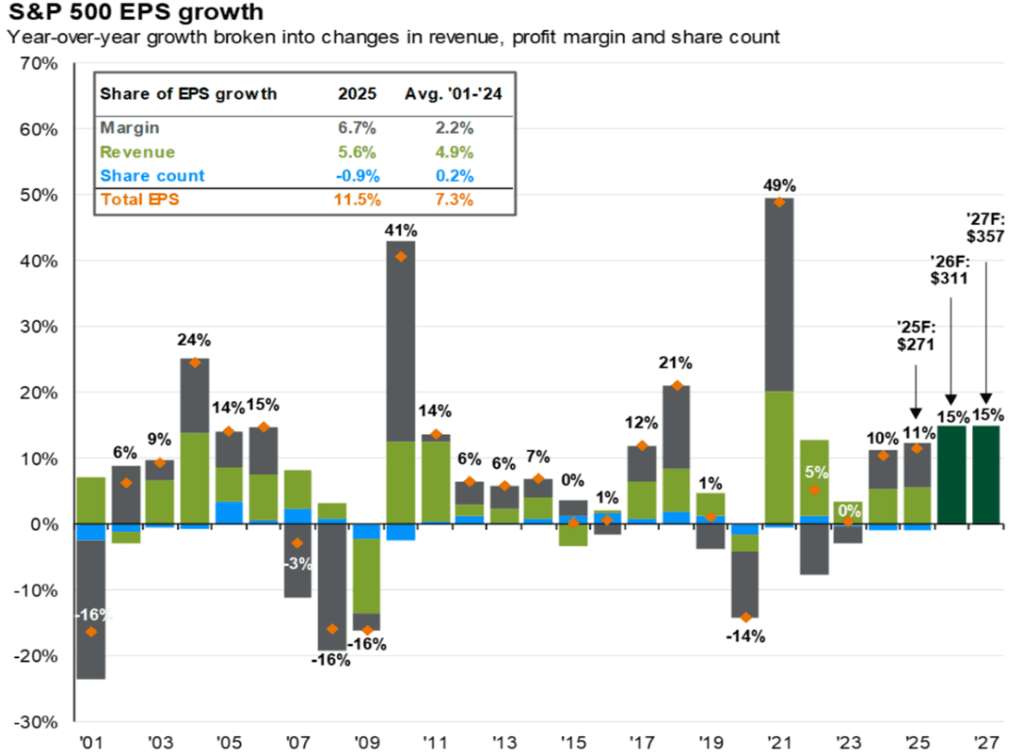

Looking ahead, earnings trends remain constructive, economic growth remains resilient, and ongoing Fed rate cuts combined with fiscal stimulus measures may continue to support growth. Strong AI-related investment was the backbone of U.S. growth in 2025, and that momentum may carry forward. In addition, the earnings picture is improving, with stronger earnings growth expected from non-tech companies and smaller companies.

At the same time, late-cycle dynamics are becoming more visible. The labor market continues to show signs of slowing. Investor expectations remain optimistic, leaving markets vulnerable to surprises. Geopolitical tensions persist, with the U.S. reshaping many norms. For example, the U.S. now has its highest effective tariff rate since 1935 (3). Furthermore, a top-heavy market increases the likelihood that company-specific issues could have broader market implications. Below is a summary of benchmark returns. (4)

U.S. Equities

- Equities outperformed other asset classes in Q4, led by international stocks and large-cap U.S. equities.

- Sector leadership broadened in Q4 as Growth cooled and cyclical Value sectors gained traction.

- With Fed easing underway, equities enter 2026 supported by policy tailwinds.

Since the rally began in April 2025, we have seen a steady reinforcement of bullish momentum across a broad range of market indicators. Historical data has been consistent with recent gains, but past trends may not persist.

Equities capped off a strong 2025 with continued leadership over other asset classes in Q4. Stocks again outperformed bonds, cash, and commodities, supported by easing financial conditions and a weakening U.S. dollar. International equities stood out, with developed markets edging out emerging markets during the quarter, while both outpaced U.S. benchmarks. Large-cap U.S. stocks led domestically, even as the tech-heavy Nasdaq cooled late in the year. Style performance was mixed: Value rebounded relative to Growth in Q4.

Sector performance in Q4 2025 reflected a clear shift toward balance after years of Growth dominance. For the bulk of the bull market since 2022, the largest stocks have led the market higher. Leadership broadened meaningfully into other sectors and stocks compared with earlier phases of the bull market, marking a meaningful transition in market dynamics.

Most sectors posted gains during the quarter, led by economically sensitive sectors such as Financial, Materials, and Industrials. Meanwhile, Defensive sectors struggled, a signal of potential economic reacceleration, or at least a clue that the economy was unlikely to head for a recession soon.

Momentum and Growth factors delivered strong returns, while Quality and dividend-oriented strategies struggled.

Corporate earnings grew double digits in 2025 (5). At year-end, investors expected double-digit growth in 2026 on the back of solid productivity gains, subdued wage pressures, and tax cuts. If earnings meet expectations, valuations will need to fall significantly for stocks to be lower one year from now.

However, earnings growth is cyclical, and an unexpected dramatic slowdown in economic growth could limit further upside, leaving equity markets vulnerable at elevated valuations.

The Fed resumed rate cuts in September, and markets expect further easing into 2026, albeit at a slower pace. Historically, equities have responded favorably following the restart of easing cycles, suggesting a constructive backdrop for Q1. The danger of re-surging inflation in combination with slowing growth remains, but it has not shown up in the data.

International Equities

- Global markets ended 2025 mixed, with steady growth and low recession risk.

- Emerging markets and Europe outperformed, while the U.S. and U.K. lagged.

- Key factors for 2026 include interest rates, currencies, inflation, and geopolitics.

Global equity markets closed the fourth quarter of 2025 with a mixed but generally constructive backdrop. The U.S. dollar fell over 9% in 2025, pressured by a high starting valuation and mounting concerns about global investor concentration in U.S. assets, the health of the U.S. economy and U.S. government policy. With the Federal Reserve still focused on easing policy and other global central banks either at or near the end of their rate cutting cycles, narrowing interest rate differentials and a still high trade deficit may drive a further decline in the dollar.

Even after this rally, international stocks continue to trade at a large discount to their U.S. counterparts. International markets have underperformed U.S. stocks in every rolling 3-year annualized return since 2009 (6). One year does not mark a trend change, but we are closely monitoring to see if non-U.S. stocks deserve a higher weighting in portfolios.

Most major economies continued to expand, avoiding recession despite persistent macro crosscurrents. The U.S., eurozone, Japan, and India maintained steady growth, while momentum softened modestly in the U.K., China, and Brazil. Inflation appears to be either steady or moving lower in most of the world’s major economies (chart right). Overall, fiscal and monetary policy conditions remained supportive, helping underpin risk assets late in Q4.

International equities showed notable regional divergence. Emerging markets benefited from improving relative growth dynamics, easing inflation, and supportive currency trends as the U.S. dollar weakened. Europe’s recovery gained traction and continued to outperform as growth broadened beyond the core economies, supported by accommodative financial conditions and improving real incomes.

In contrast, U.S. equities lagged international peers amid valuation concerns, while U.K. equities were constrained by slower domestic growth and sector concentration.

China’s economy met its annual growth objectives, supported by manufacturing strength and exports.

Looking into Q1 2026, the key variables to monitor will be interest rate trends, inflation expectations, currency movements, and global trade developments. Rising real yields or renewed dollar strength could challenge risk assets, while stable rates, easing inflation, and policy continuity would support international equity performance early in the year. Geopolitical developments and shifts in fiscal policy, particularly in Europe and the U.S., may also play a meaningful role in shaping investor sentiment and regional market leadership as the new year begins.

U.S. Economy & Fixed Income

- U.S. growth remained resilient despite manufacturing and labor market weakness, supported by strong consumers and exports.

- Inflation stayed above target but eased late quarter, calming fears of restrictive policy.

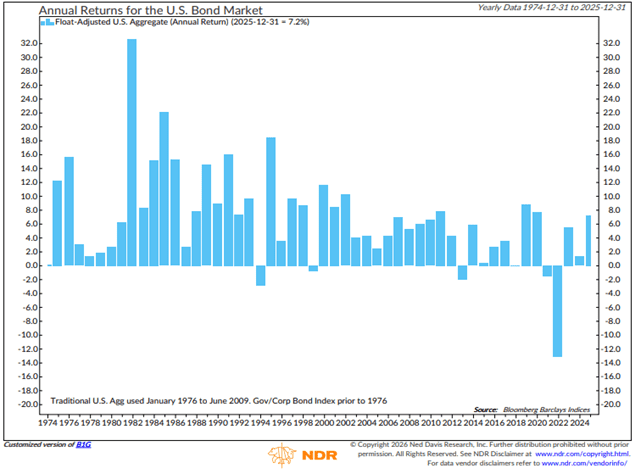

- Falling yields and Fed easing supported bonds, with gradual cuts expected into 2026.

Economic data in Q4 2025 painted a mixed but resilient picture for the U.S. economy. Manufacturing remained a clear weak spot, with the ISM Manufacturing PMI falling further into contraction in December, signaling widespread softness in factory activity. In contrast, overall growth surprised to the upside. Real GDP grew at a 4.3% annualized pace in Q3, driven primarily by strong consumer spending and investment in AI, while government spending also contributed. On a year-over-year basis, the U.S. economy grew 2.3%, though data quality was clouded by disruptions from the prolonged government shutdown.

The inflation storm that dominated recent years appeared to be easing, at least in the short term. November and December inflation surprised to the downside, easing investor concerns about persistent inflation pressures. Housing data continued to point to subdued growth, which should keep inflation from re-accelerating in the near term. A risk we continue to follow was a repeat of the 1960s and early 1970s, where the Fed lowered rates after an initial inflation wave only to see inflation rise again as the economy regained strength.

The labor market was stable on the surface, even though momentum faded underneath. Virtually every measure of the labor market moved the wrong way. A “no hire, no fire” dynamic had prevailed for the better part of two years, leading to a slow rise in the unemployment rate without the recessionary sting of mass layoffs. While this was bad news for workers seeking new jobs, it appeared to be cooling in a way that benefited corporate profitability (by increasing productivity and reducing costs). However, if this trend continues, recession risks will rise further.

Looking ahead, the start of 2026 marks key shifts in policy on multiple fronts:

- A reversal in fiscal spending from a Q4 2025 drag to an early 2026 tailwind driven by the “One, Big, Beautiful Bill Act.”

- Lagged effects from Fed rate cuts over the past 18 months, easing financial conditions

The Fed resumed rate cuts in September, delivering three reductions by year-end as labor market risks rose. Looking into Q1 2026, markets expect continued, though slower, easing. While inflation is likely to remain above target near term, fading tariff effects later in 2026 may allow further cuts, supporting bond returns amid moderating growth.

Footnotes:

- Factset

- Ned Davis Research

- Yale Budget Lab, as of 11/17/25

- Morningstar Direct, Factset. as of 12/31/2025. Indexes are unmanaged and cannot be invested in directly. Returns are total return unless noted.

- JPMorgan Guide to the Markets, as of 12/31/25

- JPMorgan Guide to the Markets, as of 12/31/25

None of the above is a prediction or guarantee. Markets involve risk, and the views are subject to change based on incoming data.

Disclosures: Leonard Rickey Investment Advisors, P.L.L.C. (“LRIA”) is an SEC-registered investment adviser. Registration does not imply a certain level of skill or training. This material is for informational purposes only and is not individualized investment, tax, or legal advice. Opinions are as of the date shown and may change. Forward-looking statements are not guarantees and involve risks and uncertainties. Indexes are unmanaged, do not incur fees, and cannot be invested in directly. Past performance is not indicative of future results. For additional information about LRIA, our Form ADV and Form CRS are available upon request. Other factors supporting stocks include corporate profits broadening across sectors, policy support through fiscal spending and lower interest rates, and continued AI-driven investment and innovation.

Company News

Market Commentary

Retirement Planning

Tax Planning

Cyber Security

Important Disclosures

Leonard Rickey Investment Advisors, PLLC (“LRIA”), is an SEC registered investment adviser located in the State of Washington. Registration does not imply a certain level of skill or training. For information pertaining to the registration status of LRIA, please contact LRIA or refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov).

This is provided for general information only and contains information that is not suitable for everyone. As such, nothing herein should be construed as the provision of specific investment advice or recommendations for any individual. To determine which investments may be appropriate for you, consult your financial advisor prior to investing. There is no guarantee that the views and opinions expressed herein will come to pass. This newsletter contains information derived from third party sources. Although we believe these third-party sources to be reliable, we make no representations as to the accuracy or completeness of any information prepared by any unaffiliated third party incorporated herein and take no responsibility therefore.

Any projections, forecasts and estimates, including without limitation any statement using “expect” or “believe” or any variation of either term or a similar term, contained here are forward-looking statements and are based upon certain current assumptions, beliefs and expectations that LRIA considers reasonable or that the applicable third parties have identified as such. Forward-looking statements are necessarily speculative in nature, and it can be expected that some or all of the assumptions or beliefs underlying the forward-looking statements will not materialize or will vary significantly from actual results or outcomes. Some important factors that could cause actual results or outcomes to differ materially from those in any forward-looking statements include, among others, changes in interest rates and general economic conditions in the U.S. and globally, changes in the liquidity available in the market, change and volatility in the value of the U.S. dollar, market volatility and distressed credit markets, and other market, financial or legal uncertainties. Consequently, the inclusion of forward-looking statements herein should not be regarded as a representation by LRIA or any other person or entity of the outcomes or results that will be achieved by following any recommendations contained herein. While the forward-looking statements here reflect estimates, expectations and beliefs, they are not guarantees of future performance or outcomes. LRIA has no obligation to update or otherwise revise any forward-looking statements, including any revisions to reflect changes in economic conditions or other circumstances arising after the date hereof or to reflect the occurrence of events (whether anticipated or unanticipated), even if the underlying assumptions do not come to fruition. Opinions expressed herein are subject to change without notice and do not necessarily take into account the particular investment objectives, financial situations, or particular needs of all investors.

For additional information about LRIA, including fees and services, please contact us for our Form ADV disclosure brochure using our contact information herein. Please read the disclosure brochure carefully before you invest or send money.

2025 3rd Quarter Investment Commentary