Jun 9, 2025 Will I Owe Estate Tax?

As with most financial planning questions, the answer depends on your personal situation. Right now, several states impose their own estate tax. These include:

Connecticut, Washington D.C., Hawaii, Illinois, Maine, Maryland, Massachusetts, Minnesota, New York, Oregon, Rhode Island, Vermont, and Washington.

If you live in one of these states, whether your estate will owe tax depends on your total net worth and that state’s exemption amount when you pass away. If you don’t live in one of these states, you’ll only need to consider federal estate tax rules.

Federal Estate Tax

At the federal level, estate taxes only apply if your estate exceeds $13.99 million per individual. This elevated exemption is temporary and is set to expire at the end of 2025. If it’s not extended (though it might be under the proposed “One Big Beautiful Bill”), the exemption will drop to around $6.8 million in 2026.

To calculate estate tax, all of the deceased’s assets are added up. Then, the applicable exemption is subtracted. If there’s anything left above the exemption, estate tax may be owed. Importantly, the estate itself—not the heirs—is responsible for paying the tax.

Inheritance Tax

A few states also impose an inheritance tax, which works differently from an estate tax. Instead of taxing the entire estate, an inheritance tax is based on what each individual beneficiary receives. The six states that currently impose an inheritance tax are: Iowa, Kentucky, Maryland, Nebraska, New Jersey, and Pennsylvania.

The tax rate and exemptions vary depending on the relationship between the deceased and the beneficiary.

If you’d like to learn more, check out this helpful overview from the Tax Foundation: Tax Foundation – Estate and Inheritance Taxes

Washington State Update

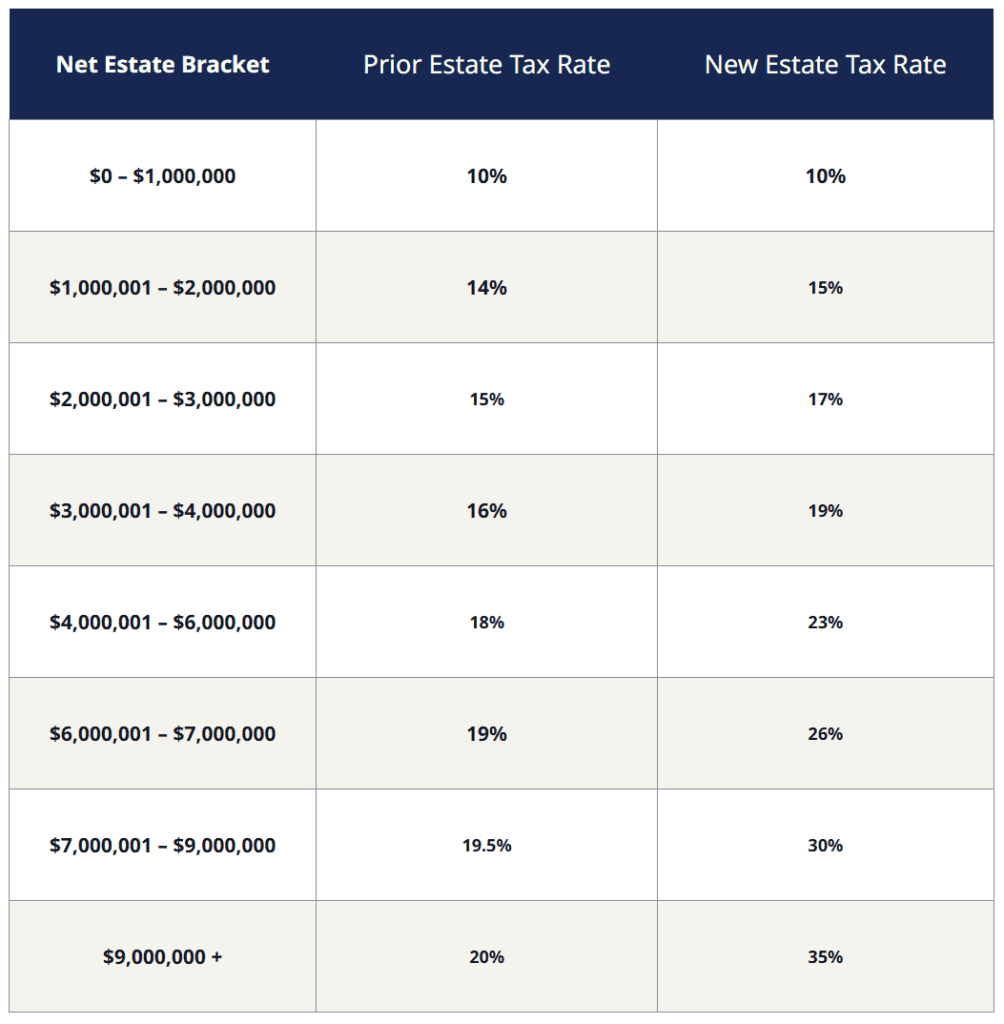

Washington recently passed a new law that increases the state’s estate tax exemption from $2.193 million to $3 million per person, starting July 1, 2025. Beginning in 2026, this exemption will be adjusted for inflation.

However, the state also raised estate tax rates overall. So, while more estates will now fall below the exemption, those above it may face higher taxes.

Example Scenarios:

- If someone passes away in July 2025 with a net worth of $2.8 million, their estate won’t owe any tax—it’s under both the Washington and federal exemptions.

- If someone passes away in July 2025 with a net worth of $5 million, the estate would owe Washington State estate tax on $2 million, the amount above the $3 million exemption. Since the estate is still below the federal limit, no federal estate tax would apply.

Chart source: https://www.eidebailly.com/insights/alerts/2025/washington-state-increases-estate-and-capital-gains-taxes

What Should I Do?

It is important to review your estate plan every few years. This includes reviewing your Will, any trusts, beneficiaries, and Powers of Attorney. Leonard Rickey Investment Advisors is not a law firm and does not provide legal advice. As your financial advisor, we can help by making sure your net worth is complete and that you understand the current flow of your accounts if something happens to you. We can help guide you through the process and connect you with the right professional to make sure your estate plan is complete.

If you would like to review your estate plan, you can contact your advisor to set up a review. If we don’t have copies of your current documents, please bring them with you or drop them off prior to your meeting.

Company News

Market Commentary

Retirement Planning

Tax Planning

Cyber Security

Important Disclosures

Leonard Rickey Investment Advisors, PLLC (“LRIA”), is an SEC registered investment adviser located in the State of Washington. Registration does not imply a certain level of skill or training. For information pertaining to the registration status of LRIA, please contact LRIA or refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov).

This is provided for general information only and contains information that is not suitable for everyone. As such, nothing herein should be construed as the provision of specific investment advice or recommendations for any individual. To determine which investments may be appropriate for you, consult your financial advisor prior to investing. There is no guarantee that the views and opinions expressed herein will come to pass. This newsletter contains information derived from third party sources. Although we believe these third-party sources to be reliable, we make no representations as to the accuracy or completeness of any information prepared by any unaffiliated third party incorporated herein and take no responsibility therefore.

Any projections, forecasts and estimates, including without limitation any statement using “expect” or “believe” or any variation of either term or a similar term, contained here are forward-looking statements and are based upon certain current assumptions, beliefs and expectations that LRIA considers reasonable or that the applicable third parties have identified as such. Forward-looking statements are necessarily speculative in nature, and it can be expected that some or all of the assumptions or beliefs underlying the forward-looking statements will not materialize or will vary significantly from actual results or outcomes. Some important factors that could cause actual results or outcomes to differ materially from those in any forward-looking statements include, among others, changes in interest rates and general economic conditions in the U.S. and globally, changes in the liquidity available in the market, change and volatility in the value of the U.S. dollar, market volatility and distressed credit markets, and other market, financial or legal uncertainties. Consequently, the inclusion of forward-looking statements herein should not be regarded as a representation by LRIA or any other person or entity of the outcomes or results that will be achieved by following any recommendations contained herein. While the forward-looking statements here reflect estimates, expectations and beliefs, they are not guarantees of future performance or outcomes. LRIA has no obligation to update or otherwise revise any forward-looking statements, including any revisions to reflect changes in economic conditions or other circumstances arising after the date hereof or to reflect the occurrence of events (whether anticipated or unanticipated), even if the underlying assumptions do not come to fruition. Opinions expressed herein are subject to change without notice and do not necessarily take into account the particular investment objectives, financial situations, or particular needs of all investors.

For additional information about LRIA, including fees and services, please contact us for our Form ADV disclosure brochure using our contact information herein. Please read the disclosure brochure carefully before you invest or send money.

2025 4th Quarter Investment Commentary