Jul 21, 2025 2025 2nd Quarter Investment Commentary

- Historic V-shaped rebound: U.S. large-cap stocks, as measured by the S&P 500, staged the fastest recovery from a 15%+ correction on record and finished the quarter at new all-time highs. Growth stocks led the rally in the U.S., but performance broadened globally as U.S. dollar weakness boosted international returns3.

- Economy cooling, not cracking: The economy showed signs of cooling while strong corporate and consumer balance sheets supported economic growth in the near term. Policy uncertainty and supply disruptions raise the risk of a contraction.

- Our playbook: We maintain a modest risk-on but diversified stance. We favor a slight equity tilt and short-term bonds and diversify into real assets and non-USD assets.

Market and Economic Summary

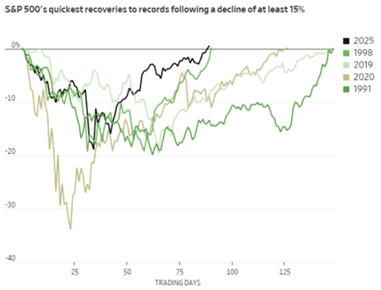

Second‑quarter price action defied the bearish consensus from April when President Trump announced a sweeping baseline 10% tariff and threatened 50% reciprocal levies. Within six trading days, the S&P 500 shed 12% for a total decline of 19% from its February highs. Yet by mid‑June, the index recovered and posted new record highs, marking the quickest rebound on record from a 15%‑plus correction.

The quick recovery was mainly due to a de-escalation of tariff policy. Most reciprocal tariffs were suspended for 90 days, and the U.S. and China de-escalated from extreme retaliatory measures in mid-May, which provided further relief to the markets. Many countries engaged with the U.S. on trade negotiations before the July 9 deadline (pushed back to August 1st); however, there was still considerable uncertainty about whether, when, and how much tariffs would be implemented.

The rebound was also supported by strong corporate earnings growth and growing expectations for interest rate cuts. The rally was concentrated in Growth areas of the market—Technology, Communication Services, and Consumer Discretionary led the way, while defensive sectors lagged. Stocks outside the U.S. fared even better thanks to U.S. dollar weakness. The U.S. dollar declined 10.8% in the first half, its worst start since 1979. Concerns around inflation caused by deficits, money printing, and economic isolationism helped non-U.S. stocks outperform during the quarter. The weak dollar also helped gold prices double since 2022.

Fixed‑income markets were more subdued but posted positive returns. Long-term bonds sold off due to concerns about the inflationary aspects of tariffs and the large U.S. budget deficit. The Fed maintained its benchmark interest rate range of 4.25–4.50% and remained divided on the necessity or timing of potential rate cuts later this year.

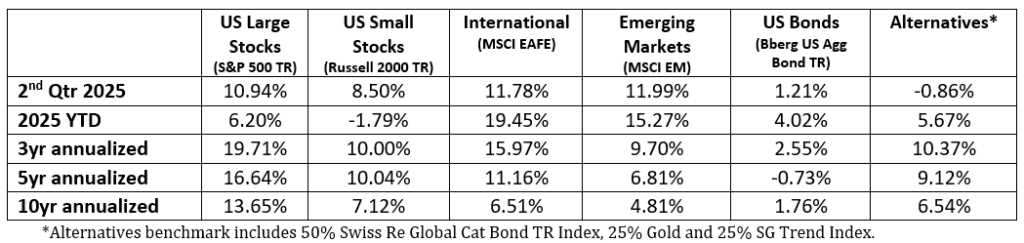

Economic signals were mixed. Sentiment data was weak due to the threat of tariffs harming economic growth and contributing to inflation, while hard data mainly remained resilient. Notably, job growth slowed to its weakest non-recessionary pace in over a decade, while consumer and corporate spending stayed firm. Below is a summary of benchmark returns (1).

Markets

The quarter delivered one of the most dramatic market reversals in recent history. The S&P 500 gained nearly 25% from the April 8th lows and took only 89 days to recover back to all-time highs reached in February (see chart (2)).

We believe the underlying reason for the strong rally was the U.S. administration’s policy pivot towards tariffs and fiscal stimulus. What started as the largest effective tariff rate in decades turned into tariff pauses and progress on trade negotiations. In addition, efforts to reduce the federal deficit were substituted by the cancellation of “DOGE” and the passing of the “One Big Beautiful Bill,” which the CBO estimates will expand the primary budget deficit by $2.4 trillion over the next decade.

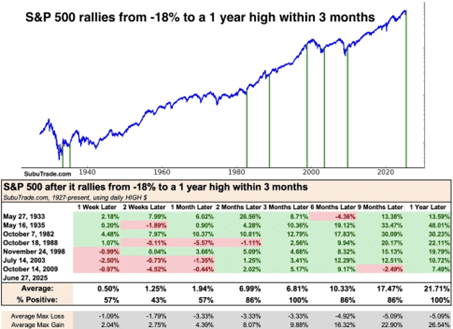

The quick turnaround contributed to a positive technical picture. Several historical market studies point to a strong momentum effect with above-average gains for the coming one-year period. For example, when the S&P 500 rallies from -18% to a 1-year high within 3 months, the track record going back to 1927 is excellent (see chart). This positive impulse could have a lasting influence over many months as it signals a significant shift in supply/demand has occurred.

Another important theme that emerged in the first half of the year was meaningful U.S. dollar weakness. The U.S. dollar posted its second straight quarterly decline and its worst first-half performance in decades. This led to strong outperformance from both developed and emerging markets, not just in equities but also in bonds. European stocks were bolstered by fiscal stimulus plans to enhance defense spending and infrastructure, providing additional market confidence. Looking forward, international markets present attractive investment opportunities driven by valuation discounts relative to the U.S. The MSCI ACWI ex USA trades at 14.1 times forward earnings versus 22.8 times for the S&P 500.

Earnings expectations remained positive, driven by ongoing growth in AI sectors such as technology and industrials. We saw signs that the AI theme is broadening out to non-tech industries that could drive productivity and boost profits in the long term. S&P 500 earnings per share grew at approximately 10% in Q1 (3). We see scope for overall corporate earnings to stay solid even if tariff-induced disruptions and corporate caution dent U.S. growth. Low corporate taxes, regulatory reforms, and AI productivity may contribute to a strong corporate earnings environment. Earnings have driven nearly all long-term stock market returns, so this is an important metric.

Looking ahead, bull market behavior is widespread, both in the U.S. and around the world. The technical picture favors the continuation of the current rally. However, high expectations and general investor optimism are already priced into many parts of the market, which leaves little margin of safety. There is a significant risk of stocks not meeting those higher expectations. For example, U.S. growth stocks are approaching their prior peak valuation just as the group’s capital investment surges. U.S. large value, US mid-cap, and non-U.S. stocks have not participated nearly as much in the last two years, leaving their valuations near historical averages and inexpensive relative to U.S. growth.

Economy

The U.S. economy remained broadly resilient despite the market turmoil and policy uncertainty. After a contraction of 0.5% in Q1, GDP data signaled a modest recovery in Q2 (4). Consumer spending data remained strong, and most labor market indicators remained stable. If consumers have jobs, which they do, it’s difficult for spending to materially slow down. In addition, federal deficit spending was still going strong without any sign of slowing down.

Inflation remained contained in the face of higher tariffs, easing to 2.7% year over year compared to 2.9% at the end of 2024. Fed Chair Jerome Powell committed to remaining patient and data-dependent, emphasizing that the economy’s solid footing gives the Fed time to monitor how tariffs play out. Market pricing signaled three more rate cuts in 2025.

We can’t discuss the current state of the economy without discussing government policy. Changes in the economic status quo due to policies under the current administration have the potential to strongly and quickly influence major macroeconomic factors. These policies and their effects are complicated to forecast and lead to a wide range of possible outcomes.

For example, US trade policies have heightened economic uncertainty and weakened consumer confidence and business investment. A global trade war would be negative, but there is also the potential for positive outcomes, like lower trade barriers.

Tariffs can be viewed as a consumption tax. Foreign producers may eat some of that tax. US consumers and businesses may bear some of it, but the exact mix isn’t known. What is known is that the U.S. imports goods and services worth roughly $4 trillion every year. According to Bank of America, investors estimated the U.S. would settle on a final tariff rate of approximately 14% on the rest of the world. A 14% tariff would raise almost $600 billion in tariff revenue. If this were a tax hike, it would be the equivalent of doubling the corporate tax rate from 21% to 42%.

The “One Big Beautiful Bill” aims to offset the negative ramifications of tariffs by expanding the primary budget deficit by $2.4 trillion over the next decade, driven by significant tax cuts. Although tariff revenue isn’t included in the bill, CBO estimates $2.8 trillion in tariff revenue by 2035 could help offset costs. The bill’s tax cuts are front-loaded while spending cuts are delayed, offering near-term economic stimulus.

Finally, Federal Reserve policy could change with the nomination of a new chairman in 2026. President Trump has clearly stated his desire to reduce interest rates and seems likely to nominate someone who shares this view. While the Fed Chair has only one vote on this board-made decision, they hold a leadership role. A change in the rate could add further stimulus and increase the risk of inflation turning higher.

The second half of the year could be more challenging, however. A key uncertainty is how tariffs evolve following President Trump’s Aug. 1 deadline for new trade deals. The question of what happens next revolves around how or if inflation will change due to tariffs, and how the Federal Reserve reacts, or doesn’t. In addition, the labor market’s rising continuing claims and decreasing weekly hours worked signaled potential warning signs of a broader slowdown.

Certain statements made herein are forward-looking and reflect our current views, which are subject to change without notice. These statements do not guarantee future results. Please contact your advisor to discuss how these views may or may not apply to your individual investment strategy.

Footnotes:

- Morningstar Direct, Factset. As of 6/30/2025

- Ned Davis Research, Dow Jones Market Data

- Day Hagan Research

- Atlanta Fed GDPNow estimate of 2.5% GDP as of 7/1/2025

INDEX DEFINITIONS

The Barclays Aggregate Bond Index represents securities that are SEC-registered, taxable, and dollar denominated. The index covers the US investment-grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities.

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. It cannot be invested into directly.

The Russell 2000 Index is an unmanaged index generally representative of the 2,000 smallest companies in the Russell Index, which represents approximately 10% of the total market capitalization of the Russell 3000 Index.

The MSCI Emerging Markets Index is a float-adjusted market capitalization index that consists of indices of approximately 800 stocks and is designed to measure equity market performance in 23 emerging economies: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Malaysia, Mexico, , Peru, Philippines, Poland, Qatar, Russia, South Africa, Taiwan, Thailand, Turkey, and the United Arab Emirates.

The MSCI EAFE (Europe, Australasia, Far East) Index is a free float-adjusted market capitalization index of approximately 900 stocks and is designed to measure equity market performance in 21 developed market countries outside of North America.

The SG Trend Index is a subset of the SG CTA Index and follows traders of trend following methodologies. The SG CTA Index is equal weighted, calculates the daily rate of return for a pool of CTAs selected from the larger managers that are open to new investment.

Swiss Re Global Cat Bond Index tracks the aggregate performance of all catastrophe bonds issued offered under Rule 144A. The index captures bonds denominated in any currency, all rated and unrated cat bonds, outstanding perils, and triggers. The index is not exposed to currency risk from non-USD denominated cat bonds.

The Nasdaq Composite Index is a market capitalization-weighted index of more than 3,000 stocks listed on the Nasdaq stock exchange.

Gold is the spot price at which gold is traded on the New York Mercantil Exchange’s Commodities Exchange

Company News

Market Commentary

Retirement Planning

Tax Planning

Cyber Security

Important Disclosures

Leonard Rickey Investment Advisors, PLLC (“LRIA”), is an SEC registered investment adviser located in the State of Washington. Registration does not imply a certain level of skill or training. For information pertaining to the registration status of LRIA, please contact LRIA or refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov).

This is provided for general information only and contains information that is not suitable for everyone. As such, nothing herein should be construed as the provision of specific investment advice or recommendations for any individual. To determine which investments may be appropriate for you, consult your financial advisor prior to investing. There is no guarantee that the views and opinions expressed herein will come to pass. This newsletter contains information derived from third party sources. Although we believe these third-party sources to be reliable, we make no representations as to the accuracy or completeness of any information prepared by any unaffiliated third party incorporated herein and take no responsibility therefore.

Any projections, forecasts and estimates, including without limitation any statement using “expect” or “believe” or any variation of either term or a similar term, contained here are forward-looking statements and are based upon certain current assumptions, beliefs and expectations that LRIA considers reasonable or that the applicable third parties have identified as such. Forward-looking statements are necessarily speculative in nature, and it can be expected that some or all of the assumptions or beliefs underlying the forward-looking statements will not materialize or will vary significantly from actual results or outcomes. Some important factors that could cause actual results or outcomes to differ materially from those in any forward-looking statements include, among others, changes in interest rates and general economic conditions in the U.S. and globally, changes in the liquidity available in the market, change and volatility in the value of the U.S. dollar, market volatility and distressed credit markets, and other market, financial or legal uncertainties. Consequently, the inclusion of forward-looking statements herein should not be regarded as a representation by LRIA or any other person or entity of the outcomes or results that will be achieved by following any recommendations contained herein. While the forward-looking statements here reflect estimates, expectations and beliefs, they are not guarantees of future performance or outcomes. LRIA has no obligation to update or otherwise revise any forward-looking statements, including any revisions to reflect changes in economic conditions or other circumstances arising after the date hereof or to reflect the occurrence of events (whether anticipated or unanticipated), even if the underlying assumptions do not come to fruition. Opinions expressed herein are subject to change without notice and do not necessarily take into account the particular investment objectives, financial situations, or particular needs of all investors.

For additional information about LRIA, including fees and services, please contact us for our Form ADV disclosure brochure using our contact information herein. Please read the disclosure brochure carefully before you invest or send money.

2025 4th Quarter Investment Commentary