Jul 21, 2025 The One Big Beautiful Bill – Bite by Bite

PART 1

The One Big Beautiful Bill (OBBB), signed into law on July 4, 2025, covers a broad spectrum of tax issues concerning individuals and businesses. Some changes are retroactive to the beginning of 2025, some take effect next year in 2026, and some are temporary, while some are permanent. In this series over the next few months, we will summarize key provisions of the bill piece by piece, starting with those to consider for this tax year.

The OBBB permanently extended many parts of the Tax Cuts and Jobs Act that were set to expire at the end of 2025. Much of the tax code we are used to will remain, including the current tax brackets, the larger standard deductions, no personal exemptions, increased child tax credit, and larger estate tax federal limit. Many of these had small changes that we will review.

Standard Deduction Increases

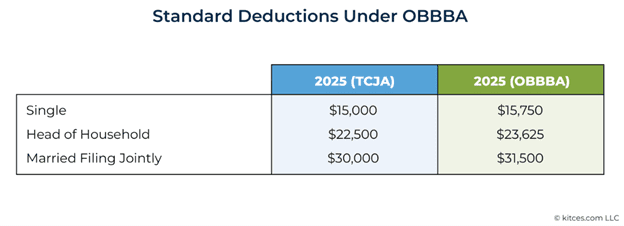

The base standard deduction is getting a slight increase starting in 2025. See the chart below:

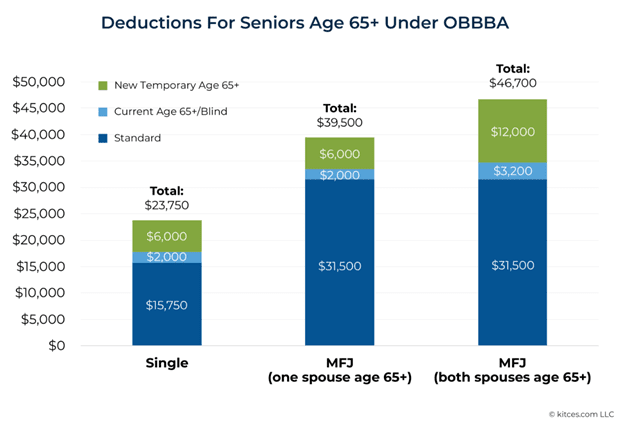

The bigger change is a temporary additional standard deduction of $6,000 from 2025 – 2028 for those over 65. This additional deduction is phased out for single filers starting with Modified Adjusted Gross Income (MAGI) over $75,000 and eliminated at $175,000 MAGI. The phase-out range for those who file jointly is $150,000 to $250,000.

For example, a married couple over age 65 with MAGI under $150,000 had a standard deduction of $33,200 before the OBBB and is now at $46,700.

Social security’s taxability is still calculated the same as last year and will not change. Even though there is more of a deduction for some, it is a below-the-line deduction and does not affect the Adjusted Gross Income used to calculate provisional income for social security.

State and Local Tax (SALT)

One of the highest negotiated items was the State and local tax (SALT) deduction. This is one of the itemized deductions on Schedule A. The Taxpayer can take the standard deduction or itemize if they have more deductions than the standard. Taxpayers were limited to deducting $10,000 of other taxes paid, so if you lived in a state with income taxes or high property taxes, you were likely not able to deduct all of them. The limit is now $40,000 starting in 2025. This is a temporary increase from 2025 to 2029. The limit will increase by 1% each year during that time and revert to $10,000 in 2030.

The higher SALT is also subject to phase-outs based on MAGI over $500,000. When you reach the upper phase-out limit of $600,000, you are capped at $10,000 SALT deduction. For those near the $500,000 phase-out range and itemizing, developing a strategy to keep income below that or bunch deductions into a particular year might make sense.

For business owners of pass-through businesses with state tax payments, there is a way to structure their taxes to be paid by the business and, therefore, not subject to the SALT limit on a personal level. You can consult your CPA to confirm you are setting these up correctly.

Tip Deduction

The promise of ‘no tax on tips’ was partially fulfilled in the OBBB. From 2025 to 2028, a deduction is created for up to $25,000 of qualified tip income. Tips are still subject to payroll tax and possibly state income tax.

To be qualified for tip income, the taxpayer must work somewhere that traditionally receives tips. Tips must be voluntary and determined by the payor, and they cannot be earned through an SSTB (specified service trade or business).

This deduction is also phased out starting at $150,000 for single filers and $300,000 for joint filers. It is phased out at $100 per $1,000 of income over the income threshold.

Overtime Deduction

The ‘no tax on overtime’ promise was partially fulfilled in a similar way. It will also be in place from 2025-2028, but the deduction is limited to $12,500 for single and head of household and $25,000 for joint. The phase out is the same as the Tip deduction.

The other important note is that the deduction applies only to the overtime premium, the amount paid above the regular hourly rate, not the entire overtime pay.

Car Loan Interest Deduction

This bill also allows interest on new car loans to be deductible again only from 2025 to 2028. The vehicle must be for personal use, must be new, assembled in the US, and the loan must have started in 2025. Originally, this was going to include used vehicles, but the final version of the bill removed that.

The deduction is capped at $10,000 and is phased out for single filers at $100,000 up to $149,000 and for married filers starting at $200,000 up to $249,000.

Child Tax Credit Increase

Another change effective in 2025 is a permanent increase in the Child Tax credit to $2,200. It will automatically increase with inflation now as well. The refundable portion of the credit remains at $1,700.

The credit phase-out remains the same for single or head of households with MAGI over $200,000 or joint households over $400,000—the credit phases out by $50 for every $1,000 of AGI above those limits.

Summary

These are just a few of the effective changes from the OBBB for 2025. We will cover a few more changes for 2025 next month, including changes to 529 accounts and energy credits. After that, we will discuss changes for 2026.

Our team is making sure to incorporate these changes into our tax planning for this year and future years. If you have any questions, please contact your advisor.

Part 2: 529 Plan Flexibility and Clean Energy Credits

In this second installment of our series on the One Big Beautiful Bill (OBBB), signed into law on July 4, 2025, we’ll examine two additional areas with important implications for 2025 tax planning: 529 plan changes and updated energy tax credits.

Expanded Use of 529 Plans

The OBBB builds on prior reforms to 529 college savings plans and permits even greater flexibility in how these funds can be used.

New Eligible Expenses

Beginning January 1, 2025, qualified expenses now include:

- The legislation expanded K-12 qualified education expenses to include:

- Tuition.

- Curriculum and curricular materials.

- Books or other instructional materials.

- Online educational materials.

- Tuition for tutoring or educational classes outside of the home, including at a tutoring facility. The tutor cannot be related to the student and must qualify as one of the following:

- A licensed teacher,

- A current or former teacher at an eligible educational institution, or

- A subject matter expert in the relevant subject.

- Fees for a nationally standardized achievement test, an Advanced Placement examination, or any college admissions/entrance exam (e.g., SAT, ACT, etc.).

- Fees for dual enrollment in an institution of higher education.

- Educational therapies for students with disabilities provided by a licensed or accredited practitioner or provider, including occupational, behavioral, physical and speech-language therapies.

- The legislation applies to K-12 attendance or enrollment at a public, private or religious elementary or secondary school.

- Beginning January 1, 2026, the total limit for all K-12 expenses will rise to $20,000 per year (from $10,000).

529 accounts can also now be used for postsecondary credentials if the beneficiary is enrolled in a program. The credential must meet certain requirements but common examples are the Certified Public Accountant (CPA) or Certified Financial Planner (CFP) credentials. It would cover tuition, fees, books, supplies as well as testing fees and continuing education if required to maintain the credentials.

Expiring Energy Efficiency Credits

The Clean Vehicle Credit is a tax credit for up to $7,500 for a new electric vehicle and $4,000 for a used one. This credit will terminate after September 30, 2025. If you bought a vehicle that qualifies before this deadline, you will still get the tax credit.

Similarly, the Alternative Fuel Vehicle Refueling Property Credit is up to $1,000 for electric vehicle charging equipment installed at a taxpayer’s personal residence. This credit ends for property placed in service after June 30, 2026.

The Energy Efficient Home Improvement Credit is for up to $1,200 toward the cost of energy-efficiency improvements. Often used for windows, doors, insulation, or heating and cooling equipment. This credit is effective for property placed in service before December 31, 2025. If you are close to getting this done, it might make sense to do it this year if you qualify for the credit.

The Residential Clean Energy Credit is for up to 30% of the cost of purchasing or installing solar panels, wind power, geothermal heat pumps, or fuel cell equipment. The bill terminates this credit for expenditures made after December 31, 2025, regardless of when the property is placed in service.

What’s Next?

In next month’s article, we’ll turn our attention to the OBBBA changes that take effect in 2026, including updates to charitable deductions for non-itemizers, the TRUMP accounts, and the alternative minimum tax. Stay tuned as we continue unpacking the bill—bite by bite.

If you have questions about how these changes affect your planning for 2025, consult your advisor or tax professional. These articles are designed to help you identify areas of opportunity, but your specific circumstances matter most.

Disclosure: This material is for informational/educational purposes only and is not investment, legal, accounting, or tax advice. If you have questions about how these concepts apply to your situation, please consult a qualified financial professional.

Company News

Market Commentary

Retirement Planning

Tax Planning

Cyber Security

Important Disclosures

Leonard Rickey Investment Advisors, PLLC (“LRIA”), is an SEC registered investment adviser located in the State of Washington. Registration does not imply a certain level of skill or training. For information pertaining to the registration status of LRIA, please contact LRIA or refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov).

This is provided for general information only and contains information that is not suitable for everyone. As such, nothing herein should be construed as the provision of specific investment advice or recommendations for any individual. To determine which investments may be appropriate for you, consult your financial advisor prior to investing. There is no guarantee that the views and opinions expressed herein will come to pass. This newsletter contains information derived from third party sources. Although we believe these third-party sources to be reliable, we make no representations as to the accuracy or completeness of any information prepared by any unaffiliated third party incorporated herein and take no responsibility therefore.

Any projections, forecasts and estimates, including without limitation any statement using “expect” or “believe” or any variation of either term or a similar term, contained here are forward-looking statements and are based upon certain current assumptions, beliefs and expectations that LRIA considers reasonable or that the applicable third parties have identified as such. Forward-looking statements are necessarily speculative in nature, and it can be expected that some or all of the assumptions or beliefs underlying the forward-looking statements will not materialize or will vary significantly from actual results or outcomes. Some important factors that could cause actual results or outcomes to differ materially from those in any forward-looking statements include, among others, changes in interest rates and general economic conditions in the U.S. and globally, changes in the liquidity available in the market, change and volatility in the value of the U.S. dollar, market volatility and distressed credit markets, and other market, financial or legal uncertainties. Consequently, the inclusion of forward-looking statements herein should not be regarded as a representation by LRIA or any other person or entity of the outcomes or results that will be achieved by following any recommendations contained herein. While the forward-looking statements here reflect estimates, expectations and beliefs, they are not guarantees of future performance or outcomes. LRIA has no obligation to update or otherwise revise any forward-looking statements, including any revisions to reflect changes in economic conditions or other circumstances arising after the date hereof or to reflect the occurrence of events (whether anticipated or unanticipated), even if the underlying assumptions do not come to fruition. Opinions expressed herein are subject to change without notice and do not necessarily take into account the particular investment objectives, financial situations, or particular needs of all investors.

For additional information about LRIA, including fees and services, please contact us for our Form ADV disclosure brochure using our contact information herein. Please read the disclosure brochure carefully before you invest or send money.

2025 4th Quarter Investment Commentary