Posts Tagged ‘RMD’

2023 Year-End Tax Planning

The window for many tax-saving opportunities closes on December 31st. It’s important to evaluate your tax situation while there’s still time to affect your bottom line for the 2023 tax year. Your specific circumstances should be considered, so please reach out if you have any questions. Charitable Contributions There are a couple of ways to…

Read MoreWhen do I start my Required Minimum Distribution?

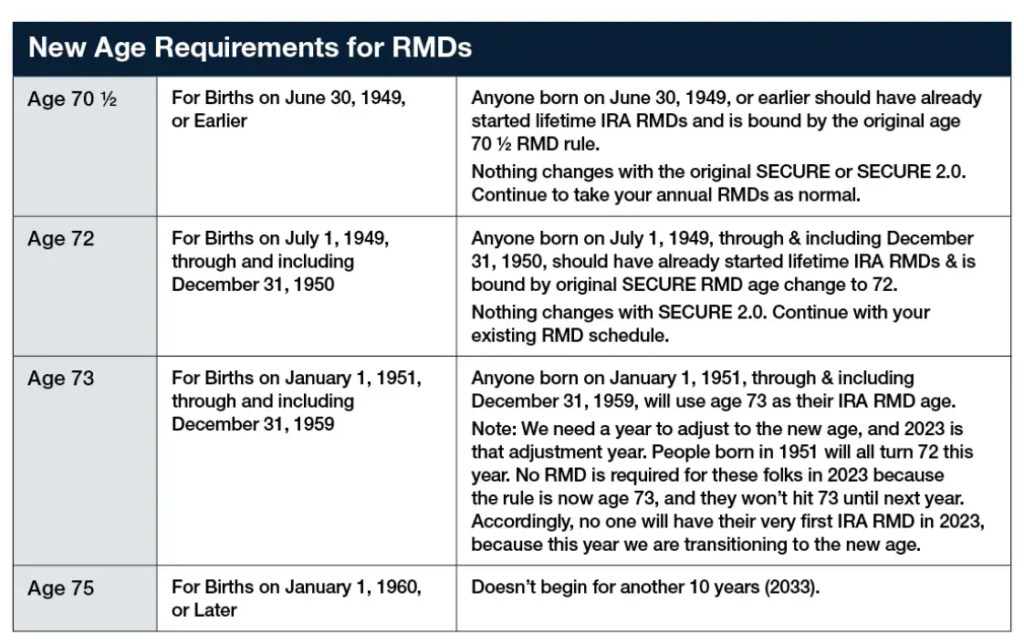

The Required Minimum Distribution (RMD) from an IRA or Employer-Sponsored retirement account began at age 70.5 for many years. It was then increased to age 72, then to age 73, and for some to age 75. So, the question remains for some; at what age will I start my Required Minimum Distribution? Below is a…

Read MoreThe 4 Changes from SECURE Act 2.0 You Should Know for 2023

SECURE Act 2.0 was signed into law at the end of 2022 as a follow up bill to the original SECURE Act that was signed into law in 2019. SECURE 2.0 targets several retirement provisions that go into effect over the next 10 years. We will focus on the changes for this year and continue…

Read More2022 Year-End Tax Planning

The window for many tax-saving opportunities closes on December 31st. It’s important to evaluate your tax situation, while there’s still time to affect your bottom line for the 2022 tax year. Your specific circumstances should be considered, so please reach out if you have any questions. Charitable Contributions There are a few ways to save…

Read MoreImportant Ages for Retirement Accounts

If you are over age 72 and have an IRA account, you are probably required to take a distribution (RMD) this year. If you inherited an IRA account, you might be required to take a distribution regardless of age. If this applies to you and we don’t have a planned distribution, we will contact you…

Read More