Posts Tagged ‘required minimum distributions’

When do I start my Required Minimum Distribution?

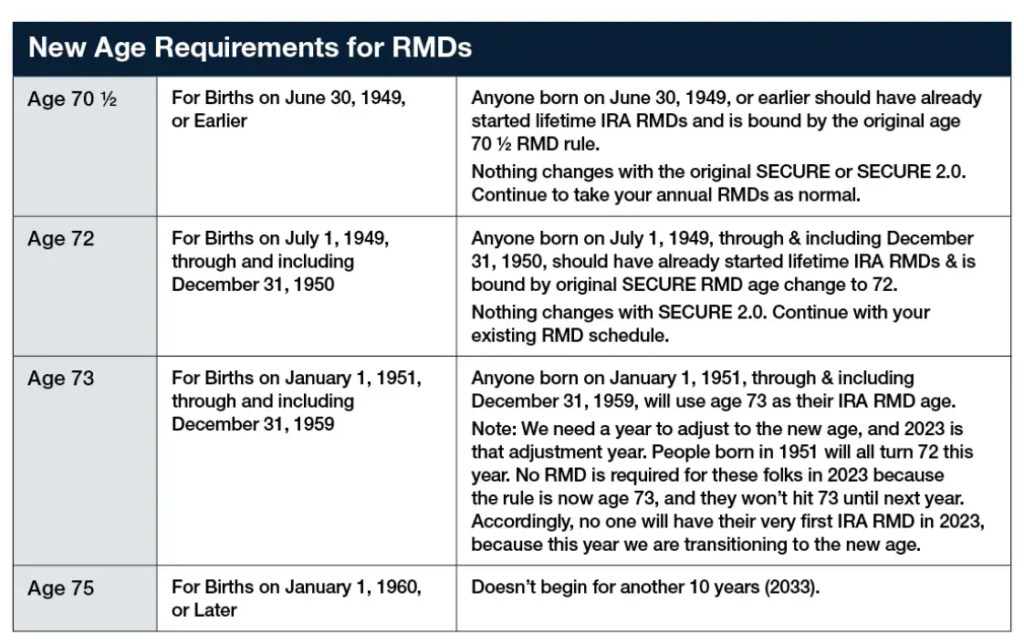

The Required Minimum Distribution (RMD) from an IRA or Employer-Sponsored retirement account began at age 70.5 for many years. It was then increased to age 72, then to age 73, and for some to age 75. So, the question remains for some; at what age will I start my Required Minimum Distribution? Below is a…

Read MoreImportant Ages for Retirement Accounts

If you are over age 72 and have an IRA account, you are probably required to take a distribution (RMD) this year. If you inherited an IRA account, you might be required to take a distribution regardless of age. If this applies to you and we don’t have a planned distribution, we will contact you…

Read More2021 Year-End Tax Planning

The window for many tax-saving opportunities closes on December 31st. It’s important to evaluate your tax situation, while there’s still time to affect your bottom line for the 2021 tax year. Your specific circumstances should be considered, so please reach out if you have any questions about 2021 Year-End Tax Planning. Charitable Contributions There are…

Read More