Blog Retirement Planning

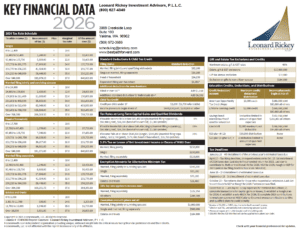

The annual exclusion for gifts remained at $19,000 for 2026. The limitation on deferrals for 401(k), 403(b), and 457 plans is increased to $24,500 for 2026, up from $23,500 in 2025. The catch-up for those over age 50 was increased to $8,000 from $7,500, so if you are maxing out your plan and over age…

Read MoreStarting January 1, 2026, a change under the SECURE 2.0 Act will affect how some employees age 50 and older make catch-up contributions to their workplace retirement plans. What’s Changing? If you turn 50 or older in 2026 and your 2025 FICA wages (Box 3 of your W-2) with your current employer were over $150,000*,…

Read MoreStarting in January 2026, Social Security beneficiaries will receive a 2.8% cost-of-living adjustment (COLA) designed to help benefits keep pace with inflation. The adjustment is based on the Consumer Price Index, reflecting changes in the cost of goods and services over the past year. Beneficiaries will be notified of their new benefit amounts by mail…

Read MoreYou still have time to contribute to your Traditional IRA, Roth IRA, SEP IRA, and HSA accounts for 2024. Contributions are due by the earlier of April 15, 2025, or the filing date of your tax return. For 2024, you can contribute up to $7,000 to your Traditional or Roth IRA and an additional $1,000…

Read MoreSocial Security recipients are getting a 3.2% increase in their 2024 benefits. The Medicare Part B premium is increasing from $164.90 to $174.70 per month. The annual exclusion for gifts increases to $18,000 from $17,000 per year per individual. The limitation on deferrals for 401(k), 403(b), and most 457 plans is increased to $23,000 for…

Read MoreSECURE Act 2.0 was signed into law at the end of 2022 as a follow up bill to the original SECURE Act that was signed into law in 2019. SECURE 2.0 targets several retirement provisions that go into effect over the next 10 years. We will focus on the changes for this year and continue…

Read MoreMedicare beneficiaries can make new choices and pick plans that work best for them during the annual Medicare Open Enrollment Period. Each year, Medicare plan costs and coverage typically change. In addition, your health-care needs may have changed over the past year. The Open Enrollment Period — which begins on October 15th and runs through…

Read More