Blog Market Commentary

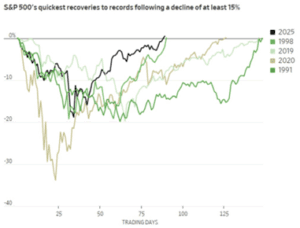

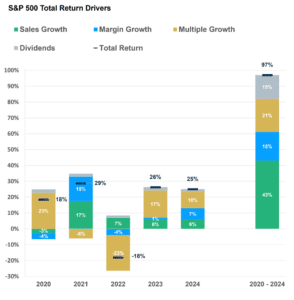

Historic V-shaped rebound: U.S. large-cap stocks, as measured by the S&P 500, staged the fastest recovery from a 15%+ correction on record and finished the quarter at new all-time highs. Growth stocks led the rally in the U.S., but performance broadened globally as U.S. dollar weakness boosted international returns3. Economy cooling, not cracking: The economy…

Read MoreAs we celebrate this 4th of July, I want to take a moment to wish you and your family a joyful, safe, and meaningful holiday. It’s a time to reflect on the freedoms we enjoy and the progress we continue to make—personally, nationally, and financially. The first half of 2025 has been full of surprises:…

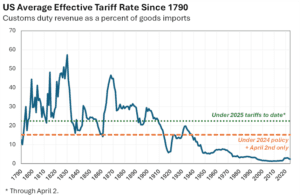

Read MoreUncertainty around tariffs sent the S&P 500 down more than 4% in the 1st quarter Technology stocks posted their worst quarter since 2020, while non-US stocks, value stocks, and defensive sectors led other sectors. Bonds also provided safety. On April 2nd, US tariffs were announced that exceeded investor expectations. This led to a market decline…

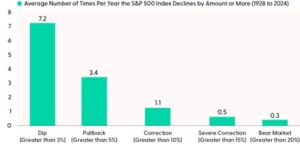

Read MoreAs of March 13, the S&P 500 declined 10.1% from its all-time closing high in mid-February. Many investors have started to worry about the prospect of further declines. As of now, the decline appears to be fairly typical. Corrections are generally sharp and fast and serve to refresh fear. The current 10% decline in the…

Read MoreA post-election rally helped the S&P 500 gain 2.4% in the quarter and over 25% on the year. US growth companies continued to lead stocks while other sectors trailed. The US economy remained healthy on the backs of a strong consumer and profitable corporate sector, but there were signs of a downshift to a lower…

Read MoreThe S&P 500 gained 5.9% in the quarter and reached new all-time highs. Non-US markets saw a strong recovery, particularly in China. The Federal Reserve cut interest rates by 50 basis points in September to support economic growth, which boosted bond prices and led markets to anticipate further easing. The environment for equities remains favorable…

Read MoreFrom 1961 to 2023, a $10,000 initial investment in the S&P 500 would have grown to over $102,000 if invested only when a Republican was in the White House. Conversely, the same investment would have grown to more than $500,000 if invested only during Democratic presidencies. While this might suggest a strategy of investing under…

Read MoreStocks headed into the second half with impressive momentum. Historically, a strong first half tended toward above-average second-half returns. Market gains were heavily skewed towards the large-cap growth and technology companies. The S&P 500 became increasingly concentrated in, with just five companies accounting for 29% of the index. Economic growth moderated but remained resilient with…

Read MoreThe S&P 500 TR Index continued its strong momentum and reached new all-time highs. Momentum often creates momentum, which leaves us optimistic about stocks currently. However, a near-term pullback wouldn’t surprise us. The U.S. economy continued to grow due to a strong labor market, healthy consumer balance sheets, and robust services activity. Due to an…

Read More

2025 3rd Quarter Investment Commentary

Global equities surged to record highs as the Fed’s rate cut, strong earnings, and large-scale spending in AI-related spending fueled the rally. The S&P 500 gained over 8% in Q3, with leadership concentrated in growth stocks, leaving valuations historically high and breadth narrow. Economic growth stayed resilient, with solid consumption and wage growth despite labor…

Read More