Posts by Chelsie Smith

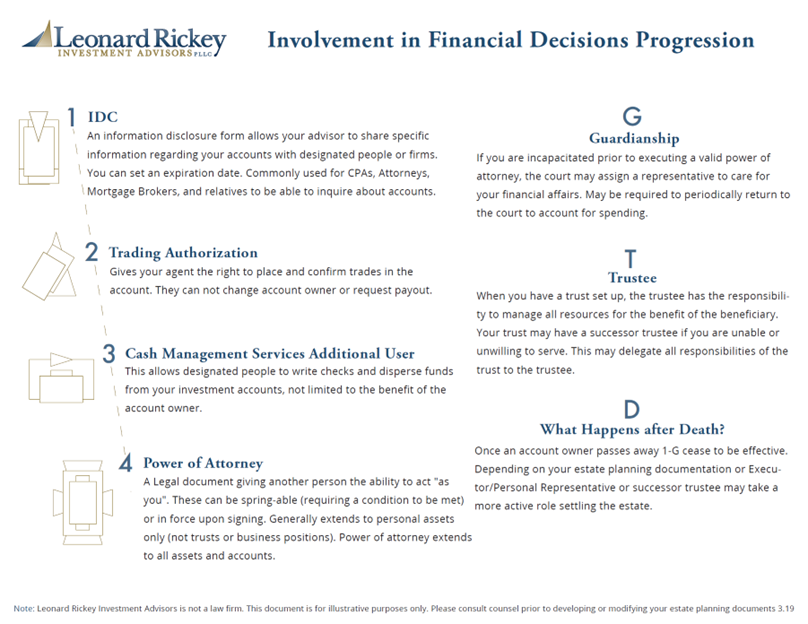

Involvement in Financial Decisions

Is it time to involve your family in your account management? There are different levels of involvement that can be helpful in various situations. Below is a chart to show the progression of participation from signing an IDC that allows us to share specific information with a particular person to a Power of Attorney that…

Read MoreWhat was the Highlight of your Summer?

We hope you are enjoying your summer and soaking up the warm days that remain. Here are the highlights of the summer from some of our team! Chelsie: With an almost 1 year old, we had lots of highlights this summer! We took our first big trip as a family, which ended with an awesome…

Read MoreImportant Ages for Retirement Accounts

If you are over age 72 and have an IRA account, you are probably required to take a distribution (RMD) this year. If you inherited an IRA account, you might be required to take a distribution regardless of age. If this applies to you and we don’t have a planned distribution, we will contact you…

Read MoreCongratulations, Dirk!

We want to congratulate one of our Advisors, Dirk Bernd, who has been a very involved member of his Rotary Club of Yakima Southwest since 2011! He has officially taken on the role as the current Rotary Club President. He’ll be club president from July 1st 2022 until June 30th 2023. He’s shown here with…

Read MoreDo I Need to Start Making Federal Estimated Income Tax Payments?

If you ask yourself this question, we have a flow chart to help you determine if you need to start making federal estimated income tax payments. Federal estimated income tax payments need to be made quarterly based on that quarter’s earnings. You may be subject to a tax penalty if you don’t pay quarterly. You…

Read MoreWhat is the SilverSneakers Program?

Are you looking for a senior fitness program? If you have a Medicare Advantage or Medigap plan, your health insurance may include a free fitness membership for adults 65+ called SilverSneakers. A SilverSneakers membership includes access to roughly 15,000 recreation centers, churches, senior communities, and other neighborhood locations across the nation. You’ll get access to…

Read MoreSeries I Savings Bonds Currently Earning 9.62%

Series I Savings Bonds (also called I-bonds) are currently earning 9.62%. The rate is determined in part by inflation, and changes every six months. The interest is tax-deferred until redeemed. If you have extra cash on the sidelines over your “rainy-day fund”, consider purchasing I-bonds to help your money keep up with inflation. These bonds…

Read MoreImportant Change Regarding your E-Delivery Preferences

Beginning with your July 2022 statements, TD Ameritrade Institutional will require clients to establish a user ID and password on the web or via mobile on AdvisorClient® and log in to maintain your enrollment in electronic delivery of statements, confirms, and any other communications. What this means for you There will be no impact if…

Read MoreCommunity Involvement: West Valley Dollars for Scholars

Leonard Rickey Investment Advisors has deep roots in the community. We support local organizations, including West Valley Dollars for Scholars. Last month, our fine team of golfers participated in the West Valley Dollars for Scholars annual fundraiser. If you would like to learn more about West Valley Dollars for Scholars or learn how you can…

Read MoreStudent Loan Update

Moratorium Extended President Biden extended the student loan moratorium to August 31, 2022. This is the seventh extension and gives the over 43 million student loan borrowers a little more time to push off repayment of their loans without accruing any interest. While this is a short extension, there has been talk of extending into…

Read More